Please use a PC Browser to access Register-Tadawul

Avis Budget Group (CAR): Is the Stock Overvalued or a Hidden Opportunity?

Avis Budget Group, Inc. CAR | 132.67 | +3.16% |

Even as broader travel demand has rebounded and competitors have faced a mixed bag of results, Avis Budget Group’s 1-year total shareholder return of 0.75% and 5-year total return of 4.15% suggest momentum has been fading rather than surging. The recent share price dip appears to be a continuation of a longer-term cooling off, as growth expectations have moderated in the face of softer earnings and macroeconomic headwinds.

If this story has you thinking bigger picture, you might want to broaden your search and discover fast growing stocks with high insider ownership.

With shares hovering just below analysts’ price targets and tepid long-term returns, the key question is whether Avis Budget Group is now undervalued, or if the market has already priced in the outlook for future growth.

Most Popular Narrative: 4.4% Overvalued

With the narrative's fair value estimate at $148, Avis Budget Group’s last close of $154.56 suggests that the market may be pricing in more optimism than forecast fundamentals support. This puts the stock in a slightly overvalued position by narrative standards and opens up debate about what is driving this premium.

The partnership with Waymo and stated ambitions to become a core fleet and asset manager for autonomous vehicles is stoking future growth narratives. Investors are projecting Avis will capture a sizable share of vehicle miles traveled (VMT) in the autonomous mobility ecosystem, which could lead to long-term revenue and free cash flow expansion that may not be realized if AV adoption or partnership economics disappoint.

Want to know the numbers behind this lofty price? The narrative hinges on ambitious projections for future profitability and a tech-driven business transformation. What bold growth factors are embedded? Dive in to see which underlying trends keep this valuation out of bargain territory.

Result: Fair Value of $148 (OVERVALUED)

However, shifts toward alternative mobility solutions and intense competition in premium segments could challenge revenue growth and put pressure on future profit expectations.

Another View: Valuation Based on Sales Multiples

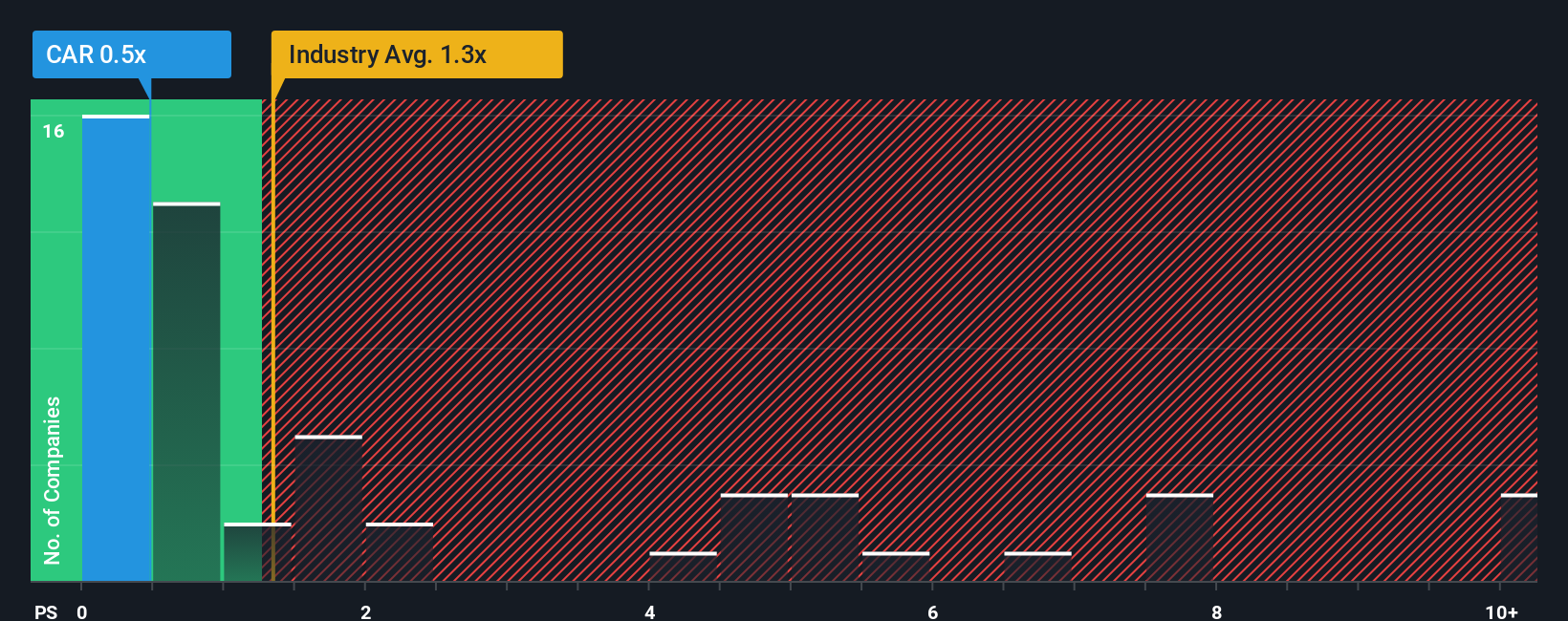

Stepping away from narrative-based fair value, the market’s focus on sales multiples paints a different picture. Avis Budget Group trades at just 0.5x sales, far below the transportation industry average of 1.4x and even under its fair ratio of 0.8x. This significant gap hints at potential value, but does it reflect caution about future risks or an overlooked opportunity?

Build Your Own Avis Budget Group Narrative

If you have your own perspective or want to dive deeper into the numbers, you can craft your own take in just a few minutes. Do it your way.

A great starting point for your Avis Budget Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you’re serious about staying ahead, check out these unique investment opportunities on Simply Wall Street. The right stock could be waiting just one click away.

- Uncover future market leaders with strong financials and growth by starting with these 3567 penny stocks with strong financials.

- Jump on innovation trends as you browse these 24 AI penny stocks that are powering the next wave of artificial intelligence breakthroughs.

- Maximize your portfolio’s value by seeking out these 896 undervalued stocks based on cash flows that are trading below their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.