Please use a PC Browser to access Register-Tadawul

Astera Labs (ALAB) Is Up 7.6% After Explosive PCIe 6 Demand and Deepened AI Partnerships – Has the Bull Case Changed?

Astera Labs ALAB | 148.85 | -14.31% |

- In recent weeks, Astera Labs announced surging demand for its PCIe 6 connectivity products and rapid growth across its Aries, Taurus, and Scorpio product lines, while expanding collaborations with major industry players such as NVIDIA, AMD, Micron Technology, and Intel. The company's Scorpio P-Series switches have become the fastest-growing product line in company history as Astera Labs accelerates production and deepens its role in major AI data center infrastructure initiatives.

- This highlights Astera Labs' strengthening position at the core of the AI hardware buildout, underscoring the importance of connectivity solutions that address growing performance bottlenecks in high-density data centers.

- We'll examine how Astera Labs' expanding partnerships and accelerating PCIe 6 product adoption influence the company's investment narrative and growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Astera Labs Investment Narrative Recap

For investors to feel confident as Astera Labs shareholders, they need to believe that accelerating demand for AI data center connectivity, specifically for PCIe 6 solutions, will persist and that Astera will keep its technical edge despite increasing competition and customer concentration risks. The latest announcement of surging demand and expanded partnerships does reinforce optimism around the company's near-term product adoption, yet it does not materially reduce exposure to the biggest short-term risk: reliance on a concentrated hyperscaler customer base and the possibility of shifting purchasing patterns.

One particularly relevant announcement is Astera Labs’ recent expansion of its PCIe 6 connectivity portfolio, including the ramp-up of Aries, Taurus, and Scorpio product lines. This launch is closely tied to the current short-term catalyst of rapid AI infrastructure deployment, supporting both top-line growth and Astera’s bid to secure design wins across major cloud and AI data center projects.

On the other hand, investors should be aware of how persistent customer concentration could pose a challenge if...

Astera Labs’ narrative projects $1.5 billion revenue and $393.5 million earnings by 2028. This requires 34.1% yearly revenue growth and a $293.3 million earnings increase from $100.2 million today.

Uncover how Astera Labs' forecasts yield a $186.22 fair value, a 17% downside to its current price.

Exploring Other Perspectives

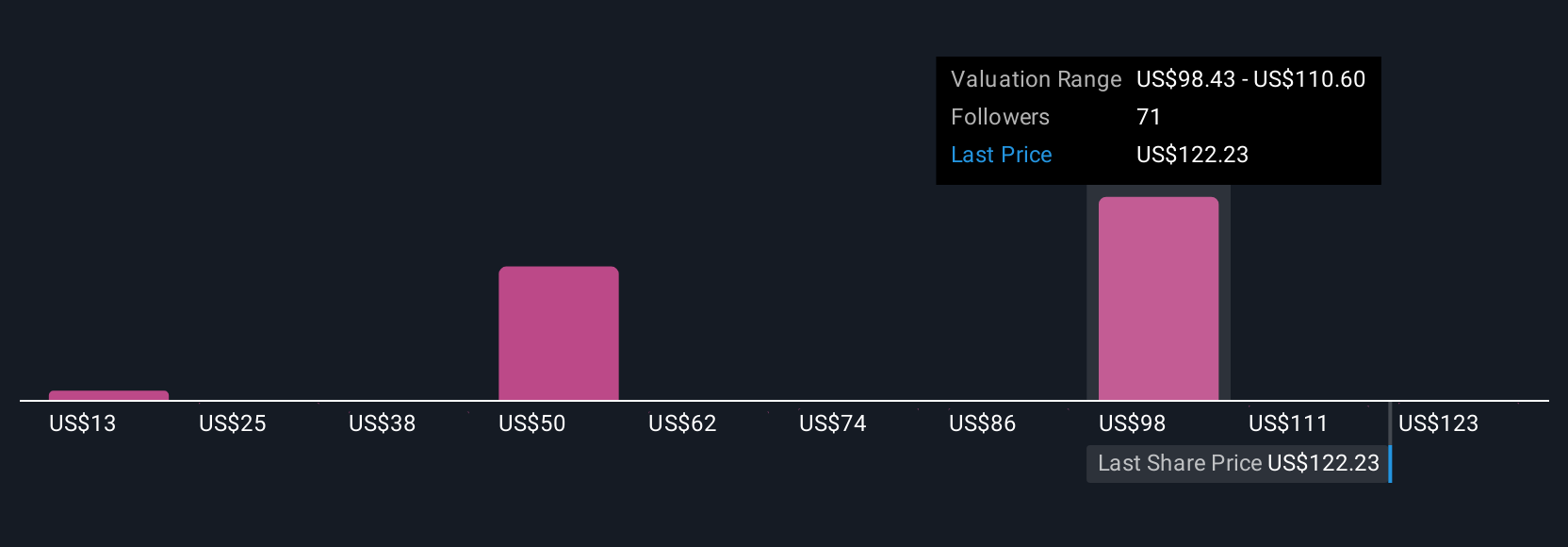

Thirty members of the Simply Wall St Community estimate Astera Labs' fair value between US$15.98 and US$262.56. With so many perspectives and concentrated customer risk in focus, you may want to see how others view the company’s future.

Explore 30 other fair value estimates on Astera Labs - why the stock might be worth less than half the current price!

Build Your Own Astera Labs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astera Labs research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Astera Labs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astera Labs' overall financial health at a glance.

No Opportunity In Astera Labs?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.