Please use a PC Browser to access Register-Tadawul

Axon Enterprise (AXON): Evaluating Valuation Following Body Camera Launch and Expanding Growth Prospects

Axovant Sciences Ltd AXON | 564.28 | -2.88% |

Axon Enterprise (AXON) recently introduced the Axon Body Workforce Mini, a compact wearable camera built for frontline workers in retail and healthcare. This move expands Axon's presence beyond law enforcement and is sparking interest among investors.

Momentum for Axon Enterprise has been building all year, driven by new launches like the Axon Body Workforce Mini and upbeat sentiment around its upcoming earnings report. After surging to a one-year total shareholder return of 61.6%, the share price has cooled recently with a 7% dip over the past month. However, the longer-term picture remains outstanding thanks to a five-year total return topping 540%. Recent insider selling and a major investor taking some profits highlight just how far the stock has come, yet the company's expanding reach and revenue prospects continue to keep it firmly in the spotlight.

If this kind of market evolution interests you, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With expectations high and Axon’s strategy driving strong growth, the key question now is whether this momentum means the stock remains undervalued, or if the market is already accounting for all that future promise.

Most Popular Narrative: 20.5% Undervalued

With Axon Enterprise's last close at $703.03, the prevailing narrative calculates a fair value 20.5% higher, signaling substantial upside from the current price. This perspective is shaped by ambitious growth projections and expanding market reach, setting the context for one of the most compelling justifications behind the valuation.

Accelerating demand for next-generation technologies including AI, drones, robotics, body cameras, and digital evidence management demonstrates a rapid shift by public safety agencies toward modern, cloud-based, and connected solutions. This supports sustained revenue growth as agencies upgrade from legacy systems and adopt more comprehensive SaaS offerings.

Want to see why the numbers behind this narrative leave markets watching? The high bar for earnings, revenue, and future margins could surprise you. Ready to unpack the assumptions that drive this bold fair value? The complete breakdown awaits.

Result: Fair Value of $884.69 (UNDERVALUED)

However, dependence on government budgets and rising regulatory scrutiny could limit Axon's recurring revenue growth and challenge the current bullish outlook.

Another View: Multiples Raise Caution

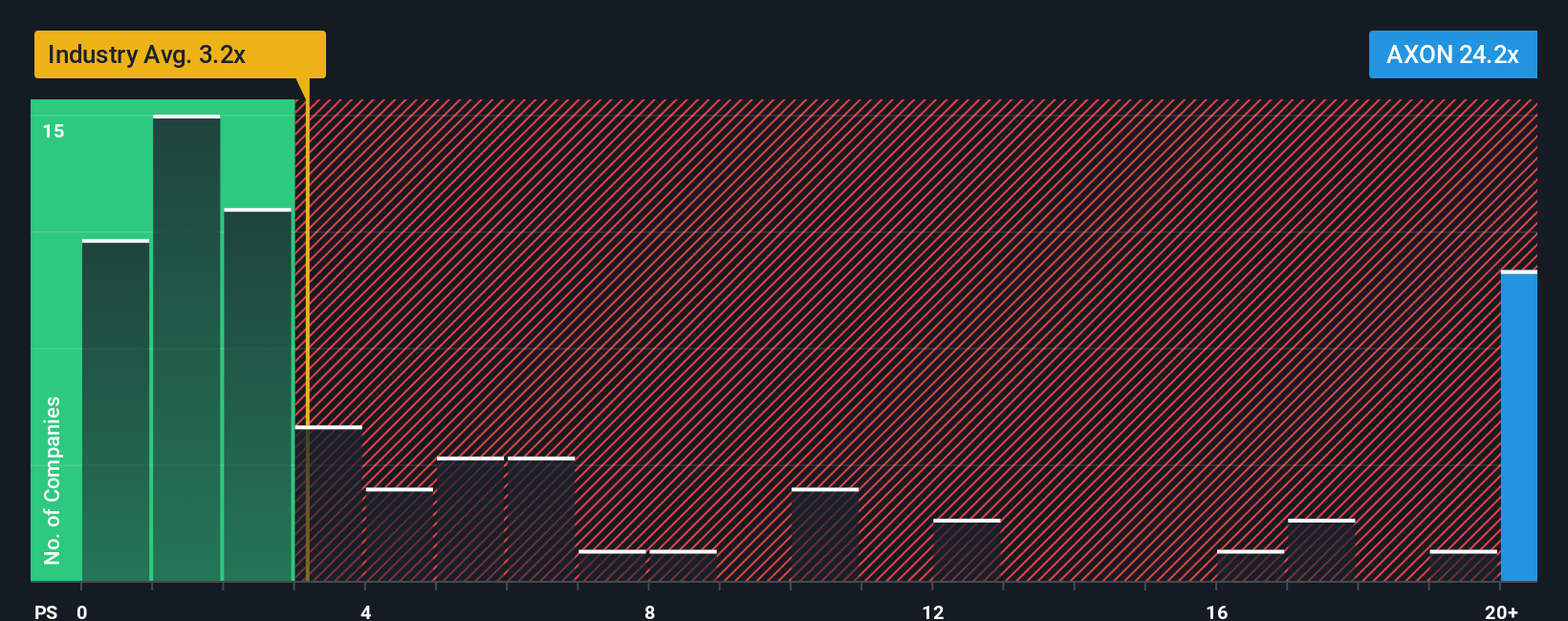

While the consensus narrative paints Axon Enterprise as undervalued, a quick look at its price-to-sales ratio tells a different story. At 23.1x, the company trades far above the US Aerospace & Defense industry average of 3.3x and even peers’ 7.6x. The fair ratio is 16.1x. Today’s premium could signal future risk if expectations falter. Are investors paying too much for strong growth?

Build Your Own Axon Enterprise Narrative

If you’d rather chart your own course or come to a different conclusion, building your own view from the ground up takes just a few minutes. Do it your way

A great starting point for your Axon Enterprise research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your options to one story? Use the Simply Wall Street Screener to set yourself apart with smart choices from standout opportunities across the market.

- Start building steady income streams by evaluating these 19 dividend stocks with yields > 3% which offers yields over 3 percent and robust financials.

- Capitalize on groundbreaking advancements and rapid innovation by focusing on these 24 AI penny stocks that are positioned to shape tomorrow’s tech landscape.

- Catch the trend early by scanning these 26 quantum computing stocks to find leading breakthroughs in computational power and new-age applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.