Please use a PC Browser to access Register-Tadawul

AvePoint (AVPT) Swings to Profit and Lifts Guidance—Is Operational Momentum Here to Stay?

AvePoint, Inc. Class A AVPT | 10.50 | -1.22% |

- On August 7, 2025, AvePoint reported its second quarter 2025 earnings, highlighting revenue of US$102.02 million, a switch to net income of US$2.7 million, and a raised full-year revenue guidance to US$406.6–410.6 million.

- This marks a significant turnaround from a prior net loss, with management's updated revenue outlook pointing to robust operational execution and escalating demand for its data management solutions.

- To understand what this improved profitability and updated guidance mean for AvePoint’s outlook, let's examine the impact on the investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

AvePoint Investment Narrative Recap

The core of AvePoint’s investment story is centered on capitalizing on growing enterprise needs for secure, compliant data management, especially as AI adoption and regulatory demands increase worldwide. The newly reported profitability and raised revenue guidance for 2025 signal stronger execution and demand, reducing but not eliminating the immediate risk of intensified competition eroding margins, the chief concern for shareholders watching spending closely. For now, guidance upgrades appear to reinforce, not materially shift, the near-term catalysts or risks that matter most.

The most relevant announcement is AvePoint’s raised full-year revenue guidance to US$406.6–410.6 million, implying 23% to 24% anticipated growth. This not only supports confidence in management’s operational performance but underpins the main short-term catalyst: surging enterprise demand for integrated data and compliance solutions as digital transformation and AI adoption accelerate. Yet, while growth remains robust, investors should closely follow...

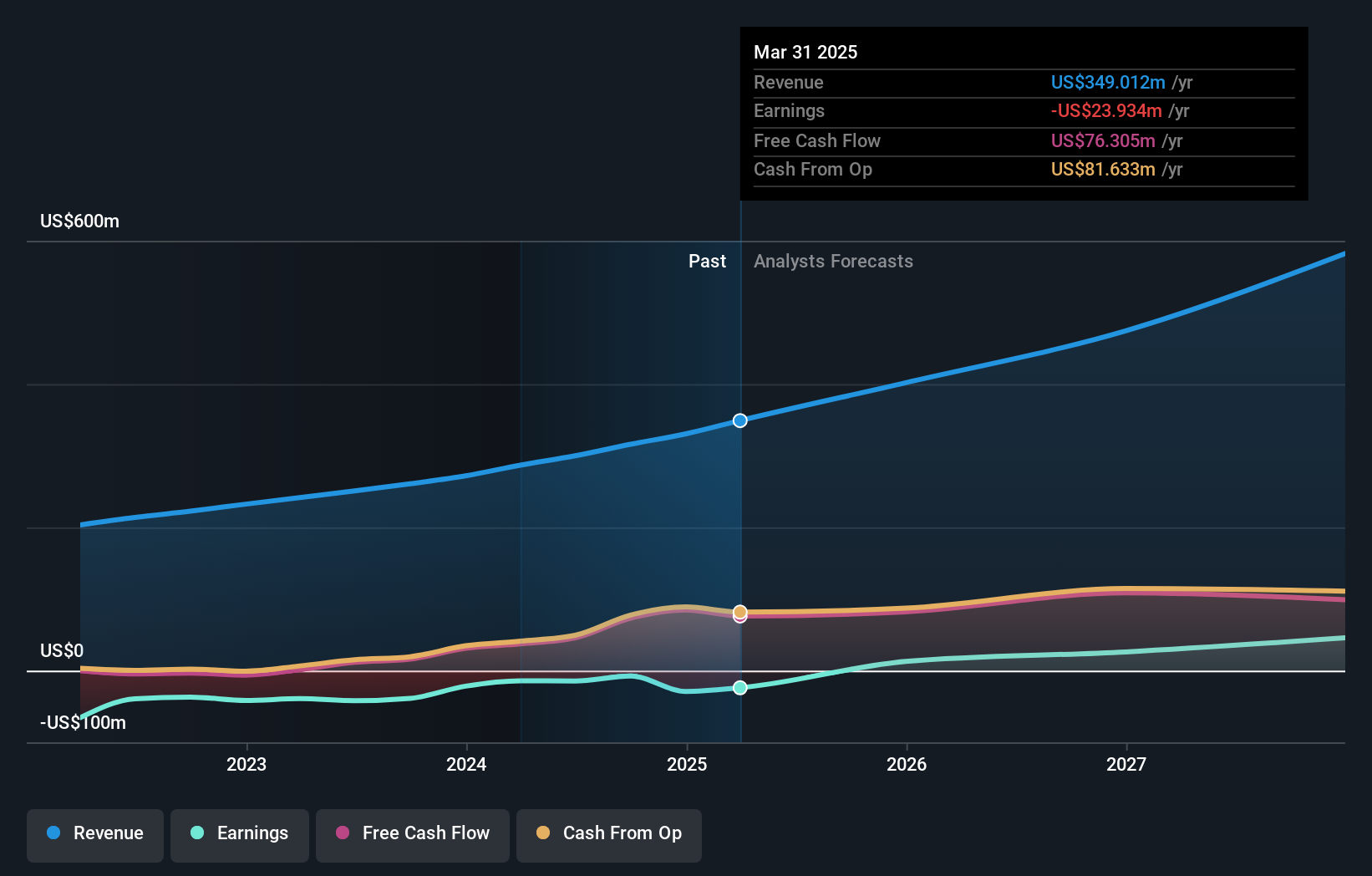

AvePoint's narrative projects $629.9 million revenue and $57.8 million earnings by 2028. This requires 21.8% yearly revenue growth and an earnings increase of $81.7 million from -$23.9 million today.

Uncover how AvePoint's forecasts yield a $21.19 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate fair value for AvePoint from US$4.27 to US$21.19, reflecting three distinct opinions. While this wide spectrum captures diverging outlooks, heightened competition and the risk of margin pressure remain critical for future performance and should be on every investor’s radar.

Explore 3 other fair value estimates on AvePoint - why the stock might be worth less than half the current price!

Build Your Own AvePoint Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AvePoint research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AvePoint research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AvePoint's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.