Please use a PC Browser to access Register-Tadawul

Assessing WESCO International (WCC) Valuation Following Executive Leadership Transition Announcement

WESCO International, Inc. WCC | 256.81 | -0.79% |

WESCO International (WCC) just signed a release and severance agreement with Mr. Squires, a key figure in the company. The agreement covers various restrictive covenants and benefits, hinting at a leadership transition that could mean fresh direction or new uncertainty for WESCO International. Moves like this can send ripples through boardrooms and Wall Street alike, since shifts in executive teams often set the stage for change, whether in strategy, risk profile, or simply investor perception.

This leadership update comes as WESCO International’s stock has generated strong returns, climbing about 32% this past year. Momentum has gathered pace recently as well, highlighted by a 25% jump over the past three months and 4% over the last month. Against a multiyear run-up, many investors are debating whether the latest news signals ongoing growth potential or a pause for reassessment, especially with annual revenue and net income both moving higher.

So, with WESCO International trading around its highs after a big year, is there still untapped upside or does the market already see what’s coming next?

Most Popular Narrative: 9.2% Undervalued

The prevailing narrative sees WESCO International as trading below fair value, supported by upbeat forecasts for market expansion and operational improvements.

Massive acceleration in data center spend, especially from hyperscale and AI-related builds, is driving outsized growth (+65% YoY in Q2; outlook increased from +20% to +40% for 2025). WESCO has deep end-user relationships and an expanding role in both white space and gray space of data centers. This positions the company to capture a multi-year expansion in its addressable market, which could lift revenue growth, operating leverage, and backlog visibility.

What secret ingredient is fueling this bullish price target? Analysts are betting on a unique blend of future profit growth and margin gains, tied to new markets and major technology shifts. Curious about the bold financial assumptions that really move the needle on WESCO's valuation? The full narrative uncovers the projections and calculations giving this stock its edge.

Result: Fair Value of $236.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressure from large-scale projects or unexpected weakness in the utility segment could quickly change the outlook that investors have priced in.

Find out about the key risks to this WESCO International narrative.Another View: What Does Our DCF Model Say?

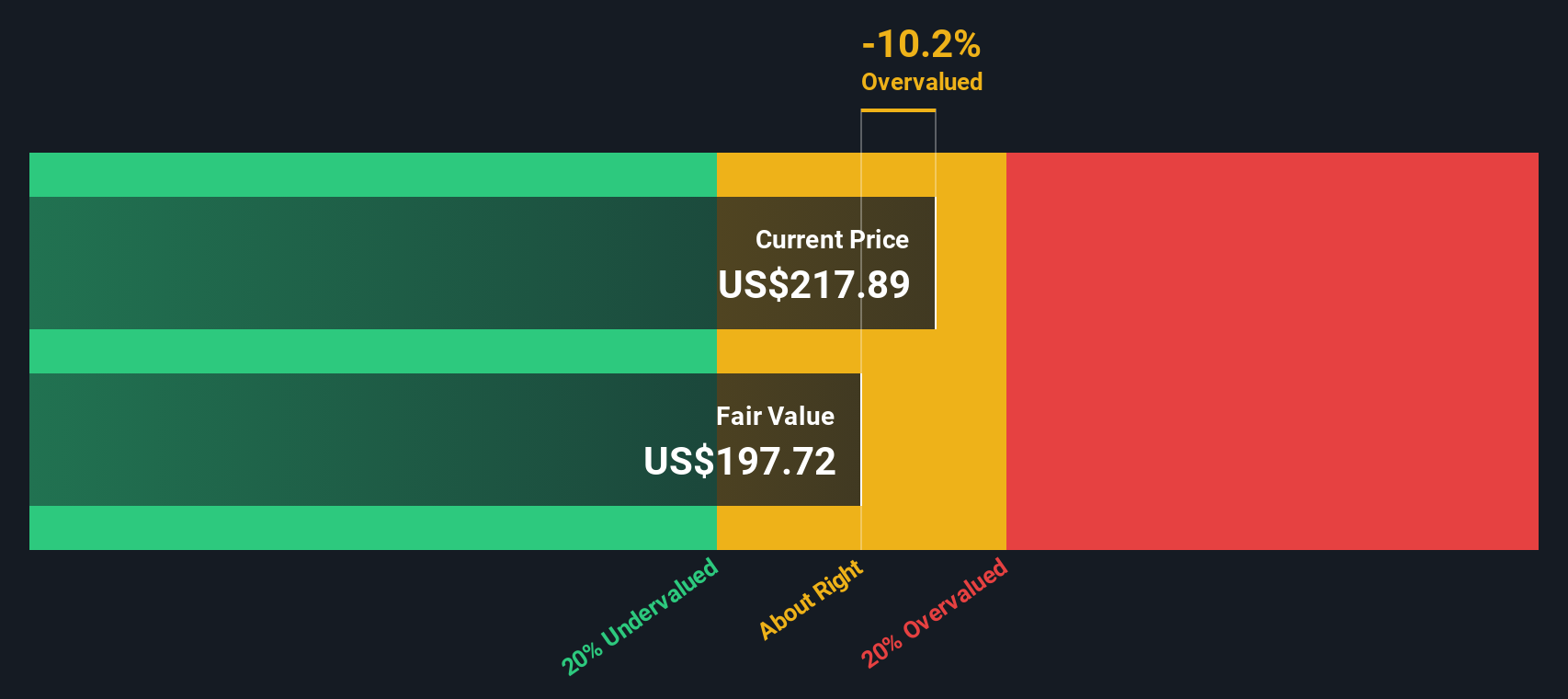

Looking from a different angle, the SWS DCF model suggests a less optimistic take compared to the market's enthusiasm. This method points to a potential overvaluation based on future cash flows. Are investor hopes running ahead of fundamentals?

Build Your Own WESCO International Narrative

Not convinced by the current consensus or want to dig into the details yourself? You can assemble your own take in just a few minutes. Do it your way.

A great starting point for your WESCO International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why settle for just one opportunity? Find stocks with real potential using the Simply Wall Street Screener and never miss a chance to get ahead in the market.

- Secure better returns by targeting companies trading below their true worth when you check out undervalued stocks based on cash flows.

- Maximize yield and steady income by selecting reliable payers through dividend stocks with yields > 3%.

- Spot the next tech wave early and gain exposure to the sector’s game changers with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.