Please use a PC Browser to access Register-Tadawul

Assessing VF Corp (VFC) Valuation After Needham Conviction List Upgrade And Holiday Brand Strength

V.F. Corporation VFC | 18.82 18.78 | -1.88% -0.21% Post |

Why Needham’s call on V.F (VFC) is drawing attention

Needham & Company’s decision to add V.F (VFC) to its Conviction List, backed by strong holiday results at The North Face and Timberland and early progress at Vans, has sharpened investor focus on the stock.

That call from Needham lands after a sharp shift in sentiment, with a 49.44% 90 day share price return and a 9.36% year to date share price return, even though the 1 year total shareholder return is still negative at 10.87%. This suggests momentum has picked up recently while long term holders remain under pressure.

If this kind of rebound has you thinking about what else might be setting up for a turn, it could be a good moment to look at fast growing stocks with high insider ownership.

So with V.F shares up sharply over 90 days, trading around $19.86 and screening on some models at roughly a 34% intrinsic discount, is there still a potential opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 17.2% Overvalued

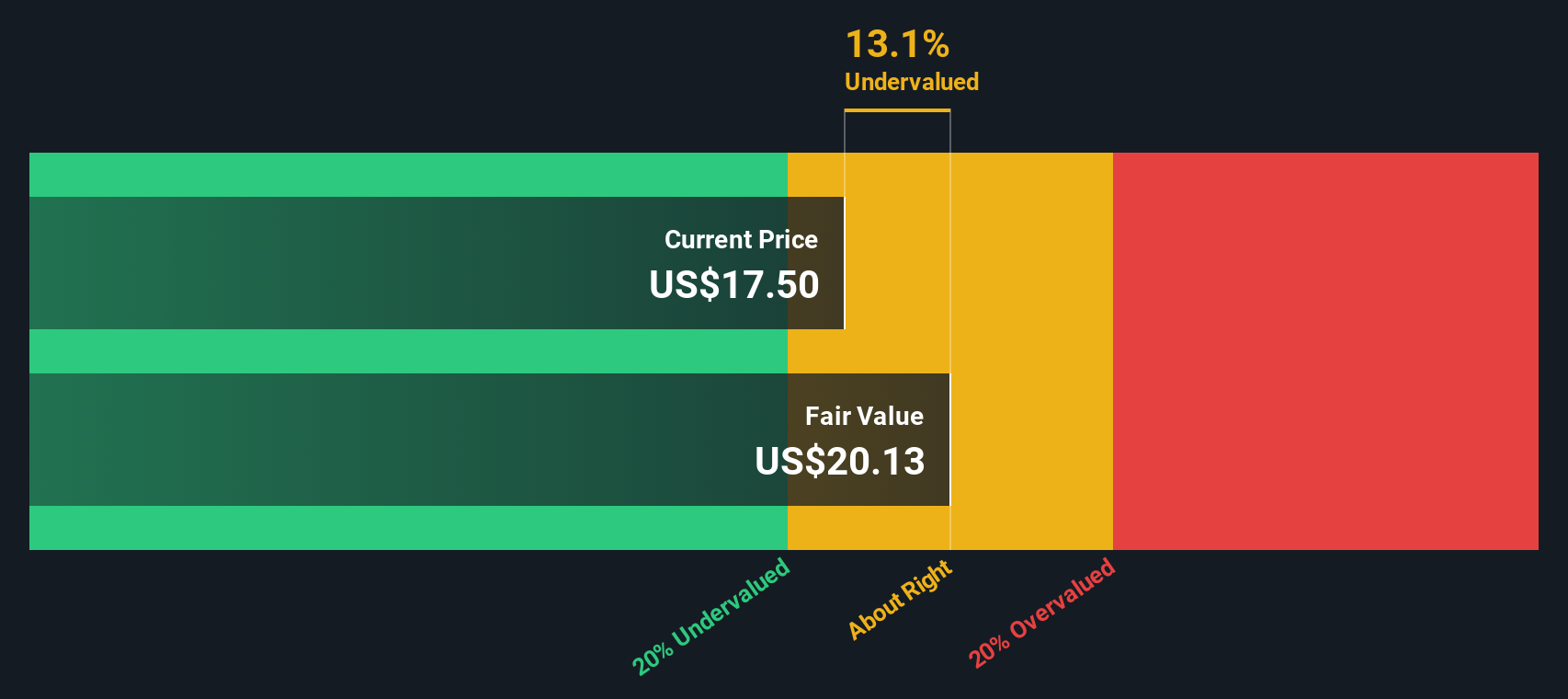

Compared with V.F's last close at US$19.86, the most followed narrative points to a fair value of about US$16.95. This frames the recent rebound against a more cautious valuation anchor.

The analysts have a consensus price target of $15.19 for V.F based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $10.0.

Curious what justifies a higher fair value than the Street target, yet still below today’s price? The narrative leans heavily on faster earnings growth, thicker margins, and a future profit multiple that looks very different to where the stock trades now. Want to see which assumptions really carry the weight in that calculation?

Result: Fair Value of $16.95 (OVERVALUED)

However, the story can change quickly if Vans continues to post high single-digit revenue declines or if elevated leverage above 4x limits room to invest in brand recoveries.

Another View: DCF Says Undervalued

While the popular narrative pegs V.F shares as about 17.2% overvalued versus a US$16.95 fair value, our DCF model lands in a very different place. In that view, the stock at US$19.86 trades roughly 34.1% below an estimated fair value of US$30.13. This comparison puts the recent rebound in a very different light.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out V.F for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own V.F Narrative

If you see the numbers differently, or prefer to test your own assumptions against the data, you can put together a full narrative in minutes by starting with Do it your way.

A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If V.F has sharpened your interest, do not stop here. Broadening your watchlist across different themes could help you spot opportunities you might otherwise miss.

- Spot potential mispricings by scanning these 880 undervalued stocks based on cash flows that may offer more attractive entry points based on their fundamentals.

- Ride powerful tech themes by checking out these 28 AI penny stocks that are tied to artificial intelligence trends across multiple industries.

- Stay ahead of the digital assets theme by reviewing these 79 cryptocurrency and blockchain stocks connected to cryptocurrency and blockchain activity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.