Please use a PC Browser to access Register-Tadawul

Burke & Herbert Financial Services (BHRB) Net Margin Surge Tests Bullish Narratives

Burke Herbert Financial Services Corp BHRB | 67.94 | +0.79% |

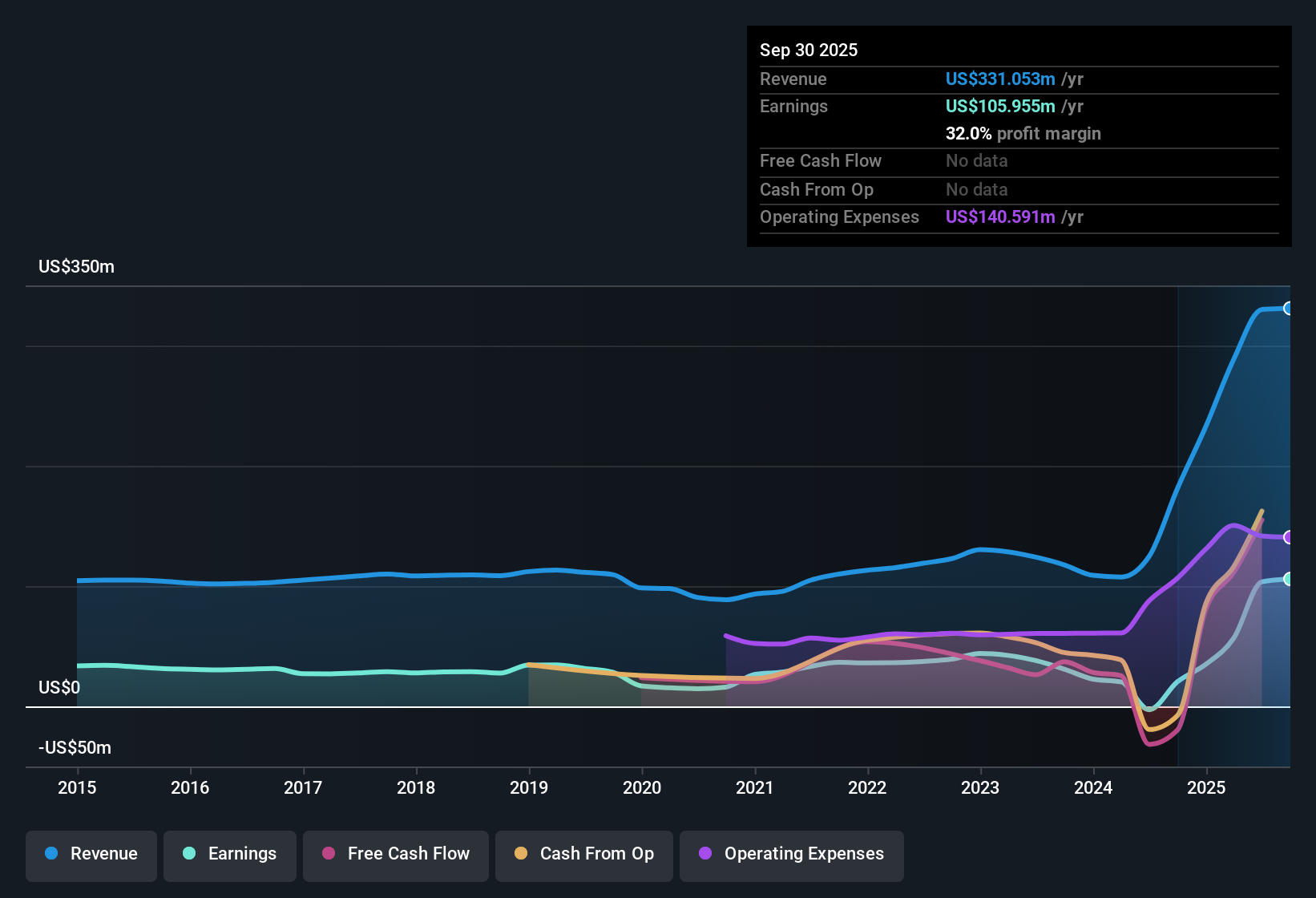

Burke & Herbert Financial Services (BHRB) has capped FY 2025 with fourth quarter revenue of US$86.4 million and EPS of US$2.00, against a trailing twelve month tally of US$340.5 million in revenue and EPS of US$7.72. The company has seen revenue move from US$233.0 million and EPS of about US$2.83 on a trailing basis a year earlier to US$340.5 million and EPS of US$7.72, which helps explain why trailing net income is now US$116.4 million. With net margin reported at 34.2% for the latest twelve months versus 15% the year before, the story this quarter is very much about how profitability is shaping the quality of these results.

See our full analysis for Burke & Herbert Financial Services.With the headline numbers on the table, the next step is to see how they line up against the widely held narratives around Burke & Herbert, where some long running views may be reinforced and others tested by the latest margin profile and earnings mix.

Net Margin Jumps To 34.2%

- Trailing net income for the last twelve months sits at US$116.4 million on revenue of US$340.5 million, which is where the 34.2% net margin figure comes from, compared with 15% a year earlier.

- What stands out for a bullish read is how this margin lines up with the earnings story. Trailing EPS of US$7.72 and a five year earnings growth pace of 23.2% per year are paired with that 34.2% margin, while revenue is expected to grow around 10.5% per year. This means:

- Supporters of a bullish view can point to the gap between earnings growth of 232.3% on a trailing basis and the more moderate revenue path to argue that profitability is currently doing a lot of the heavy lifting.

- At the same time, the step up from a 15% margin to 34.2% invites the question of how much of that earnings strength is repeatable versus tied to factors that are not spelled out in the figures here.

Loan Quality And 76% Allowance

- Within the loan book, non performing loans on a trailing basis are reported at US$89.1 million against an allowance for bad loans of 76%, which is flagged in the data as a relatively low buffer.

- Critics who lean bearish on banks often focus on credit risk, and here they would likely highlight that rising non performing loans from US$35.9 million in 2024 Q3 to US$89.1 million on the latest trailing view sit alongside that 76% allowance, prompting two key questions:

- One concern is that if credit conditions were to tighten, a lower allowance ratio gives the bank less built in coverage relative to the problem loan balance shown in the recent figures.

- Another is that the stronger net income profile, with US$116.4 million on a trailing basis, may in part rely on not adding more aggressively to provisions, which is something cautious investors often watch closely.

P/E Of 8.3x Versus DCF Fair Value

- The shares trade on a P/E of 8.3x with a current price of US$64.00, while the provided DCF fair value figure is US$36.70 and an analyst price target cited in the data is US$73.67. The stock therefore sits above the DCF line but below that target.

- What is interesting for a bullish and bearish debate is how this mix of numbers interacts with the fundamentals:

- Bulls can point to the low P/E relative to the US banks peer average of 12.1x, the 3.44% dividend yield, and trailing net income of US$116.4 million as evidence that the market is not paying a high multiple for the recent profitability profile.

- Bears, on the other hand, may focus on the DCF fair value of US$36.70 being well below the US$64.00 share price and argue that, if that cash flow model is given more weight than simple multiples, the stock could be seen as expensive despite the current P/E.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Burke & Herbert Financial Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong profitability figures, the combination of a relatively low 76% loan loss allowance and a share price above the DCF fair value presents some clear risk flags.

If you want ideas where pricing appears more conservative relative to underlying cash flows, check out these 864 undervalued stocks based on cash flows today and compare alternatives that may better fit your risk comfort zone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.