Please use a PC Browser to access Register-Tadawul

BlackRock (BLK) Is Up 5.2% After Q2 Earnings Beat and Aladdin Platform Enhancements - What's Changed

BlackRock, Inc. BLK | 1091.17 | +0.19% |

- In July 2025, BlackRock reported higher year-over-year revenue and net income for the second quarter and unveiled collaborative product and platform enhancements, including new risk data on Aladdin and a tax-managed UMA for RIAs.

- These developments highlight BlackRock's ongoing investment in technology and alternatives, positioning the firm to provide a broader range of solutions for institutional and wealth clients.

- We'll examine how BlackRock's integration of RepRisk data into Aladdin could influence its investment narrative and longer-term competitive position.

BlackRock Investment Narrative Recap

To be a BlackRock shareholder, you need to believe in its ability to expand into alternatives, harness technology, and deliver diversified solutions that capture new client demand. The latest collaboration to enhance Aladdin with RepRisk data and the roll-out of a tax-managed UMA for RIAs both reinforce this trajectory, but do not materially change the near-term catalysts or meaningfully diminish the biggest risk: shifts in client behavior or a downturn in high-margin alternative fee revenues.

The July 2025 launch of a tax-managed UMA through Vestmark, developed with BlackRock’s asset allocation models, directly supports the firm’s drive to grow in private markets and alternatives. This product integration for RIAs illustrates how BlackRock is executing on key growth priorities, remaining relevant amid client shifts and strengthening its positioning for incremental revenue as demand for alternatives grows.

By contrast, one risk investors should be aware of is how rapidly changing client sentiment could impact...

BlackRock's narrative projects $27.8 billion in revenue and $9.1 billion in earnings by 2028. This requires 9.9% yearly revenue growth and a $2.8 billion earnings increase from the current $6.3 billion.

Exploring Other Perspectives

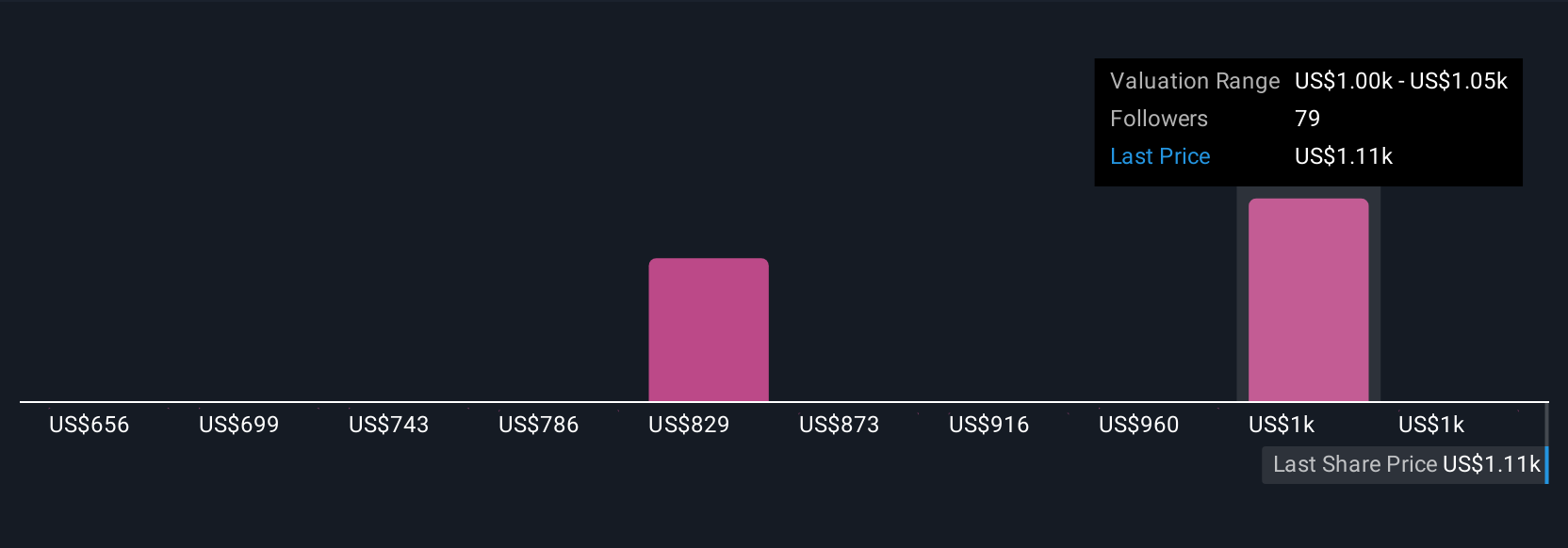

Fourteen Simply Wall St Community members see BlackRock's fair value everywhere from US$655.81 to US$1,090. The wide spread reflects how perceptions of BlackRock’s growth in private markets and technology can shape very different outlooks for the company’s future performance.

Build Your Own BlackRock Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackRock research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BlackRock research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackRock's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.