Please use a PC Browser to access Register-Tadawul

Behind the Scenes of Costco Wholesale's Latest Options Trends

Costco Wholesale Corporation COST | 884.47 | 0.00% |

Whales with a lot of money to spend have taken a noticeably bearish stance on Costco Wholesale.

Looking at options history for Costco Wholesale (NASDAQ:COST) we detected 31 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 51% with bearish.

From the overall spotted trades, 13 are puts, for a total amount of $703,731 and 18, calls, for a total amount of $840,453.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $800.0 to $1200.0 for Costco Wholesale over the last 3 months.

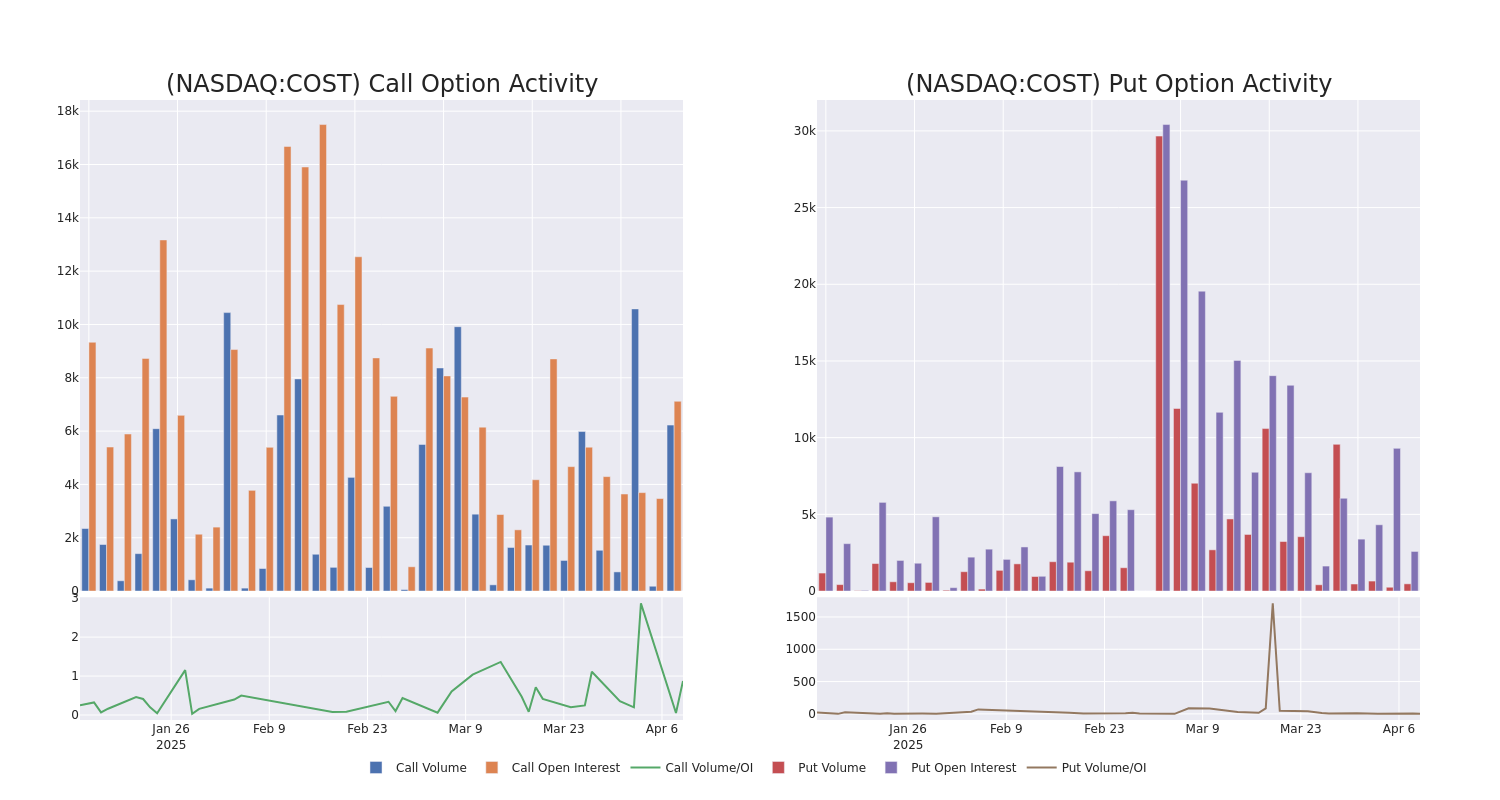

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Costco Wholesale's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Costco Wholesale's whale activity within a strike price range from $800.0 to $1200.0 in the last 30 days.

Costco Wholesale Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COST | PUT | TRADE | BEARISH | 06/20/25 | $82.0 | $77.75 | $82.0 | $1000.00 | $164.0K | 539 | 1 |

| COST | CALL | TRADE | BEARISH | 07/18/25 | $71.9 | $68.95 | $68.95 | $955.00 | $110.3K | 40 | 16 |

| COST | PUT | TRADE | BULLISH | 04/17/25 | $10.5 | $10.25 | $10.25 | $905.00 | $102.5K | 355 | 110 |

| COST | CALL | SWEEP | BULLISH | 06/18/26 | $176.7 | $168.15 | $172.09 | $900.00 | $87.5K | 38 | 0 |

| COST | CALL | TRADE | BULLISH | 05/16/25 | $45.25 | $44.15 | $45.25 | $955.00 | $67.8K | 148 | 2 |

About Costco Wholesale

Costco operates a membership-based, no-frills retail model predicated on offering a select product assortment in bulk quantities at bargain prices. The firm avoids maintaining costly product displays by keeping inventory on pallets and limits distribution expenses by storing its inventory at point of sale in the warehouse. Given its frugal cost structure, the firm is able to price its merchandise below that of competing retailers, driving high sales volume per warehouse and generating strong profits on thin margins. Costco operates over 600 warehouses in the United States and has over 60% share in the domestic warehouse club industry. Internationally, Costco operates another 280 warehouses, primarily in Canada, Mexico, Japan, and the UK.

After a thorough review of the options trading surrounding Costco Wholesale, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Costco Wholesale

- Trading volume stands at 599,650, with COST's price down by -1.01%, positioned at $954.57.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 48 days.

What Analysts Are Saying About Costco Wholesale

In the last month, 5 experts released ratings on this stock with an average target price of $1051.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Telsey Advisory Group has decided to maintain their Outperform rating on Costco Wholesale, which currently sits at a price target of $1100. * An analyst from Stifel persists with their Buy rating on Costco Wholesale, maintaining a target price of $1035. * Consistent in their evaluation, an analyst from Loop Capital keeps a Buy rating on Costco Wholesale with a target price of $1045. * Reflecting concerns, an analyst from Mizuho lowers its rating to Neutral with a new price target of $975. * An analyst from Telsey Advisory Group has decided to maintain their Outperform rating on Costco Wholesale, which currently sits at a price target of $1100.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Costco Wholesale with Benzinga Pro for real-time alerts.