Please use a PC Browser to access Register-Tadawul

Assessing Vulcan Materials (VMC) Valuation After Recent Share Price Weakness And Strong Longer Term Gains

Vulcan Materials Company VMC | 305.29 | +0.81% |

Vulcan Materials (VMC) has drawn fresh attention after recent share price moves, with the stock closing at $319.78. For investors, that headline figure is only the starting point for assessing the business.

That 1 day share price decline of 3.21% sits against a stronger recent trend, with a 90 day share price return of 12.56% and a 1 year total shareholder return of 22.12%. This suggests momentum has been building over time despite short term swings.

If Vulcan Materials has you thinking about long term infrastructure and construction themes, it could be a good moment to widen your search. Our 24 power grid technology and infrastructure stocks can serve as a starting list of related opportunities.

With Vulcan Materials trading near its recent price target and showing positive multi year returns, the key question now is whether the current valuation still leaves room for upside or if the market is already pricing in future growth.

Most Popular Narrative: 2.5% Undervalued

At $319.78, Vulcan Materials is trading a little below the most followed fair value estimate of about $328, which is built off detailed long term forecasts.

The company's dominant footprint in rapidly urbanizing and growing Sunbelt metros, coupled with a visible pipeline of large scale public and private projects (notably data centers, highways, and non residential), positions Vulcan to capture outsized volume recovery and expansion, directly benefiting revenue growth and sustaining robust pricing power.

Curious what is baked into that fair value? The narrative leans heavily on steady revenue gains, rising profit margins, and a future earnings multiple that stays rich by sector standards.

Result: Fair Value of $328.13 (UNDERVALUED)

However, the story could change quickly if infrastructure funding is disrupted, or if weather and project delays keep squeezing volumes and margins more than expected.

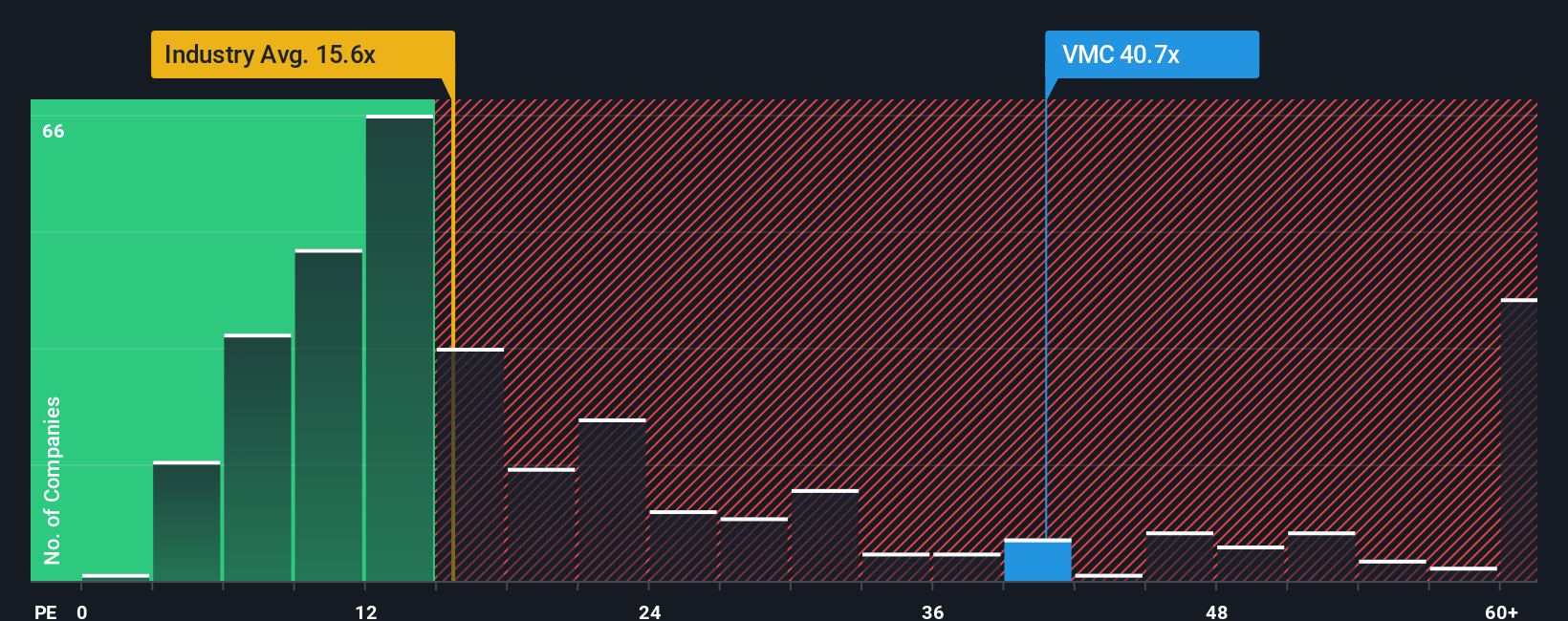

Another View: Rich P/E Signals A Very Different Story

That 2.5% “undervalued” narrative sits awkwardly next to Vulcan Materials' P/E of 37.6x. This is well above both the peer average of 26.6x and a fair ratio of 24.7x. In plain terms, the market is already paying up, so is the safety margin thinner than it looks?

Build Your Own Vulcan Materials Narrative

If you see the numbers differently or prefer to weigh the assumptions yourself, you can build a tailored Vulcan Materials view in just a few minutes, starting with Do it your way.

A great starting point for your Vulcan Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Vulcan Materials has sharpened your interest, do not stop here. Use this momentum to check out other opportunities that might fit your style even better.

- Target quality at a discount by scanning our 51 high quality undervalued stocks, built to surface companies with strong fundamentals at prices that may look appealing.

- Prioritise staying power with the solid balance sheet and fundamentals stocks screener (45 results), focusing on businesses that pair financial strength with underlying business stability.

- Hunt for promising outliers using the screener containing 24 high quality undiscovered gems, where you can spot underfollowed companies that our filters flag as worth a closer look.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.