Please use a PC Browser to access Register-Tadawul

BioNTech (NasdaqGS:BNTX) Valuation in Focus After AI Strategy Showcase and Positive Pfizer Developments

BioNTech BNTX | 94.81 | -1.24% |

BioNTech (BNTX) recently showcased its AI initiatives, led by its subsidiary InstaDeep, at an Innovation Series event, sparking a rise in share price. Fresh developments from partner Pfizer offered an extra boost for investor sentiment.

BioNTech’s recent push into AI, combined with a wave of upbeat headlines from its partner Pfizer, helped lift investor enthusiasm and push the share price higher. Even so, the stock’s 1-year total shareholder return stands at -14.0%, highlighting that momentum has yet to fully turn the corner despite brighter long-term prospects and a steady flow of innovation-focused news.

If you’re curious where the next growth stories might come from in the biotech and pharma world, it’s worth exploring See the full list for free.

With shares still well below analysts’ long-term targets and optimism building around innovation, the key question facing investors is whether there is genuine value left on the table, or if the market has already priced in BioNTech’s growth story.

Most Popular Narrative: 22.3% Undervalued

Compared to its most popular narrative fair value estimate, BioNTech's $105.49 share price trades at a significant discount. This hints at an unrealized investor opportunity if projections prove accurate. Expectations around pipeline progress and profit trends are central to this view.

Robust pipeline expansion in oncology, with multiple late-stage (Phase II/III) clinical trials for BNT327 and mRNA cancer immunotherapies across high-prevalence cancers (lung and breast), positions BioNTech to launch multiple new products. This could drive significant top-line revenue growth and enhance earnings visibility over the next several years.

Want to know the story behind this valuation gap? The most-followed forecast leans heavily on aggressive pipeline launches and structural transformation. Curious which bold earnings and margin assumptions could support such a premium? Dive in to uncover what’s driving this ambitious price target.

Result: Fair Value of $135.85 (UNDERVALUED)

However, persistent dependence on COVID-19 vaccine sales and setbacks in launching new oncology therapies could quickly undermine the current optimism around BioNTech’s future trajectory.

Another View: Multiples Suggest a Premium

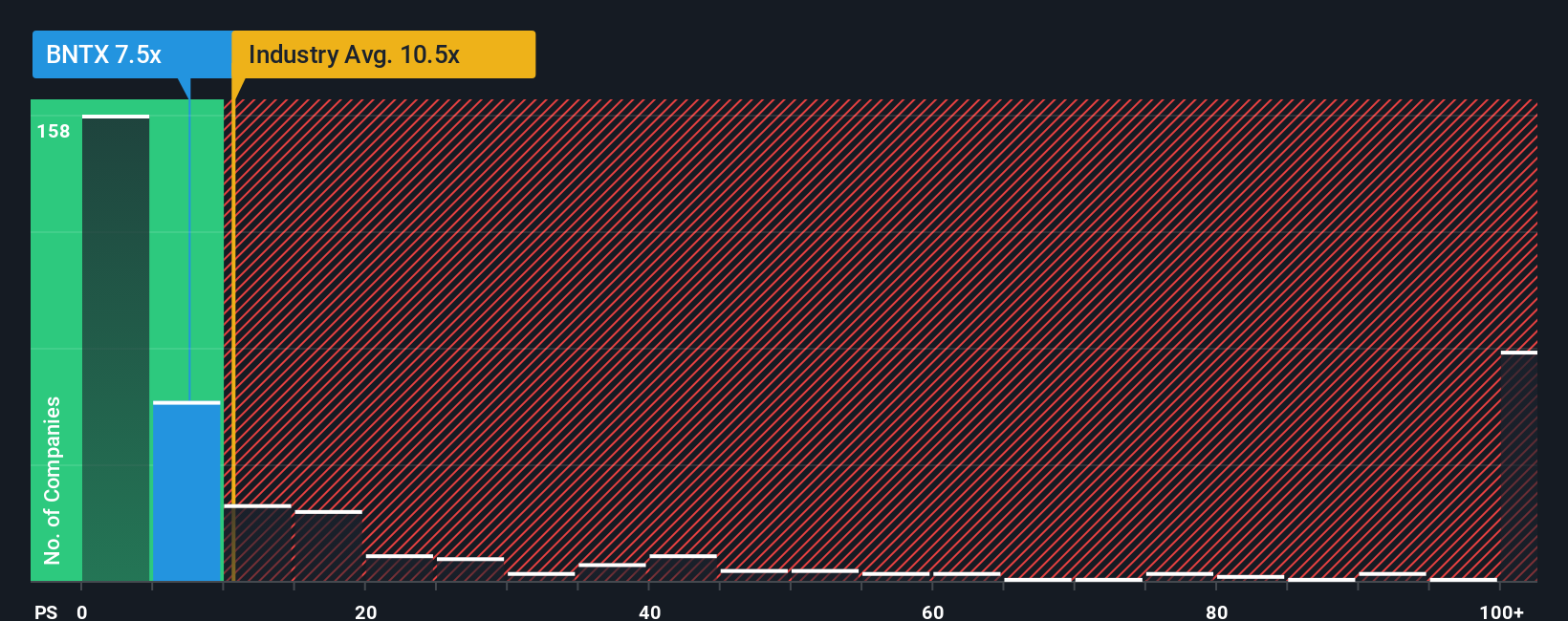

Looking at BioNTech’s valuation through the lens of its sales ratio offers a different signal. Its sales ratio stands at 7.4x, which is higher than both its peer average of 4x and the fair ratio estimate of 6.5x. This implies that the stock trades at a clear premium relative to many biotech peers, raising the potential for valuation risk if growth expectations fall short. Does the market believe BioNTech’s innovation justifies this premium?

Build Your Own BioNTech Narrative

If you see things differently or want to conduct your own analysis, you can shape your own view of BioNTech in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding BioNTech.

Looking for More Investment Ideas?

Smart investors don’t limit themselves to a single opportunity. Get ahead of the curve and broaden your watchlist with handpicked stocks primed for growth and resilience.

- Uncover high-yield possibilities by checking out these 19 dividend stocks with yields > 3%. These consistently deliver strong payouts and may boost your portfolio’s income.

- Spot innovators in the healthcare sector leading real-world change by reviewing these 31 healthcare AI stocks. See how AI is transforming patient outcomes and company prospects.

- Zero in on undervalued companies flying under the radar with these 901 undervalued stocks based on cash flows. This offers a fresh path to potential bargains others might be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.