Please use a PC Browser to access Register-Tadawul

Bristol-Myers Squibb (BMY): Evaluating Valuation After Bold Pricing Moves, Regulatory Headwinds, and New AI Healthcare Push

Bristol-Myers Squibb Company BMY | 52.41 | +2.36% |

If you have been watching Bristol-Myers Squibb (BMY) lately, you are not alone. The company grabbed headlines after voicing strong opinions on NHS drug pricing, unveiling plans to sell its new schizophrenia treatment in the UK at US-level prices, and reinforcing its push into AI-driven healthcare engagement with Veeva Systems. These moves, along with industry-wide conversations about regulatory shakeups in patent fees and tariffs, have put BMY at the center of investor debates.

Amid all this, shares have seen renewed volatility this year, reflecting investors reassessing both near-term risks and future rewards. The stock has faced a steady decline over the year, struggling with weak sentiment and broader uncertainty across pharmaceuticals. While BMY continues to expand its Growth Portfolio, recent dividend affirmations show management is intent on rewarding long-term holders even as they navigate headwinds from declining legacy product revenues and a shifting regulatory landscape.

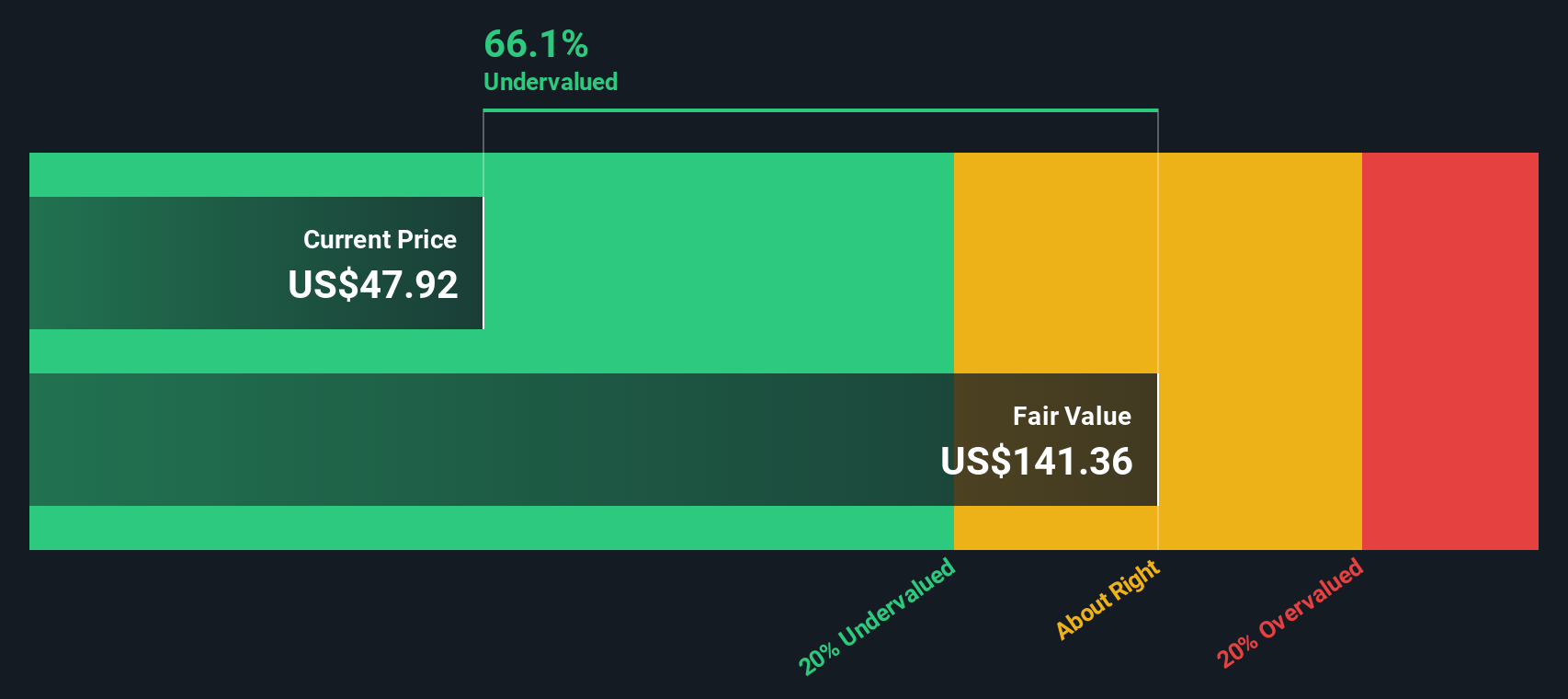

With the share price under pressure and ongoing headlines about undervaluation, the question is whether BMY is starting to look like a real bargain or if the market is rightly cautious about future growth risks.

Most Popular Narrative: 30.8% Undervalued

According to the most widely followed narrative, Bristol-Myers Squibb is trading well below its estimated fair value, hinting at a potential undervalued situation for investors reconsidering their stance in 2024.

Full-Year 2024 Highlights:

• Total Revenues: $48.3 billion, a 7% increase from 2023.

• GAAP Loss Per Share: $(4.41), compared to earnings of $3.86 in 2023.

• Non-GAAP EPS: $1.15, a significant decrease from $7.51 in 2023.

• Growth Portfolio Revenues: $22.6 billion, a 17% increase, indicating robust performance of newer products.

Want to know how this narrative points to a huge upside? The key factors include projections about the company's newest products and cost-saving ambitions, but there is also an unexpected twist in the margin story. Interested in seeing which numbers could change your view of BMY's future? Review the forecasts that build this bullish case.

Result: Fair Value of $65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory changes and execution risk around new drug launches could quickly shift sentiment if growth does not materialize as hoped.

Find out about the key risks to this Bristol-Myers Squibb narrative.Another View: What Does Our DCF Model Say?

Looking at Bristol-Myers Squibb through the lens of our SWS DCF model adds another perspective. This valuation approach also suggests the shares are undervalued, but does it tell the full story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bristol-Myers Squibb Narrative

If you see things differently or enjoy diving into the numbers yourself, you can quickly craft your own take on Bristol-Myers Squibb's outlook in just a few minutes. Do it your way.

A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities pass you by. The Simply Wall St Screener helps you pinpoint standout stocks across the market using the latest data and analysis. Check out these powerful ideas before the crowd finds them:

- Capture steady income with reliable high-yield plays by checking out dividend stocks with yields > 3% for yields above 3%.

- Tap into the AI revolution and spot companies harnessing artificial intelligence for rapid growth in AI penny stocks.

- Uncover hidden gems most investors miss by reviewing undervalued stocks based on cash flows and see which stocks are trading below their true value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.