Please use a PC Browser to access Register-Tadawul

Atlassian Corporation (NASDAQ:TEAM) Shares May Have Slumped 27% But Getting In Cheap Is Still Unlikely

Atlassian Corp Class A TEAM | 75.98 | -5.33% |

Atlassian Corporation (NASDAQ:TEAM) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

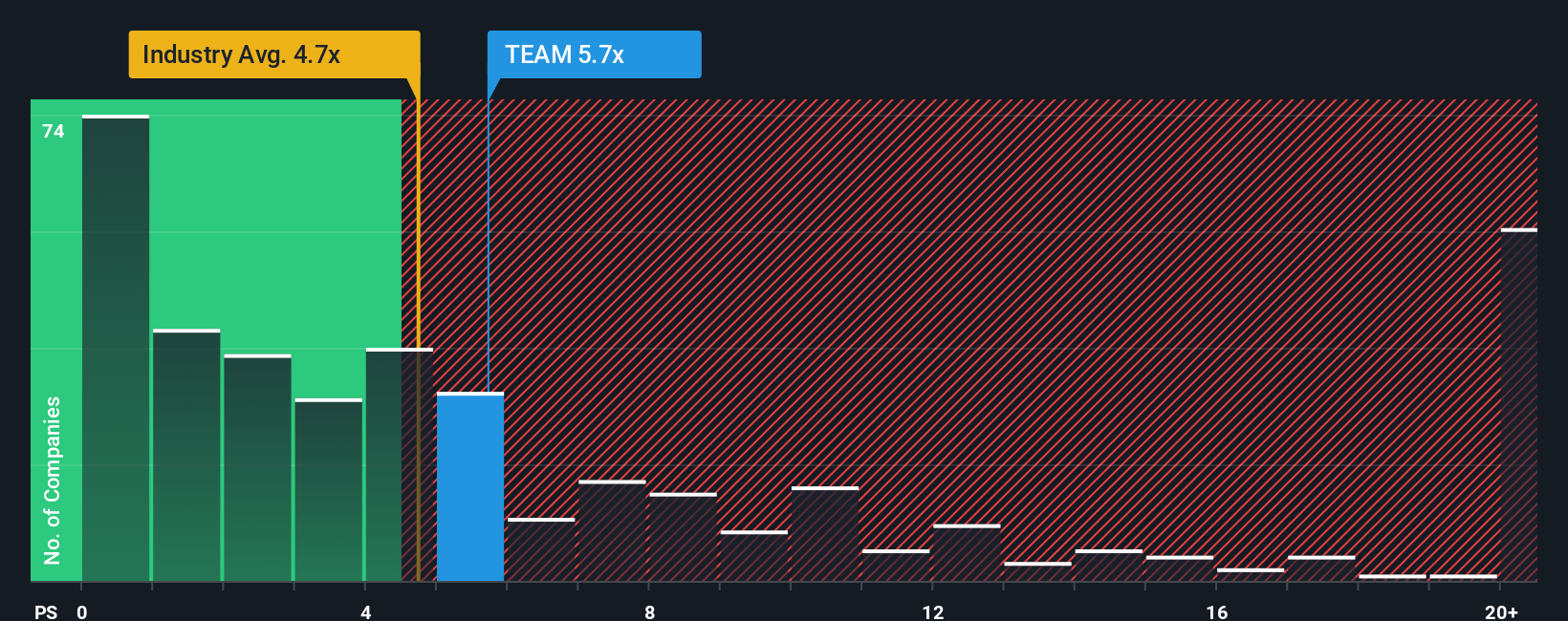

In spite of the heavy fall in price, Atlassian may still be sending sell signals at present with a price-to-sales (or "P/S") ratio of 5.7x, when you consider almost half of the companies in the Software industry in the United States have P/S ratios under 4.7x and even P/S lower than 1.9x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Atlassian's Recent Performance Look Like?

Recent revenue growth for Atlassian has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Atlassian's future stacks up against the industry? In that case, our free report is a great place to start.How Is Atlassian's Revenue Growth Trending?

In order to justify its P/S ratio, Atlassian would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. Pleasingly, revenue has also lifted 82% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 19% each year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 33% per annum growth forecast for the broader industry.

With this information, we find it concerning that Atlassian is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Atlassian's P/S Mean For Investors?

There's still some elevation in Atlassian's P/S, even if the same can't be said for its share price recently. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see Atlassian trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks.

If these risks are making you reconsider your opinion on Atlassian, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.