Please use a PC Browser to access Register-Tadawul

Block (SQ): Assessing Valuation Following Grubhub Integration and New Cash App Pay Features for Restaurants

Block XYZ | 64.75 65.46 | +1.79% +1.10% Pre |

Block’s new partnership with Grubhub targets the restaurant space by allowing businesses to manage all their orders directly from Square’s point-of-sale system. This integration reduces hassle and operational friction for staff.

With the addition of Cash App Pay as a checkout option for Grubhub diners, Block also offers more payment choices, giving restaurants new ways to reach customers and streamline transactions.

Block’s steady string of product rollouts this year, including its Square Bitcoin launch and major food and beverage platform revamp, has kept the spotlight firmly on the company. Despite this buzz, Block’s share price has declined 13.3% year-to-date, with the most recent 1-year total shareholder return coming in at a modest 1.75%. While momentum has been sluggish lately, Block’s multi-year strategy bets on ecosystem expansion that could rejuvenate sentiment over time.

If you’re curious about companies making bold moves in tech and financial innovation, it’s a smart moment to broaden your search and discover fast growing stocks with high insider ownership

This raises an important question for investors: with Block’s recent innovations and partnerships, is the current share price underestimating its long-term potential, or has the market already priced in the company’s next chapter of growth?

Most Popular Narrative: 13.7% Undervalued

Block's prevailing narrative suggests the stock is trading below its estimated fair value of $87.17, compared to the latest closing price of $75.20. This gap draws focus to the company's evolving fundamentals and future earnings potential.

The scaling and innovation within Square for Businesses, highlighted by the launch of new hardware like Square Handheld, adoption of omnichannel commerce tools, and growing field and telesales teams, positions Block to further capture share from the global trend toward digitalization and consolidation of small business commerce. This supports topline growth and eventual margin expansion as the business scales internationally.

Block's narrative is built on rapid launches, expansion moves, and evolving profit levers. What essential assumptions fuel the calculations behind this fair value? Uncover the rationale driving such an optimistic pricing outlook and see what could surprise even the savviest market watchers.

Result: Fair Value of $87.17 (UNDERVALUED)

However, as competition in fintech intensifies and reliance on lending products increases, the bullish outlook on Block’s long-term growth could be quickly tested.

Another View: Discounted Cash Flow Model

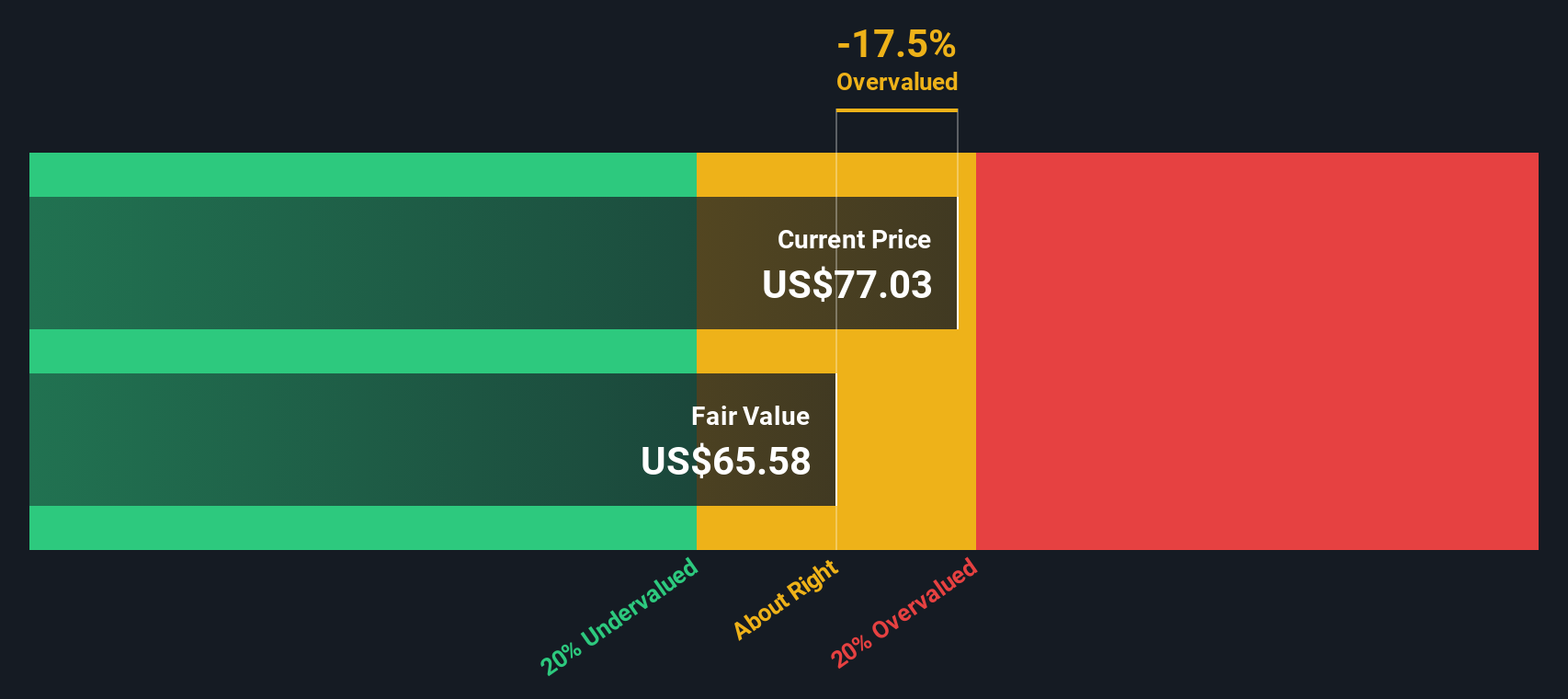

Taking a look through the lens of the SWS DCF model, Block’s current share price of $75.20 sits above our fair value estimate of $64.18. This method presents a more cautious picture, suggesting Block may be slightly overvalued if current forecasts prove accurate. Could the market be anticipating more future growth than the underlying fundamentals support?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Block for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Block Narrative

If you’d like to dig into the numbers or take a different perspective, you can shape your own Block narrative in just a few minutes. Do it your way

A great starting point for your Block research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give yourself an edge by checking out high-potential companies in fast-changing industries that have a history of rewarding bold investors. Don’t miss out on these standout opportunities selected for growth, innovation, and strong fundamentals.

- Capitalize on strong income potential and start building your portfolio with steady earners like these 18 dividend stocks with yields > 3% for yields above 3%.

- Stay ahead of fintech innovation and meet the disruptors transforming finance by reviewing these 79 cryptocurrency and blockchain stocks in decentralized payment and blockchain technology.

- Seize the chance to uncover value gems trading below their true worth with the latest picks from these 871 undervalued stocks based on cash flows based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.