Please use a PC Browser to access Register-Tadawul

Avidity Biosciences (RNA): Assessing Valuation Following Breakthrough Del-zota Trial Data and $600M Equity Raise

Avidity Biosciences RNA | 72.90 | +0.11% |

If you own or have been eyeing shares of Avidity Biosciences (RNA), the past week’s whirlwind of updates may be giving you pause or inspiration. First, the company dropped some eye-catching clinical data: new one-year del-zota trial results point to reversal of disease progression and major functional gains, backed by robust, statistically significant increases in dystrophin production. That announcement arrived alongside reminders that del-zota is supported by multiple regulatory designations and an end-of-year FDA submission target, all hints of a pivotal period ahead. And just as the news was sinking in, Avidity followed up by completing a $600 million equity offering, hinting at ambitious funding for the next phase of growth.

This string of news has reshaped the narrative on Avidity’s potential. While recent months saw the stock gaining ground, the last year as a whole has been somewhat mixed. Momentum built impressively this quarter, with shares climbing more than 40%, though longer-term returns remain volatile. Previous updates, including a shareholder call and earlier product news, have kept this name in the headlines, but the del-zota data and funding round together create a different kind of inflection point for investors focused on valuation and sustainability.

So with investor enthusiasm building, is Avidity Biosciences a bargain waiting to be bought, or is the market already pricing in much of its future growth?

Price-to-Book of 5.1x: Is it Justified?

Based on the price-to-book ratio, Avidity Biosciences shares trade at 5.1 times book value, compared to a sector average of 2.2 times. This suggests that the stock is currently expensive relative to its biotech peers when using this commonly referenced metric.

The price-to-book ratio measures a company’s market value versus its net assets. For biotechs, which often remain unprofitable for years, this multiple can reflect both speculative growth expectations and the premium investors are willing to pay for future innovation. In Avidity’s case, the above-average ratio raises questions about whether the current valuation fully incorporates future developments or stretches too far beyond fundamentals.

Given the level of unprofitability and volatility in recent returns, the market may be placing a hefty price tag on future growth potential rather than what has been delivered so far.

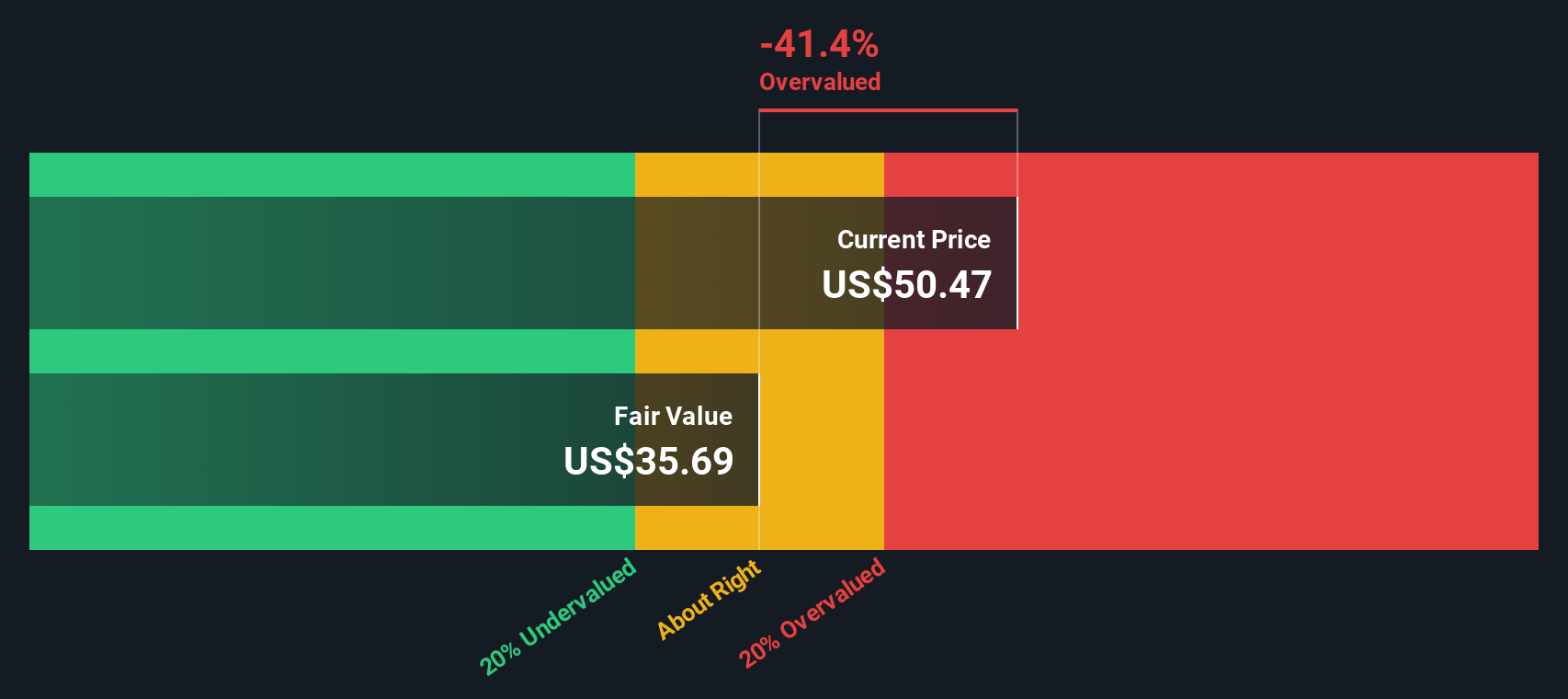

Result: Fair Value of $35.84 (OVERVALUED)

See our latest analysis for Avidity Biosciences.However, setbacks in clinical progress or a slower than expected revenue ramp could quickly dampen current optimism surrounding Avidity Biosciences’ outlook.

Find out about the key risks to this Avidity Biosciences narrative.Another View: SWS DCF Model Takes a Closer Look

The SWS DCF model points to the same conclusion as the earlier multiple-based approach, suggesting shares are not undervalued at today’s price. Could this double confirmation mean risks are stacking up, or is the market missing something?

Build Your Own Avidity Biosciences Narrative

If these results don't align with your perspective, or you’d rather chart your own path, you can build a personalized view in just a few minutes using all the latest numbers. Do it your way

A great starting point for your Avidity Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why stop here? Explore additional stock opportunities that could influence your portfolio’s future by using the Simply Wall Street Screener. Choosing the right investment at the right moment can make a significant difference, so consider these unique strategies before making your next move.

- Discover hidden gems on Wall Street and unlock potential with undervalued stocks based on cash flows.

- Pursue gains by focusing on companies advancing intelligent automation through AI penny stocks.

- Seek consistent income by identifying top-paying shares using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.