Please use a PC Browser to access Register-Tadawul

Braze's (BRZE) Raised Revenue Guidance Might Change the Case for Investing in the Stock

Braze, Inc. BRZE | 33.14 | -5.12% |

- Braze, Inc. recently announced its second quarter fiscal 2025 results, reporting sales of US$180.11 million and an increased net loss of US$27.9 million compared to the same period last year.

- While revenue continued to grow, the updated guidance projects annual sales between US$717.0 million and US$720.0 million, offering fresh insight into management’s expectations for the remainder of the fiscal year.

- We'll assess how Braze's updated revenue outlook for the year may influence its investment narrative and long-term growth trajectory.

Find companies with promising cash flow potential yet trading below their fair value.

Braze Investment Narrative Recap

To be a shareholder in Braze, you need to believe in the company's ability to drive sustainable revenue growth by delivering advanced customer engagement solutions, even as it manages ongoing losses. The recent Q2 results, showing continued sales growth alongside a wider net loss, do not materially change the most important short-term catalyst, successful AI integration following the OfferFit acquisition, but they do reinforce the biggest current risk: persistent unprofitability and pressure on net margins.

Among recent announcements, Braze’s updated guidance for fiscal 2025 revenue to US$717.0 million–US$720.0 million stands out. This revised outlook signals management’s sustained confidence in topline growth despite heightened losses, reinforcing the view that near-term revenue expansion remains central to the story, even as operating margins remain under scrutiny.

In contrast, investors should be aware that as revenue climbs, the underlying challenge of ongoing net losses and margin pressure remains unresolved, especially if...

Braze's outlook anticipates $1.0 billion in revenue and $133.0 million in earnings by 2028. This requires annual revenue growth of 17.9% and an earnings increase of $236.9 million from the current earnings of -$103.9 million.

Uncover how Braze's forecasts yield a $43.72 fair value, a 45% upside to its current price.

Exploring Other Perspectives

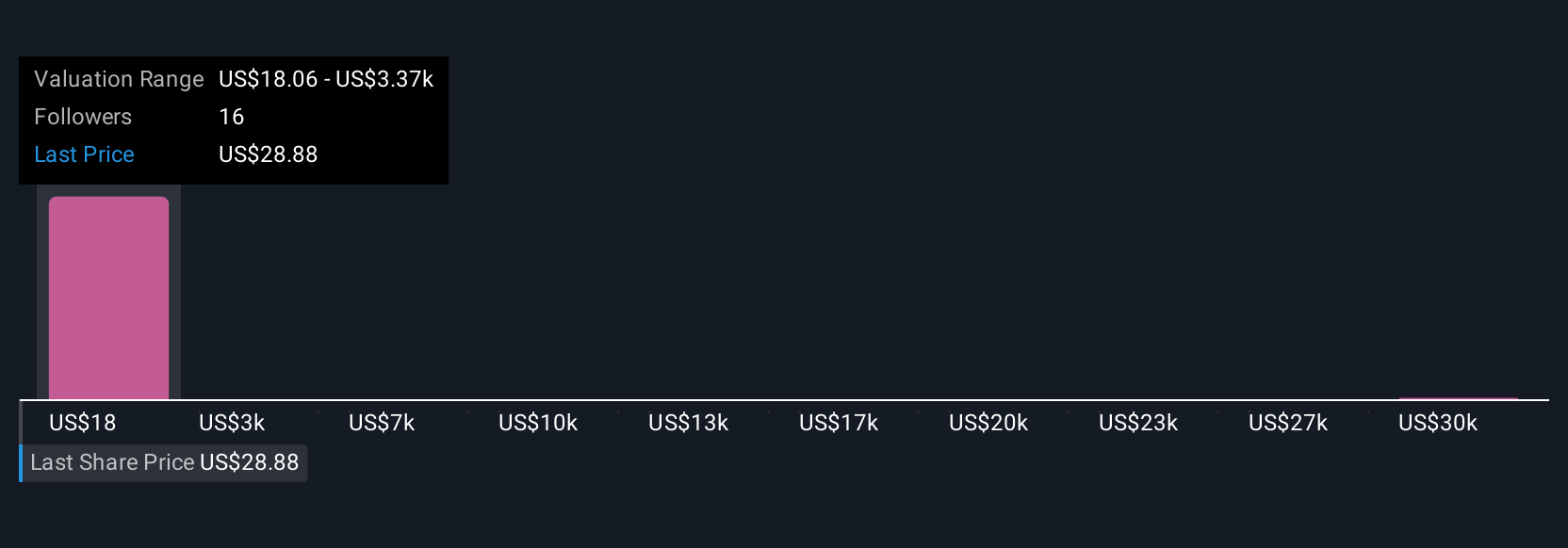

Four individual fair value estimates from the Simply Wall St Community for Braze span from just over US$23 to more than US$33,500 per share. While this reflects highly varied opinions, remember that ongoing losses and difficult profitability targets could shape future outcomes, so consider multiple viewpoints.

Explore 4 other fair value estimates on Braze - why the stock might be worth 23% less than the current price!

Build Your Own Braze Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Braze research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Braze research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Braze's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.