Please use a PC Browser to access Register-Tadawul

Bunge Global (NYSE:BG) Is Due To Pay A Dividend Of $0.70

Bunge Limited BG | 92.48 | -0.38% |

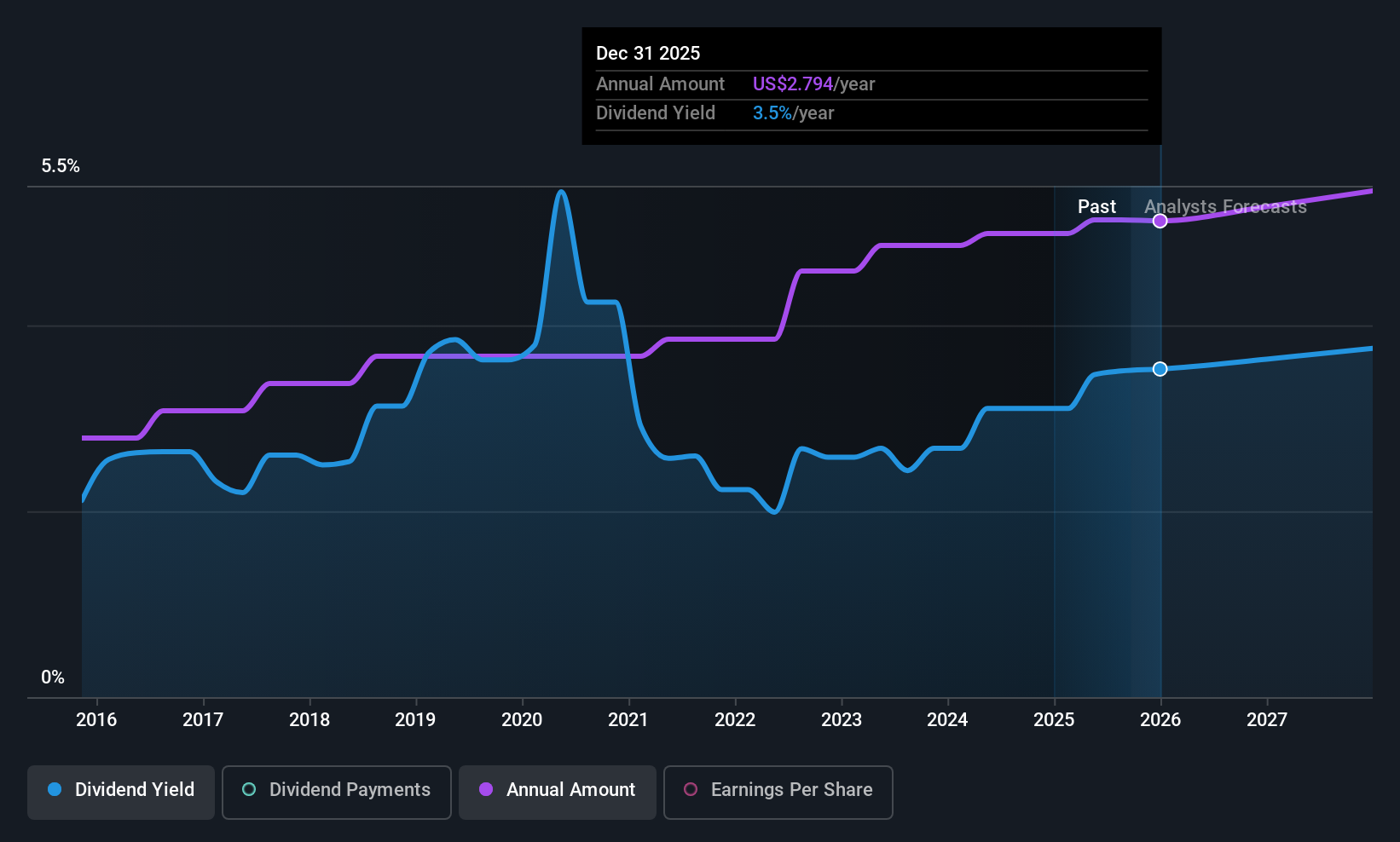

The board of Bunge Global SA (NYSE:BG) has announced that it will pay a dividend on the 1st of December, with investors receiving $0.70 per share. Based on this payment, the dividend yield for the company will be 3.5%, which is fairly typical for the industry.

Bunge Global's Projected Earnings Seem Likely To Cover Future Distributions

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Prior to this announcement, Bunge Global's earnings easily covered the dividend, but free cash flows were negative. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Over the next year, EPS is forecast to fall by 12.2%. If the dividend continues along recent trends, we estimate the payout ratio could be 49%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Bunge Global Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was $1.36 in 2015, and the most recent fiscal year payment was $2.80. This implies that the company grew its distributions at a yearly rate of about 7.5% over that duration. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Bunge Global Could Grow Its Dividend

Investors could be attracted to the stock based on the quality of its payment history. Bunge Global has impressed us by growing EPS at 6.0% per year over the past five years. Bunge Global definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

An additional note is that the company has been raising capital by issuing stock equal to 41% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Our Thoughts On Bunge Global's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. To that end, Bunge Global has 3 warning signs (and 1 which can't be ignored) we think you should know about. Is Bunge Global not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.