Please use a PC Browser to access Register-Tadawul

Avidity Biosciences (RNA) Raises $600 Million After Positive Duchenne Data Is the Growth Thesis Strengthening?

Avidity Biosciences RNA | 71.92 | +0.08% |

- Avidity Biosciences recently announced the completion of a US$600 million follow-on public offering, selling 15,000,000 shares of common stock at US$40 per share, to fund late-stage clinical programs and commercial expansion.

- This financing followed the release of encouraging new data from its EXPLORE44 and EXPLORE44-OLE trials, where its drug candidate del-zota showed significant improvement in reversing disease progression for Duchenne muscular dystrophy patients with exon 44 mutations.

- We'll examine how the combination of positive trial results and substantial new capital could influence Avidity Biosciences' investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Avidity Biosciences' Investment Narrative?

To be a shareholder in Avidity Biosciences right now, you have to buy into the idea that the company’s fresh US$600 million capital raise, combined with recently published del-zota trial results, offers a meaningful bridge to its next set of major clinical and regulatory milestones. This new funding directly addresses what was one of the business’ biggest near-term risks: running short of cash before possible product approvals and commercial launches. It gives Avidity more room to accelerate late-stage programs, scale up manufacturing, and potentially move toward revenue generation, particularly if a BLA for del-zota is filed as planned by year-end 2025. That said, while the capital boost may ease financial pressure, Avidity remains unprofitable and is still banking on regulatory success and a strong commercial launch to transform its future. Positive trial news can shift sentiment, but execution and approval risks remain front and center for investors. However, lock-up expiries and the path to profitability are still key risks investors should be aware of.

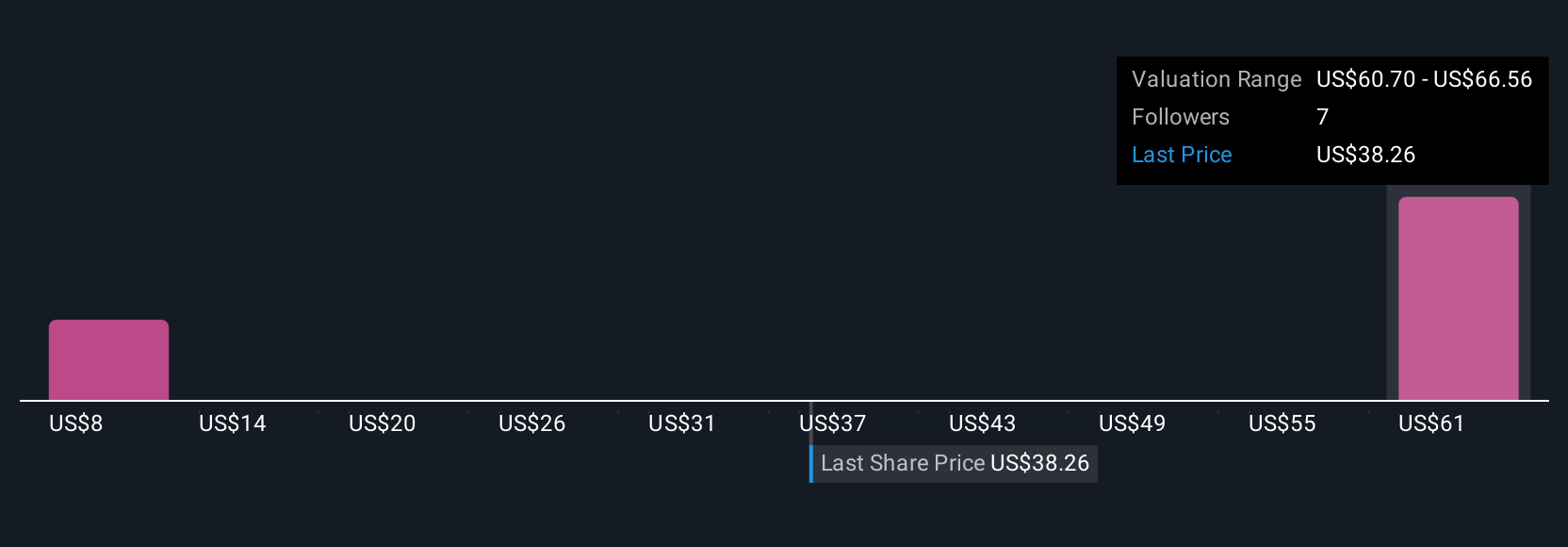

Avidity Biosciences' share price has been on the slide but might be up to 12% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 2 other fair value estimates on Avidity Biosciences - why the stock might be worth 11% less than the current price!

Build Your Own Avidity Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avidity Biosciences research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Avidity Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avidity Biosciences' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.