Please use a PC Browser to access Register-Tadawul

Baidu (NasdaqGS:BIDU) Announces CNY-Denominated Offshore Notes Offering For General Corporate Purposes

Baidu, Inc. Sponsored ADR Class A BIDU | 118.75 | -0.06% |

Baidu (NasdaqGS:BIDU) recently announced a debt financing event, proposing an offering of CNY-denominated senior unsecured notes targeted at non-U.S. investors. This move highlights Baidu's efforts to secure capital for its corporate needs, possibly influencing investor sentiment positively. Alongside this, the company also experienced significant leadership change with the appointment of Ms. Xiaodan Liu as an independent director and audit committee chair, which could boost confidence in its governance practices. Additionally, Baidu completed a share buyback program, repurchasing 1.12% of its shares, likely supporting the stock by directly returning value to shareholders. These factors may have collectively contributed to the nearly 3% price movement seen over the last quarter. This performance is noteworthy given the mixed economic environment, where market indices have been wavering, and broader market trends have seen a 3% decline over the same period, contrasting Baidu’s upward trajectory within its own strategic initiatives.

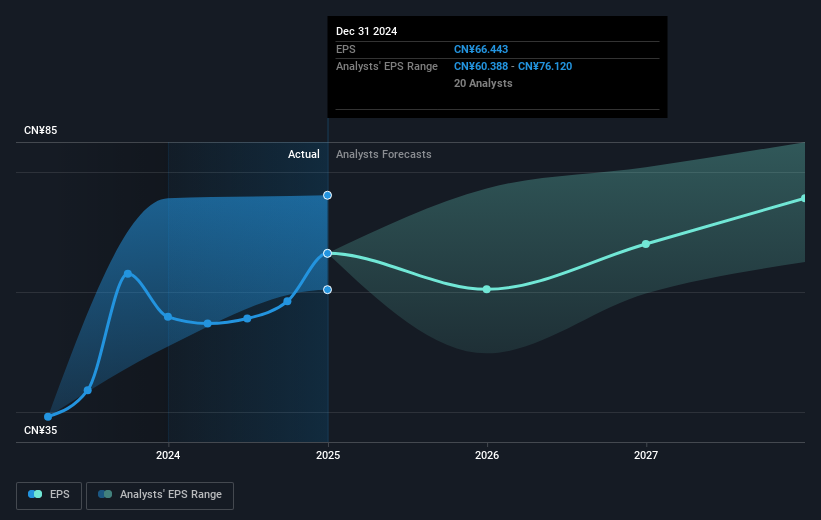

Baidu's total shareholder return was 11.30% decline over the last year, reflecting a contrast to the broader US Interactive Media and Services industry, which saw a 27.6% gain, and the US Market's 13.1% return during the same period. Throughout the year, Baidu navigated some challenges, including a slight revenue drop, as evidenced in its 2024 earnings where full-year revenue decreased to CNY 133.13 billion from the previous year's CNY 134.60 billion. Despite this, the company achieved a rise in net income to CNY 23.76 billion, marking improvements in efficiency.

Key initiatives likely influencing shareholder returns included significant share repurchase activities, with Baidu buying back shares multiple times over the year, such as completing a US$1.72 billion buyback by February 2025. Additionally, the company's inroads into AI, like advancements in image generation and application-building tools announced in November 2024, strengthen its technological foundation and future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.