Please use a PC Browser to access Register-Tadawul

Brookdale Senior Living (BKD) Guides to Higher 2025 Revenue but Deeper Losses from Impairment Charges

Brookdale Senior Living Inc. BKD | 14.90 | -0.33% |

- Brookdale Senior Living recently issued guidance for 2025, projecting revenue of about US$3.20 billion versus US$3.10 billion in 2024, alongside a wider net loss of approximately US$263 million due largely to non-cash impairment charges.

- At the same time, the company outlined ambitious 2026 targets for revenue per available room growth and adjusted EBITDA, signaling management’s confidence in extracting more earnings power from its existing senior housing footprint.

- Next, we’ll examine how Brookdale’s focus on growing revenue per available room shapes its investment narrative in light of these developments.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Brookdale Senior Living's Investment Narrative?

To own Brookdale today, you really have to believe its senior housing platform can eventually turn improving occupancy and revenue per available room into sustainable cash earnings, despite a history of losses and a leveraged balance sheet. The latest guidance and investor day sharpen that trade-off: management is talking up 2026 revenue-per-room growth and adjusted EBITDA while still guiding to a wider 2025 net loss of about US$263 million, largely from non-cash impairment. That mix, plus fresh refinancing of roughly US$550 million of 2026–2027 mortgage debt and a new CEO and COO, makes the near-term story more about execution than survival. The stock’s sharp rerating after RBC’s higher price target suggests these targets are already influencing expectations, so any stumble on occupancy, pricing, or debt reduction could quickly become the dominant catalyst. Yet there is one balance sheet pressure point many Brookdale shareholders might be underestimating.

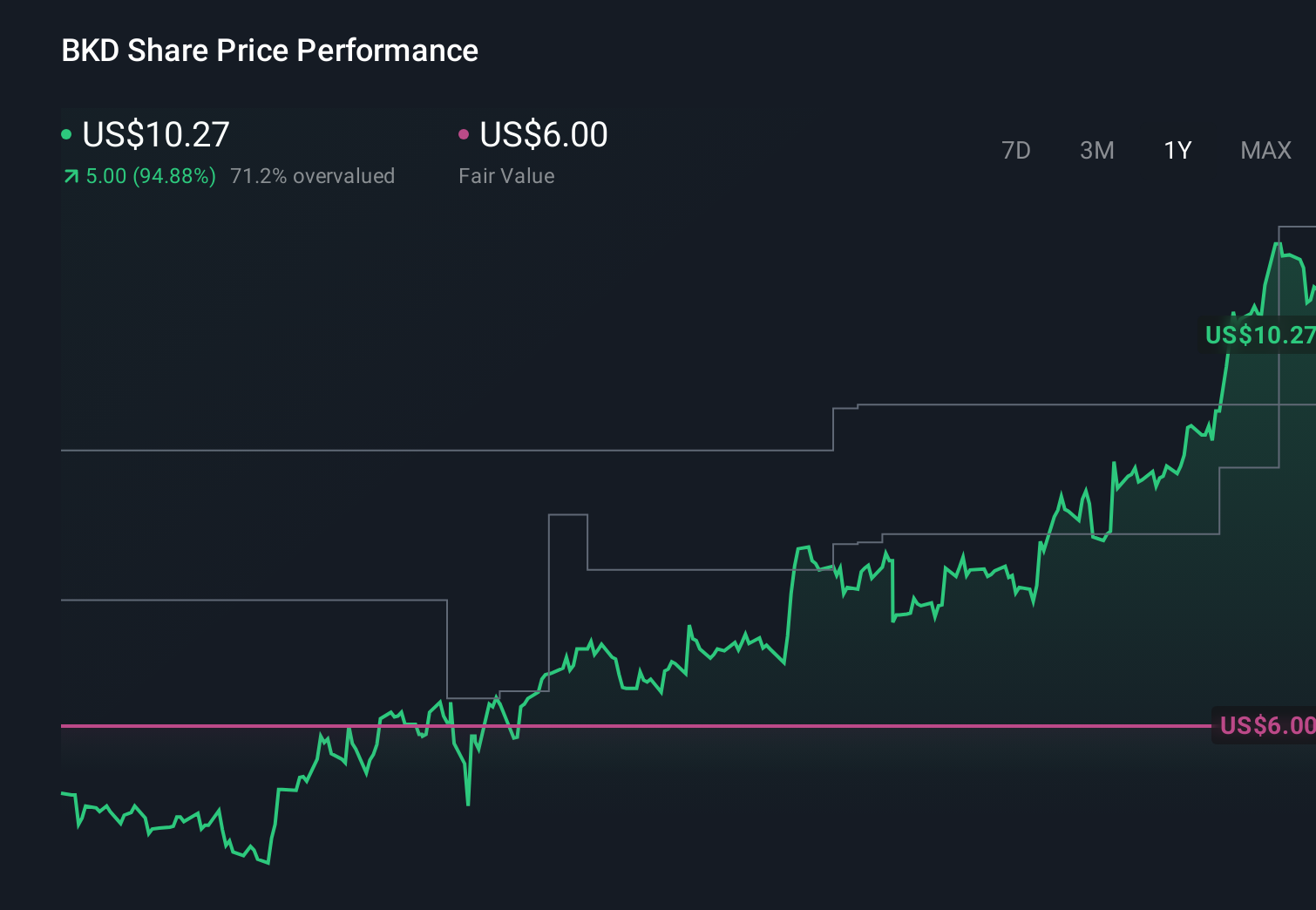

Brookdale Senior Living's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Two Simply Wall St Community fair value views, spanning about US$12.50 to over US$36.00, show how far apart private investors can be on Brookdale. When you set these against management’s focus on lifting revenue per available room and adjusted EBITDA, it underlines why some see upside while others worry about the company’s debt load and ongoing losses. You are getting a wide spectrum of opinion, so it pays to weigh more than one angle before deciding how these risks and catalysts could affect Brookdale’s longer term performance.

Explore 2 other fair value estimates on Brookdale Senior Living - why the stock might be worth over 2x more than the current price!

Build Your Own Brookdale Senior Living Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookdale Senior Living research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Brookdale Senior Living research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookdale Senior Living's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.