Please use a PC Browser to access Register-Tadawul

Atkore (ATKR) Earnings Swings Keep Dividend Coverage Concerns In Focus

Atkore Inc ATKR | 67.18 | +0.70% |

Atkore Q1 2026 Earnings Snapshot

Atkore (ATKR) opened its new fiscal year with Q1 2026 results that sit against a mixed recent track record, with quarterly revenue over the last two reported periods at US$735.0 million and US$752.0 million, while EPS moved from US$1.26 to a loss of US$1.62 alongside net income shifting from a profit of US$42.3 million to a loss of US$54.3 million. Looking back further, the company has seen quarterly revenue range between US$661.6 million and US$822.4 million since early 2024, with EPS oscillating between profits of up to US$3.36 and losses of around US$1.47. This context may encourage investors to focus closely on how margins are holding up as they interpret the latest print.

See our full analysis for Atkore.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the main stories around Atkore, and where the hard data may support or challenge those narratives.

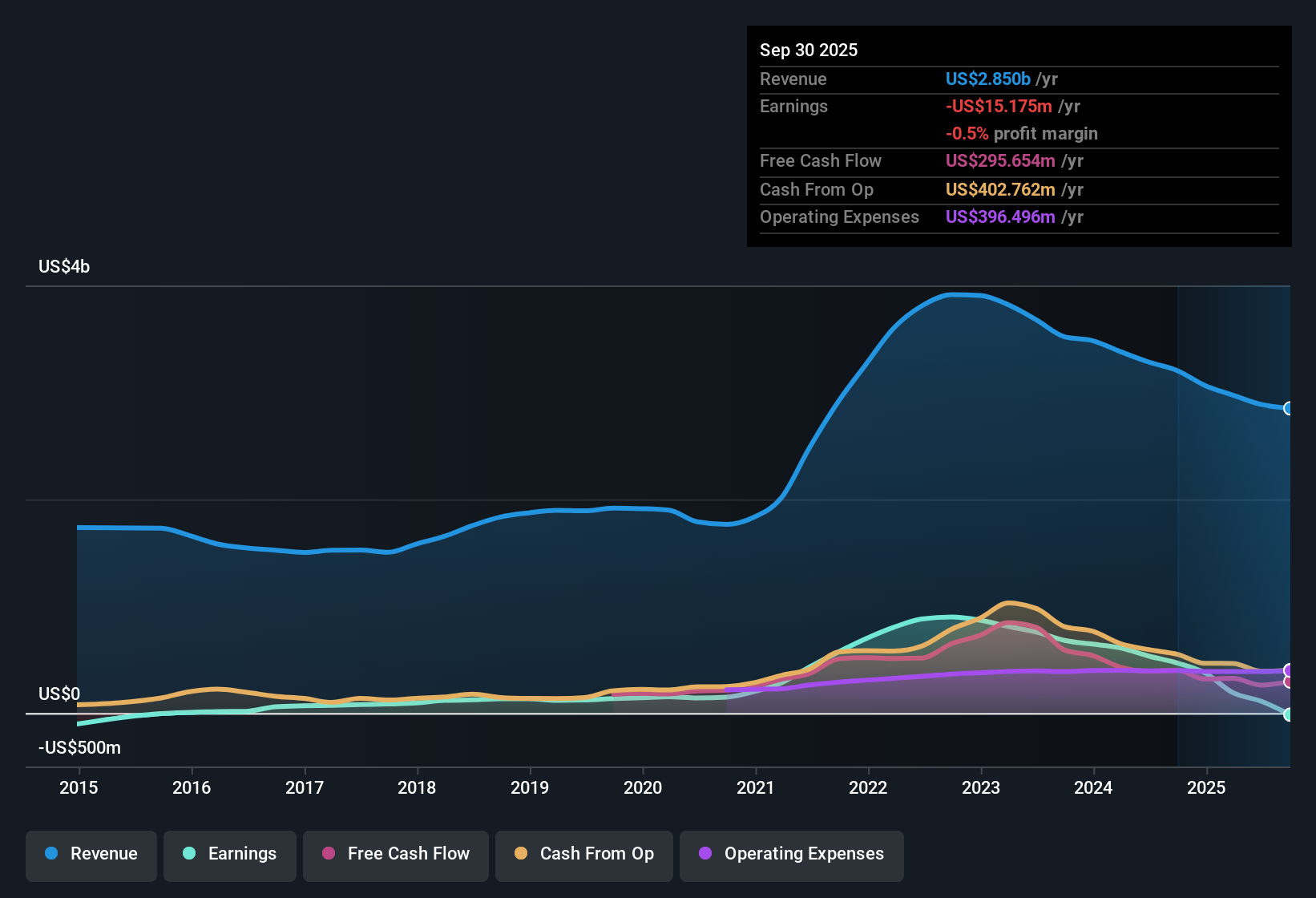

Losses Persist Despite US$2.9b Trailing Revenue

- Over the last twelve months to Q4 2025, Atkore booked about US$2.9b in revenue but still recorded a net loss of US$15.2 million and basic EPS of US$0.45 loss, showing that recent sales levels have not translated into positive trailing earnings.

- Bears focus on this unprofitable profile, and the data backs them up, as five year losses widened at about 12.1% per year even while trailing revenue still grew around 3.4% per year, which is slower than the cited 10.1% US market benchmark.

- This pattern of modest revenue growth alongside continued losses signals that profitability, not just sales volume, is the key pressure point for the bearish view.

- The mix of US$2.9b revenue and a small net loss also means even a small margin shift can flip results between profit and loss, which bears point to as evidence of limited cushion in the current setup.

Valuation Gap Between P/S And DCF Fair Value

- Atkore trades on a P/S of about 0.8x, compared with roughly 2.8x for peers and 2.4x for the wider US Electrical industry. At the same time, the current share price of US$69.89 sits well above a DCF fair value in the dataset of US$28.59, giving two very different valuation signals for the same company.

- What stands out for cautious investors is how this contrast feeds a bearish narrative that market pricing is rich relative to that DCF estimate, even though the low P/S multiple looks cheap against peers.

- The roughly 0.8x P/S suggests the market is paying less for each dollar of Atkore revenue than for peers, which may appeal to value focused investors who prioritize simple sales multiples.

- At the same time, a share price more than double the DCF fair value in the inputs challenges the idea that the stock is automatically a bargain, and gives bears a numbers based argument that cash flow expectations matter just as much as the headline multiple.

Uncovered Dividend And Profit Swings

- The stock carries a 1.89% dividend yield, but with trailing basic EPS at US$0.45 loss and recent quarters flipping between profits such as US$45.8 million in Q1 2025 and losses such as US$54.3 million in Q4 2025, the dataset flags that earnings coverage for that payout is weak.

- For income oriented investors, this supports a bearish narrative that the dividend is not yet backed by a stable profit base, because earnings have alternated between positive and negative across the last six reported quarters.

- In profitable stretches, quarterly net income reached as high as US$121.9 million in Q3 2024, but loss making quarters like the US$50.1 million loss in Q2 2025 highlight how uneven that support for dividends has been.

- The mix of a near 2% yield with this earnings volatility means critics see the payout as something that needs close monitoring against future profit figures rather than a set and forget income stream.

Want a clearer picture of how these profit swings, dividend coverage, and valuation signals fit together over time? Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Atkore's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Atkore’s mix of recent net losses, uncovered dividend, and profit swings shows that earnings support for income and valuation stories is still inconsistent.

If you would rather focus on companies with steadier fundamentals and income support, you can use our CTA_SCREENER_STABLE_GROWTH to zero in on stocks with more consistent revenue and earnings performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.