Please use a PC Browser to access Register-Tadawul

August 2025's Promising Penny Stock Picks

Caesarstone Ltd CSTE | 1.65 1.65 | +6.45% 0.00% Pre |

As the U.S. markets experience a mix of record highs and recent slumps, investors are keeping a close eye on economic resilience and corporate earnings amidst ongoing tariff uncertainties. In this context, penny stocks—often associated with smaller or newer companies—remain an intriguing investment option despite their somewhat outdated label. These stocks can offer unique growth opportunities at lower price points, especially when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.61 | $582.28M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.85 | $264.88M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.8928 | $152.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $92.33M | ✅ 3 ⚠️ 2 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.897275 | $6.47M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.40 | $99.52M | ✅ 3 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.98 | $46.5M | ✅ 2 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $4.10 | $520.32M | ✅ 2 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.49 | $29.37M | ✅ 2 ⚠️ 2 View Analysis > |

Let's review some notable picks from our screened stocks.

CPS Technologies (CPSH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CPS Technologies Corporation offers advanced material solutions across various industries including transportation, automotive, energy, and defense in the United States, Europe, and Asia with a market cap of $37.91 million.

Operations: CPS Technologies does not report specific revenue segments.

Market Cap: $37.91M

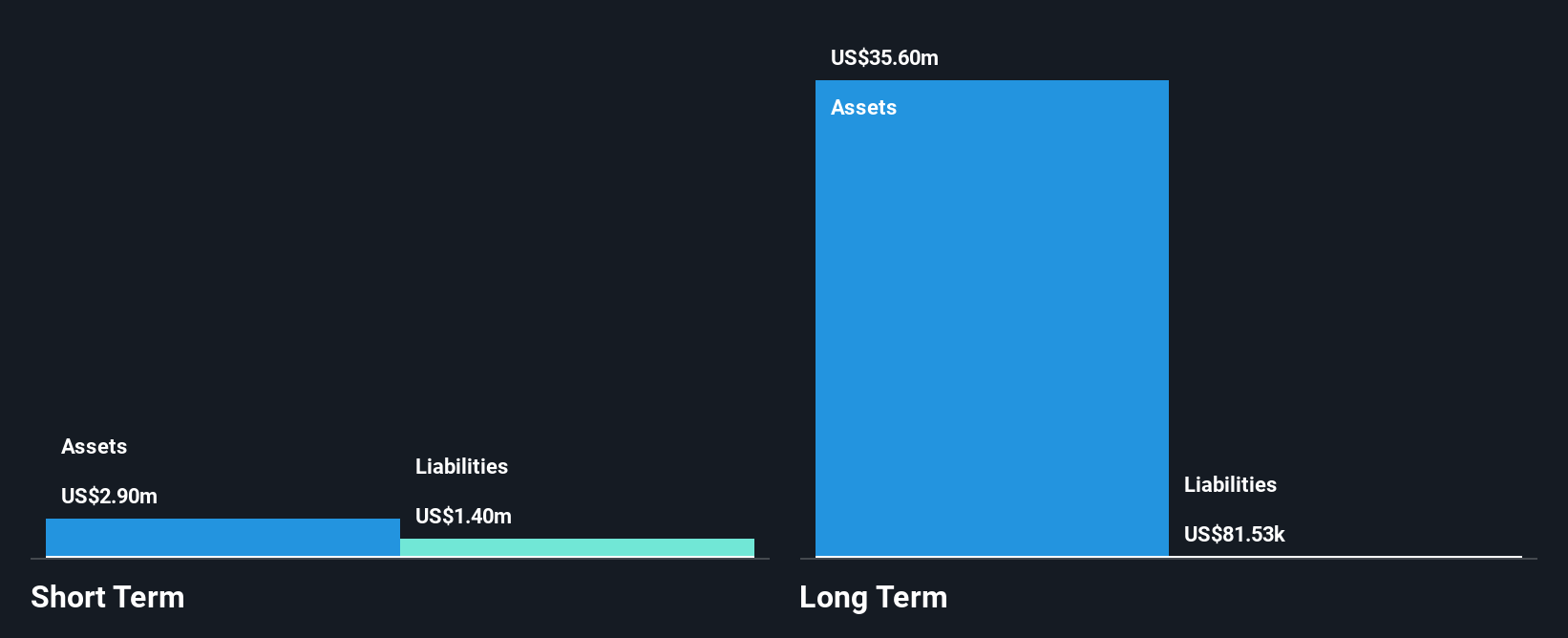

CPS Technologies Corporation, with a market cap of US$37.91 million, has shown recent improvements by reporting a net income of US$0.10 million for Q2 2025, compared to a loss the previous year. The company is debt-free and its short-term assets exceed liabilities, indicating financial stability despite being unprofitable with declining earnings over five years. Recent achievements include securing its fourth SBIR contract with the U.S. Navy and providing positive guidance for increased profitability in the second half of 2025, highlighting its commitment to innovation in material science and defense solutions amidst high share price volatility.

Caesarstone (CSTE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Caesarstone Ltd., along with its subsidiaries, designs, develops, manufactures, and sells engineered stone and porcelain products globally under various brands, with a market cap of $67.04 million.

Operations: The company's revenue is primarily derived from its Building Products segment, which generated $424.49 million.

Market Cap: $67.04M

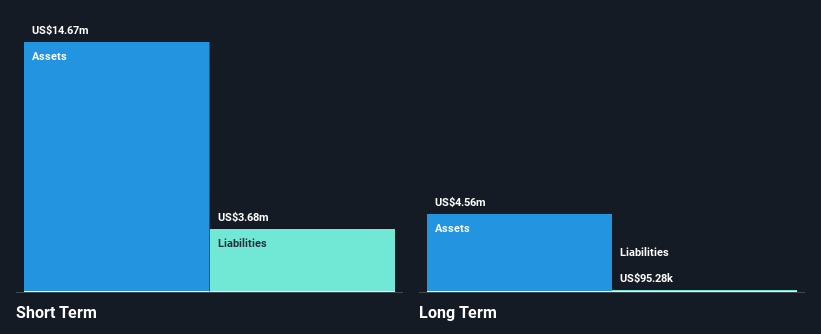

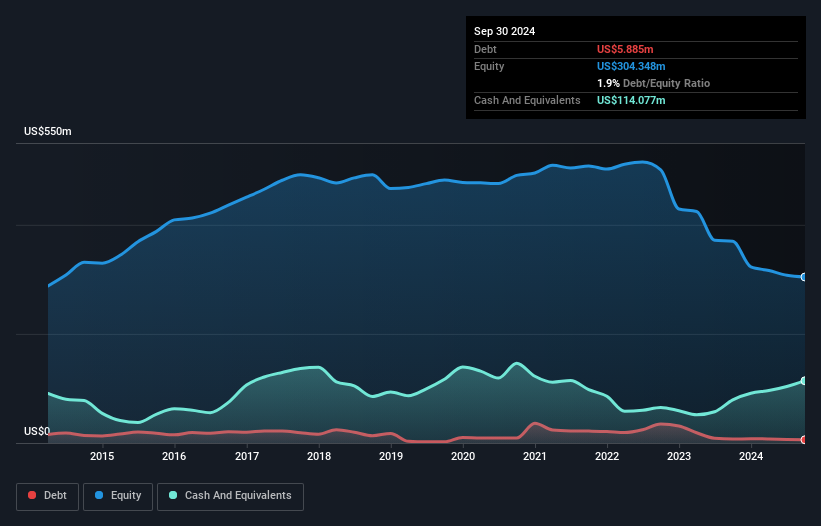

Caesarstone Ltd., with a market cap of US$67.04 million, faces challenges as it was recently dropped from multiple Russell indices, reflecting investor concerns. Despite having more cash than total debt and short-term assets exceeding both short and long-term liabilities, the company remains unprofitable with a negative return on equity of -19.52%. Revenue for Q1 2025 was US$99.56 million, down from the previous year, while net loss widened significantly to US$12.88 million. Although trading at good value compared to peers, its inexperienced management team may impact strategic direction amidst ongoing financial struggles and volatility in share price performance.

Verde Resources (VRDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Verde Resources, Inc. focuses on producing biochar from waste materials in the dairy, palm, and other natural resource industries across the United States and Malaysia, with a market cap of $111.75 million.

Operations: The company generates revenue by producing biochar from waste materials in the dairy, palm, and other natural resource industries within the United States and Malaysia.

Market Cap: $111.75M

Verde Resources, with a market cap of US$111.75 million, is pre-revenue, generating less than US$1 million annually while focusing on biochar production and innovative asphalt solutions. Recent developments include a pioneering Biochar-Asphalt test with NCAT and partnerships aimed at commercializing low-carbon technologies in the U.S. Despite promising technological advancements and potential new revenue streams from Carbon Removal Credits, the company faces financial challenges with less than a year of cash runway and increased losses. Leadership changes have brought industry expertise to support its Net Zero ambitions, but operational execution remains critical for sustainable growth.

Seize The Opportunity

- Navigate through the entire inventory of 421 US Penny Stocks here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.