Please use a PC Browser to access Register-Tadawul

Bausch Health (NYSE:BHC): Evaluating Valuation as Shares Surge Without Clear Catalyst

Bausch Health Companies Inc. Common Stock BHC | 6.93 | +0.29% |

Most Popular Narrative: 3.5% Overvalued

The most followed narrative currently sees Bausch Health Companies trading just above fair value, with its share price reflecting slightly more optimism than analysts' consensus.

Strong operating performance, ongoing deleveraging, and digital sales initiatives improve financial stability, operating margins, and long-term growth prospects. Dependence on a few key products, regulatory pricing pressures, and heavy debt burden create significant risks to revenue stability, profitability, and future growth opportunities.

Is the market getting ahead of itself? The key to this valuation lies in ambitious assumptions about profit growth and operating margins. Are you curious which bold long-term projections underpin this call? Uncover the essential financial expectations and discover what could set the bar for Bausch’s future performance.

Result: Fair Value of $7.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are certainly risks, including potential price cuts to its top drug and ongoing regulatory scrutiny. These factors could quickly undermine this cautious optimism.

Find out about the key risks to this Bausch Health Companies narrative.Another View: The SWS DCF Model

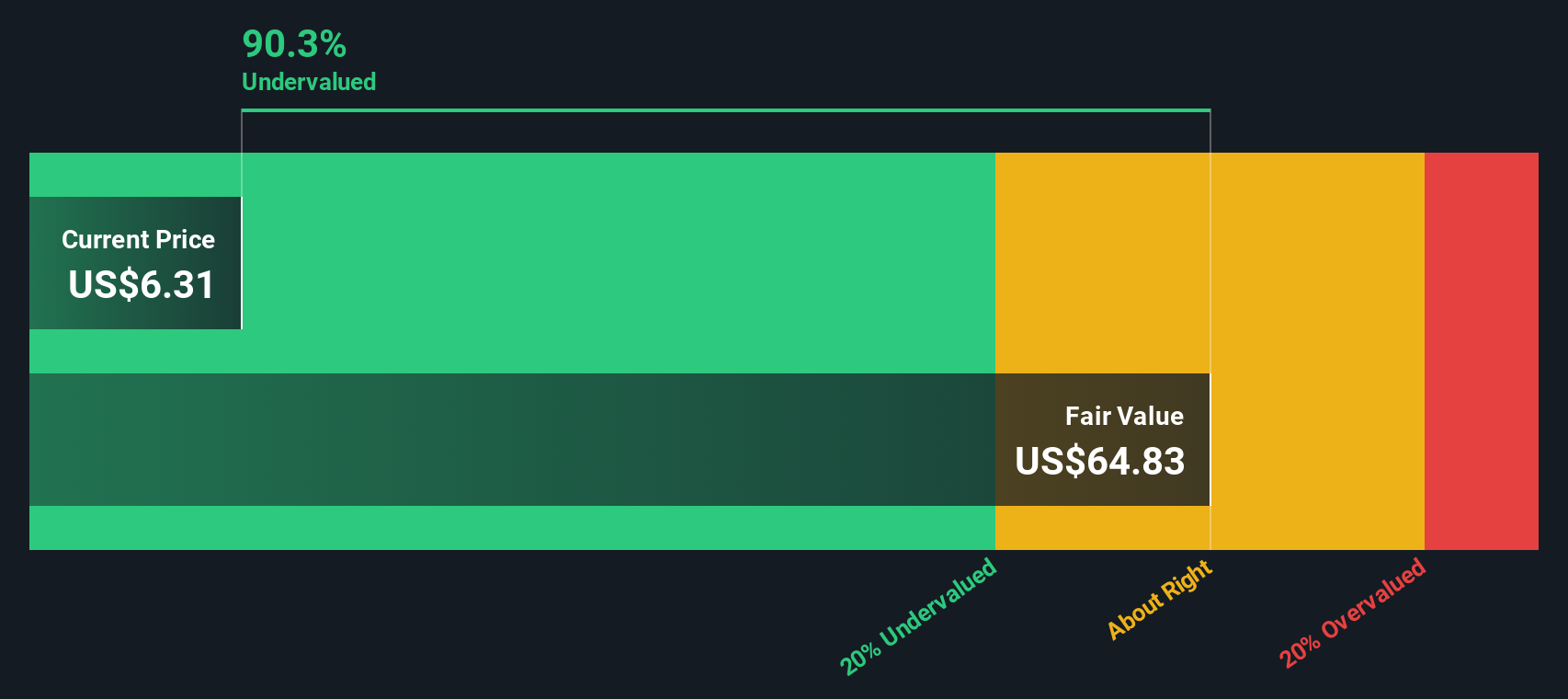

Looking at Bausch Health Companies through our DCF model offers a different perspective. This approach suggests the shares may be significantly undervalued compared to the earlier estimate. Could this alternative approach change the outlook entirely?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bausch Health Companies Narrative

If you have a different perspective or want to dive deeper on your own terms, you can build your own view in just a few minutes. Do it your way

A great starting point for your Bausch Health Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Want an edge in your portfolio? Get ahead of the crowd with smart tools that uncover opportunities hiding in plain sight. Don’t miss your best chance to stay on top of tomorrow’s trends and potential breakouts. See what could supercharge your returns today.

- Target untapped value by scanning for stocks that look undervalued based on their cash flow outlook with our undervalued stocks based on cash flows to potentially spot your next bargain early.

- Catch the future of innovation by hunting for companies shaping breakthroughs in healthcare and artificial intelligence with our healthcare AI stocks, fueling growth in cutting-edge medicine and smart technologies.

- Boost your income stream by zeroing in on opportunities offering generous yields. Use our dividend stocks with yields > 3% to find strong dividend payers with the potential for steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.