Please use a PC Browser to access Register-Tadawul

Assurant Enters Real Estate With Home Warranty As Shares Screen Undervalued

Assurant, Inc. AIZ | 224.31 | +0.62% |

- Assurant, Inc. (NYSE:AIZ) launched Assurant Home Warranty through a partnership with Compass International Holdings.

- The move introduces Assurant into the real estate services space, offering home warranty products to agents and consumers.

- The rollout is tied to major real estate brands with a nationwide reach across the U.S. market.

For investors watching NYSE:AIZ, this partnership links a long standing specialty insurance and protection company directly to the real estate transaction process. Home warranties sit at the intersection of housing, consumer protection, and property services, an area where interest in bundled protection products has been growing. Tapping a broad agent network gives Assurant a new way to distribute coverage at the point where buyers and sellers are already making key decisions.

Looking ahead, readers may want to track how deeply Assurant Home Warranty is adopted across Compass International Holdings affiliated brands and how agents position these offerings with clients. The scale and stickiness of this distribution channel, along with any future product extensions around the home, could influence how meaningful this move becomes within Assurant's overall mix.

Stay updated on the most important news stories for Assurant by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Assurant.

Quick Assessment

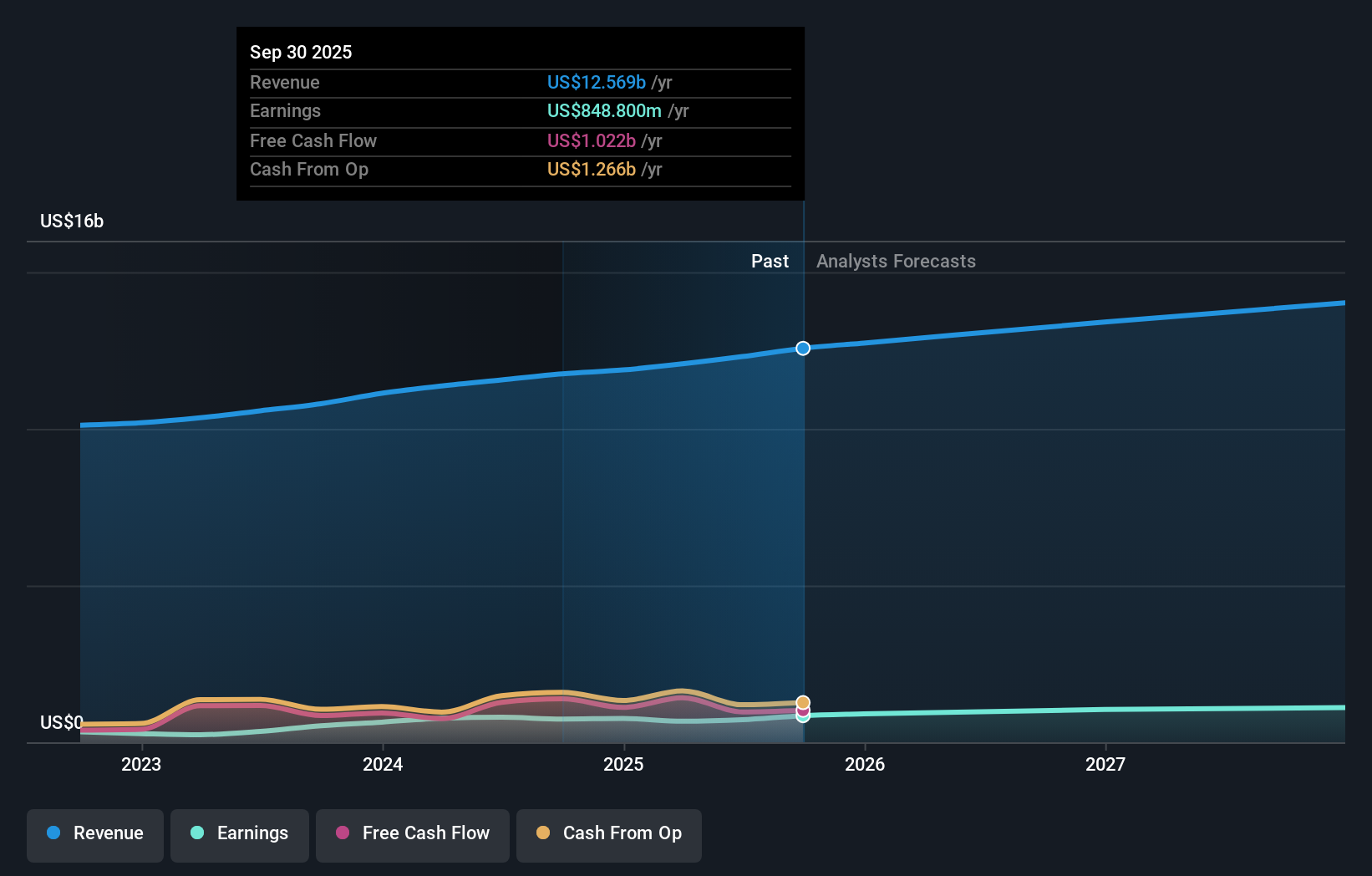

- ✅ Price vs Analyst Target: At US$217.48 versus an analyst target of US$260.33, the price sits about 16% below consensus.

- ✅ Simply Wall St Valuation: Assurant is flagged as undervalued, trading 56.3% below an estimated fair value.

- ❌ Recent Momentum: The 30 day return of about 8.6% decline shows recent pressure on the share price.

There is only one way to know the right time to buy, sell or hold Assurant. Head to Simply Wall St's company report for the latest analysis of Assurant's Fair Value.

Key Considerations

- 📊 The home warranty launch ties Assurant more closely to real estate transactions, which could broaden its protection services footprint if agents adopt the product at scale.

- 📊 Watch uptake across Compass affiliated brands, any reported warranty attachment rates, and how this new line sits alongside Assurant's P/E of 12.5 versus the insurance industry average of about 12.3.

- ⚠️ Execution risk around distribution and integration with real estate partners is key, as low adoption could limit the impact despite supportive valuation signals.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Assurant analysis. Alternatively, you can check out the community page for Assurant to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.