Please use a PC Browser to access Register-Tadawul

Bath & Body Works (BBWI): Assessing Valuation After Second Quarter Growth and Profit Guidance Update

Bath & Body Works, Inc. BBWI | 19.66 | -0.33% |

If you have been following Bath & Body Works (BBWI) lately, there is plenty to unpack after the company released its second quarter results. The biggest news is that sales are up compared to the same quarter last year, but net income and earnings per share dipped noticeably. The management also narrowed its guidance for 2025, predicting modest sales growth, yet signaling that profits are likely to come in lower than the prior year. These shifts are getting attention as investors sort out what all this means for the stock moving forward.

This fresh data lands just as Bath & Body Works has been working to steady its performance. While the past three months have shown some momentum with gains in the stock price, the year so far has proved challenging; shares remain well below where they started in January. Over the longer term, performance has been a mixed bag, with the recent buyback program and financial updates all contributing to a sense that the company is actively recalibrating after some turbulence.

After this quarter’s combination of higher top-line numbers and lower profit guidance, the big question is whether the market is creating a real buying opportunity, or whether future growth is already reflected in today’s share price.

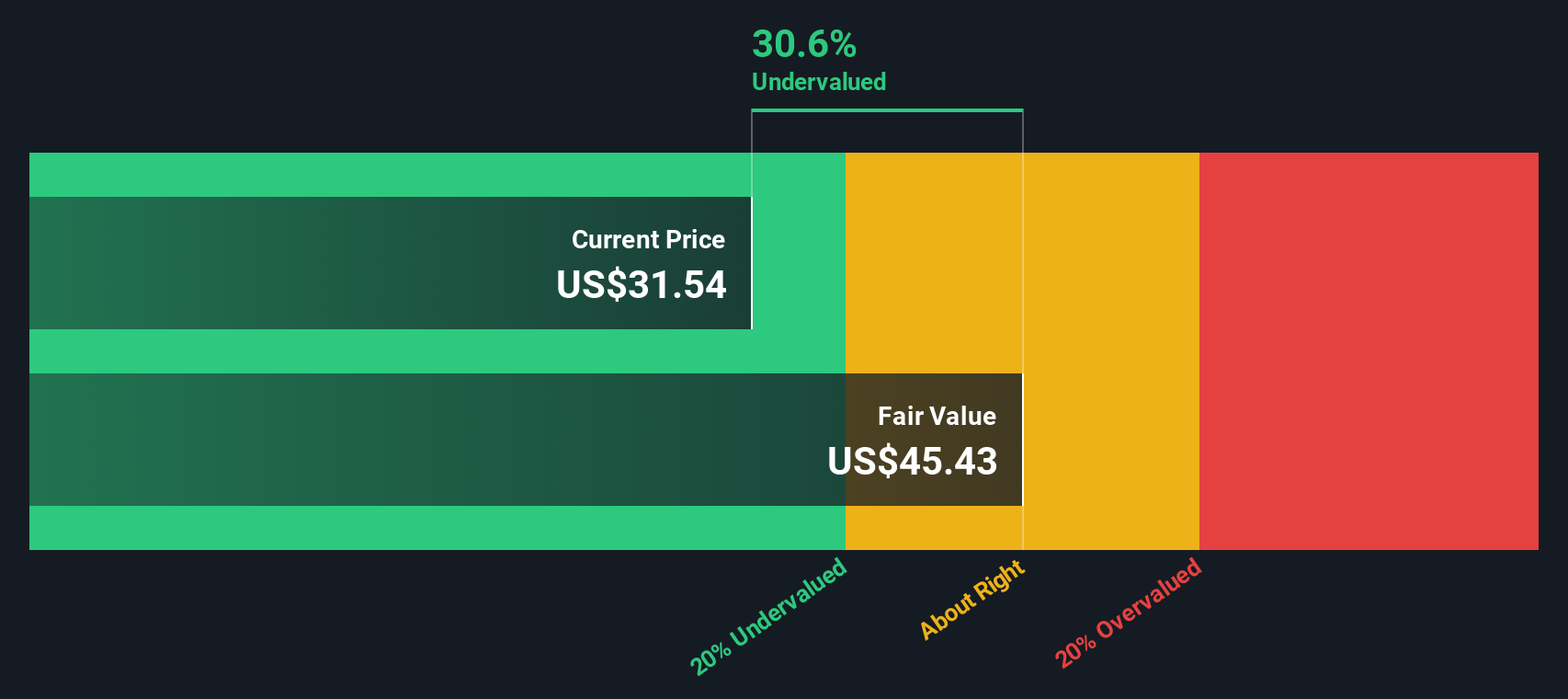

Most Popular Narrative: 30.1% Undervalued

According to the widely followed narrative, Bath & Body Works is believed to be trading at a significant discount to its fair value, suggesting potential upside for investors who are paying attention to the numbers behind the story.

"The first thing is they need to get through their mountain of debt. Once they can get through this debt, their earnings growth is expected to improve and become more productive. This will not address their low revenue growth, but it could result in a significant increase in free cash flow and strengthen the company overall, especially considering their current revenue levels."

Curious how one retail stock could be poised for explosive growth despite its recent struggles? Key assumptions set the stage for a potential turnaround, pointing to ambitious earnings expansion and future valuations that challenge current expectations. Interested in the fundamental changes that could drive this shift? Learn what justifies this fair value estimate and the specific financial criteria supporting the projection.

Result: Fair Value of $40.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, looming debt levels and challenges in expanding to new markets could undermine these optimistic projections if progress stalls or if headwinds intensify.

Find out about the key risks to this Bath & Body Works narrative.Another View: DCF Valuation Perspective

Taking a different approach, our SWS DCF model also points to Bath & Body Works trading at a discount to its fair value. This supports the view that the stock may be undervalued. However, could the assumptions behind these calculations be too optimistic if future profits do not meet expectations?

Build Your Own Bath & Body Works Narrative

If you see the story differently or want to investigate the numbers on your terms, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Bath & Body Works research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't settle for just one opportunity. Unlock even more ways to boost your returns with investment ideas tailored to your strategy. The Simply Wall Street Screener provides you with an advantage, revealing hidden gems and high-potential plays you might otherwise miss.

- Tap into the future of healthcare breakthroughs by checking out healthcare AI stocks as artificial intelligence transforms the medical world.

- Fuel your search for resilient income by scouting dividend stocks with yields > 3% that are delivering 3%+ yields right now to investors seeking dependable returns.

- Catch the undervalued stars making waves in the market and spot fresh opportunities before the crowd through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.