Please use a PC Browser to access Register-Tadawul

Boot Barn (BOOT) Is Up 10.9% After Raising FY26 Guidance and Accelerating Store Expansion Plans

Boot Barn Holdings, Inc. BOOT | 199.76 | +1.46% |

- Boot Barn Holdings, Inc. reported past third-quarter fiscal 2026 results with sales of US$705.64 million and net income of US$85.81 million, and updated full-year guidance that includes anticipated total sales of about US$2.24–2.25 billion and net income of roughly US$222.8–225.8 million.

- Alongside planning to open 70 new stores and completing a US$37.44 million share repurchase program, management is emphasizing same-store sales growth and margin improvement across both retail and e-commerce channels.

- Next, we will examine how Boot Barn’s upgraded full-year guidance and focus on expanding its store base shape the investment narrative.

Capitalize on the AI infrastructure supercycle with our selection of the 33 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

What Is Boot Barn Holdings' Investment Narrative?

To own Boot Barn today, you have to believe its Western and workwear niche can keep supporting a larger store base, while e-commerce and exclusive brands do more of the heavy lifting on profitability. The latest quarter and upgraded full-year guidance reinforce that story in the near term, with management leaning into 70 new store openings and calling out same-store sales and margin focus as key levers. Short-term, the main catalysts now sit around execution on that expansion plan, maintaining gross margin discipline as volume scales, and how effectively the completed US$37.44 million buyback and any future repurchases support earnings per share. On the risk side, the strong share price run and a price-to-earnings multiple above peers leave less room for disappointment if sales or margins soften.

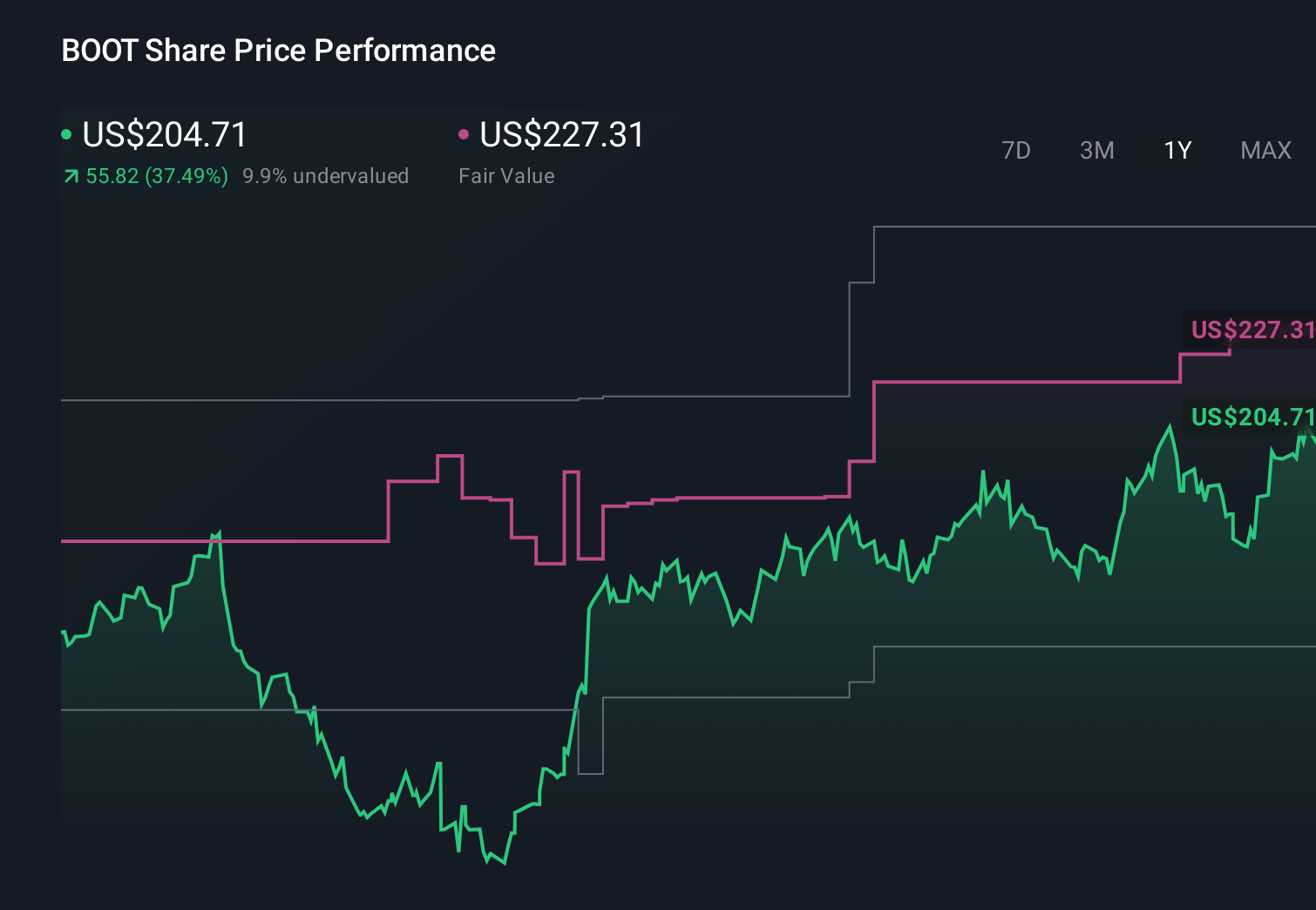

Boot Barn Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Five fair value views from the Simply Wall St Community span roughly US$27.81 to US$278.15 per share, underlining how far apart individual expectations can be. When you set that against Boot Barn’s store expansion push and reliance on same-store sales and margin gains, it becomes clear that different investors are weighing execution risk and growth potential very differently. You are not short of alternative viewpoints to compare with your own assumptions.

Explore 5 other fair value estimates on Boot Barn Holdings - why the stock might be worth less than half the current price!

Build Your Own Boot Barn Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boot Barn Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Boot Barn Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boot Barn Holdings' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find 52 companies with promising cash flow potential yet trading below their fair value.

- We've uncovered the 14 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.