Please use a PC Browser to access Register-Tadawul

BioNTech (BNTX) Faces Legal Challenges Over mRNA Patent

BioNTech BNTX | 91.60 | -2.36% |

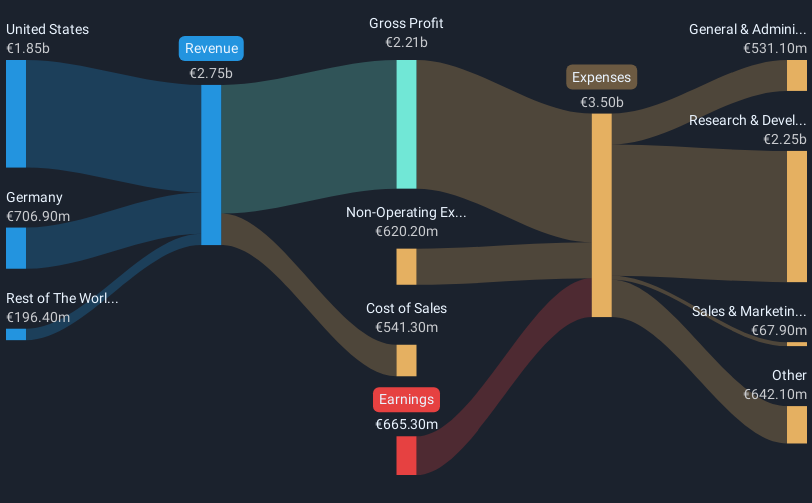

BioNTech (BNTX) has been under scrutiny due to significant legal challenges, including a recent claim construction ruling in a patent lawsuit involving its COVID-19 mRNA vaccine technology. At the same time, the company has engaged in collaborations, such as the co-development agreement with Bristol-Myers Squibb, and reported positive trial results for various vaccines and therapies. Despite these developments, BioNTech's shares saw a price move of 9% decline last quarter. This decline contrasts with the broader market trends, where indexes like the Nasdaq reached new highs, reflecting a mixed sentiment among investors towards the company's ongoing legal and clinical endeavors.

BioNTech's recent legal challenges and collaborative efforts could significantly influence its long-term growth narrative. The patent lawsuit may increase regulatory and operational costs, while collaborations with companies like Bristol-Myers Squibb may drive innovation and open new revenue streams. Over the past five years, BioNTech's total shareholder return, including share price appreciation and dividends, was 45.79%. This long-term return is noteworthy given the recent quarterly share price decline of 9% amid broader market gains.

In the last year, BioNTech's performance lagged behind the US Biotechs industry and the broader US market, highlighting the mixed investor sentiment. These developments indicate potential volatility in revenue and earnings forecasts. The legal issues could affect short-term financial performance, while successful product launches from ongoing collaborations might support future revenue stability. Analysts' consensus price target of US$135.85 suggests a potential 40.4% upside from the current share price of US$96.74, reflecting a degree of optimism about BioNTech's ability to overcome current hurdles and capitalize on its oncology and mRNA pipeline advances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.