Please use a PC Browser to access Register-Tadawul

Bentley Systems (BSY) Is Up 7.4% After Joining S&P MidCap 400 to Replace Western Union

Bentley Systems, Incorporated Class B BSY | 34.94 | +1.45% |

- Bentley Systems has been selected to join the S&P MidCap 400 index, replacing Western Union, in a change effective prior to the market opening on October 6, 2025, following Western Union's move to the S&P SmallCap 600 after Rocket Companies acquired Mr. Cooper Group.

- This index inclusion can drive fresh interest from institutional investors and index funds, often enhancing a company's visibility and overall market recognition.

- We'll explore how Bentley Systems' upcoming addition to the S&P MidCap 400 could influence its overall investment outlook and industry positioning.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bentley Systems Investment Narrative Recap

The core belief driving interest in Bentley Systems is its ability to capitalize on global infrastructure investment and a sector-wide shift to digital engineering tools. While index inclusion in the S&P MidCap 400 can boost the company's market presence, it does not materially change the primary near-term catalyst, ongoing demand for AI-driven, cloud-based solutions, or alleviate the key risk of rapid automation and evolving pricing models impacting margins and revenue predictability.

Among recent announcements, the upcoming Q3 2025 earnings release on November 5 carries the most weight for investors focused on Bentley's momentum. This financial update may provide critical insight into whether Bentley's portfolio expansion and AI initiatives are translating into improved profitability, addressing the most meaningful short-term catalyst tied to accelerating digital adoption in infrastructure.

However, despite increased attention around the index move, investors should not overlook how fast-moving automation trends threaten to unsettle the traditional software pricing model and...

Bentley Systems' outlook projects $1.9 billion in revenue and $443.2 million in earnings by 2028. This requires 9.7% annual revenue growth and a $188.9 million increase in earnings from the current $254.3 million.

Uncover how Bentley Systems' forecasts yield a $59.08 fair value, a 6% upside to its current price.

Exploring Other Perspectives

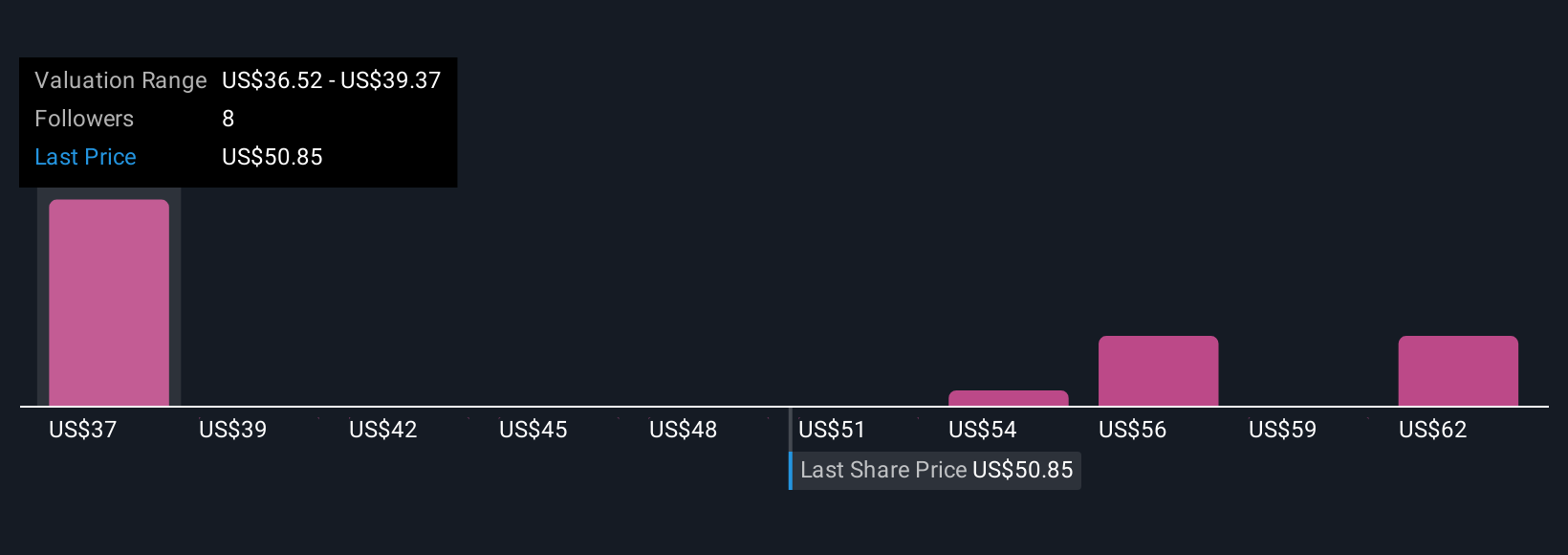

Four community members on Simply Wall St estimate Bentley Systems’ fair value from US$36.28 to US$65. Some believe global digital transformation will drive growth, while others advise caution as profitability faces pressure.

Explore 4 other fair value estimates on Bentley Systems - why the stock might be worth 35% less than the current price!

Build Your Own Bentley Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bentley Systems research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Bentley Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bentley Systems' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.