Please use a PC Browser to access Register-Tadawul

Azenta’s Space Trials Put Sample Tools And Valuation In New Focus

Azenta, Inc. AZTA | 29.28 | -1.31% |

- Azenta (NasdaqGS:AZTA) has entered a partnership with Frontier Space to bring its sample management technologies into space-based life sciences research.

- The collaboration includes testing Azenta’s FluidX consumables in microgravity and other extreme space conditions.

- This move introduces Azenta’s solutions to space research programs that rely on reliable sample handling and storage.

For investors following life sciences tools and services, Azenta sits in the middle of sample management and cold chain solutions that support research workflows. The partnership with Frontier Space connects that core business to a new setting in orbit, where reliability and traceability of samples are critical for experiments that cannot be easily repeated.

Space-based testing could help Azenta validate its technologies for customers that work in harsh or remote environments on Earth as well as in orbit. It also gives the company another reference point when talking to biopharma, academic, and government customers that are watching how space research might feed back into their own R&D programs.

Stay updated on the most important news stories for Azenta by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Azenta.

Quick Assessment

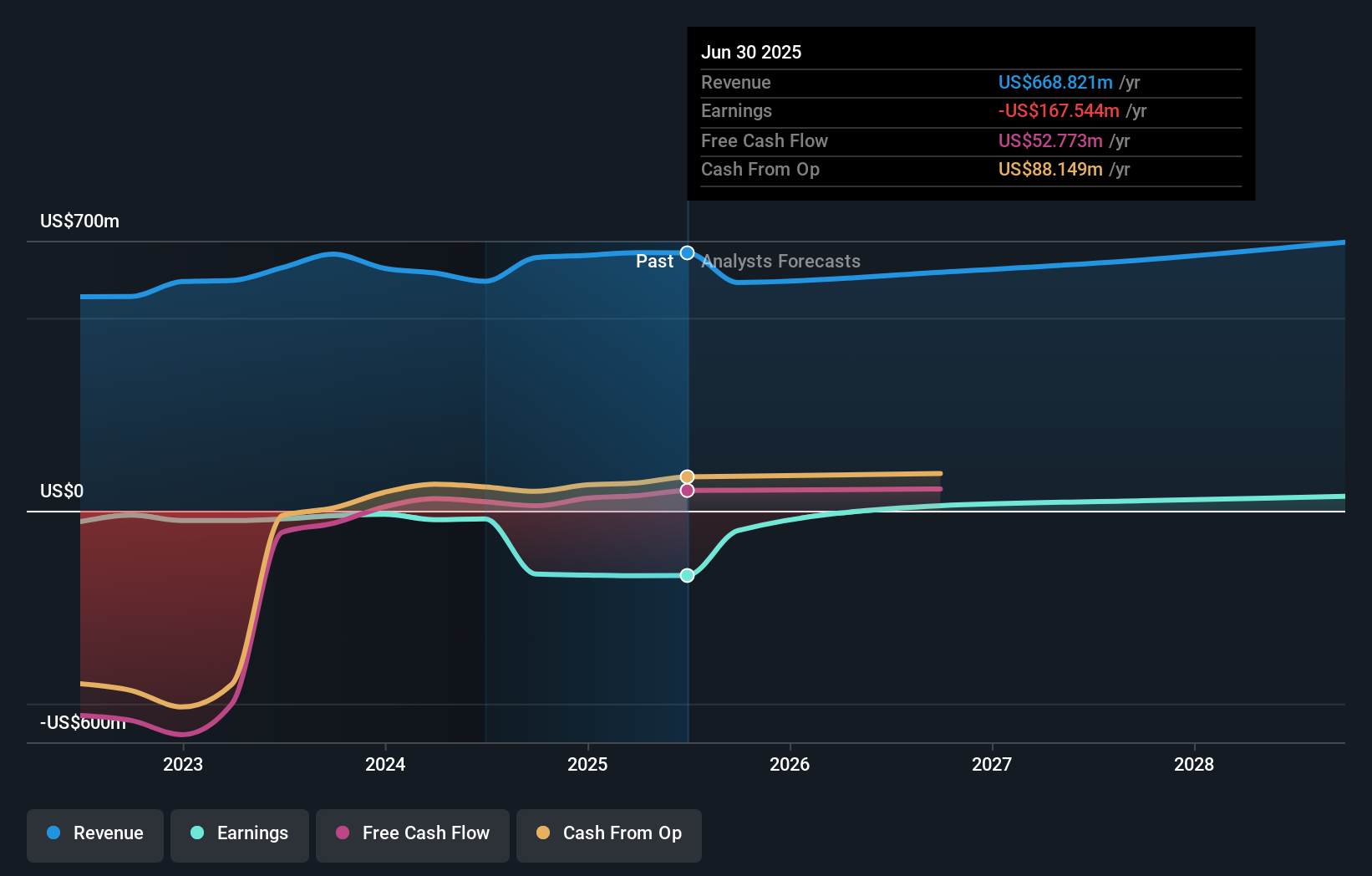

- ✅ Price vs Analyst Target: At US$30.45 versus a US$38.67 analyst target, the price sits around 21% below consensus.

- ✅ Simply Wall St Valuation: Shares are described as trading about 30.2% below estimated fair value.

- ❌ Recent Momentum: The 30 day return of roughly 18.9% decline points to weak short term sentiment.

There is only one way to know the right time to buy, sell or hold Azenta. Head to Simply Wall St's company report for the latest analysis of Azenta's Fair Value.

Key Considerations

- 📊 The Frontier Space partnership puts Azenta's sample management tools in a high profile testing ground that could matter for customers with demanding storage needs.

- 📊 Keep an eye on any disclosures about performance of FluidX consumables in microgravity, customer adoption linked to space trials, and how that aligns with the current 53.25x P/E versus the 32.89x industry average.

- ⚠️ One flagged risk is that large one off items affect reported earnings quality, which is important if you are weighing the 30.2% estimated discount to fair value.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Azenta analysis. Alternatively, you can check out the community page for Azenta to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.