Please use a PC Browser to access Register-Tadawul

BWX Technologies (BWXT) Advances Microreactor Projects and Wins $2.6B in Defense Contracts Is Momentum Building?

BWX Technologies, Inc. BWXT | 175.88 175.88 | -0.73% 0.00% Post |

- In July 2025, BWX Technologies began fabricating the reactor core for the Department of Defense's Pele microreactor and announced new contracts totaling US$2.6 billion for U.S. naval nuclear propulsion components, expanding its TRISO nuclear fuel manufacturing capabilities along the way.

- This development highlights how BWXT is strengthening its presence in both defense and advanced nuclear technology markets, positioning the company to meet growing demand for resilient, transportable nuclear power and next-generation military energy solutions.

- We'll explore how BWXT's progress in microreactor fabrication could influence its investment narrative and future growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

BWX Technologies Investment Narrative Recap

For investors considering BWX Technologies, the central belief is in ongoing demand for advanced nuclear technologies supporting both defense and commercial sectors, underpinned by substantial government contracts and a growing nuclear energy market. The latest contract wins and the Pele microreactor milestone reinforce the company’s momentum, but the most significant near-term catalyst remains the execution and delivery of recent naval nuclear propulsion contracts, while risks tied to supply chain costs and profitability in commercial operations are still present and not immediately offset by this news.

Of the recent announcements, the $2.6 billion in new U.S. Navy contracts stands out as strongly linked to BWXT’s short-term success, given its exclusive position as a supplier and the visibility it brings to revenue streams. The start of microreactor core fabrication and TRISO fuel advancements add long-term possibilities, but the impact on the most immediate business drivers is secondary compared to naval contract execution.

However, investors should be aware that, despite these wins, margin pressure from zirconium and inflation-related costs in the commercial segment could still...

BWX Technologies is projected to reach $3.7 billion in revenue and $445.4 million in earnings by 2028. This outlook assumes a 10.2% annual revenue growth rate and a $156.5 million increase in earnings from the current $288.9 million level.

Uncover how BWX Technologies' forecasts yield a $148.30 fair value, a 3% downside to its current price.

Exploring Other Perspectives

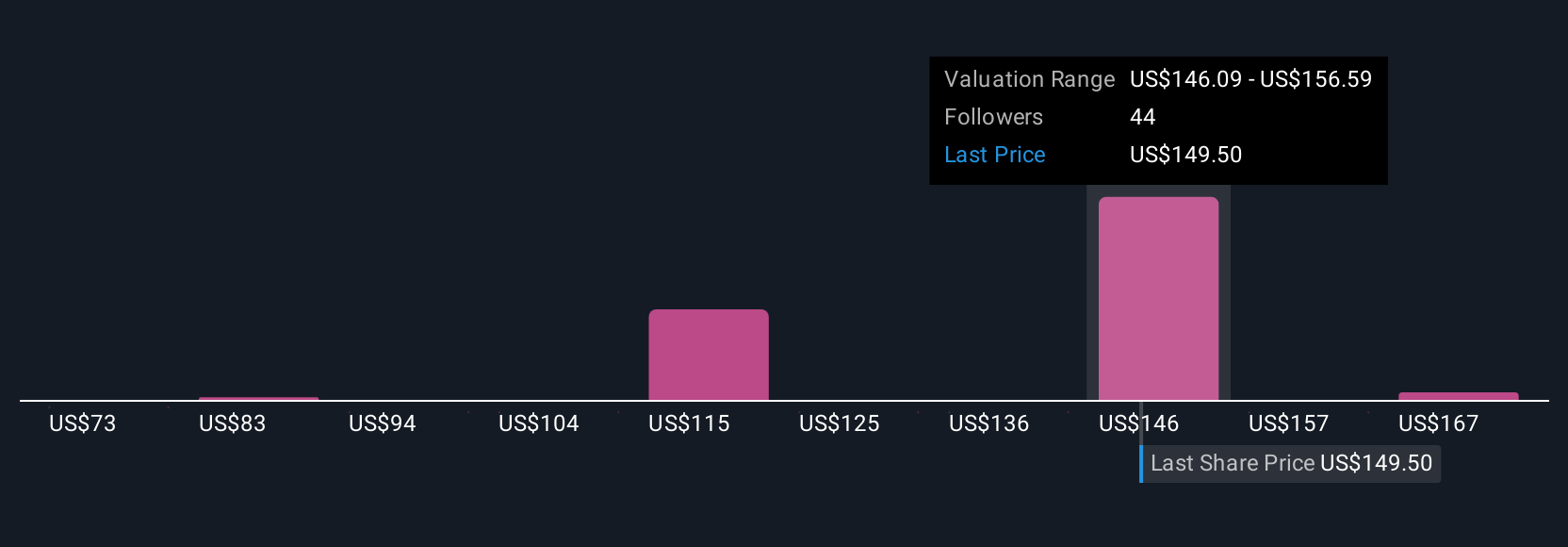

Seven Simply Wall St Community fair value estimates range from US$72.55 to US$177.60, showing a wide spread of independent outlooks. Given ongoing headwinds in raw material costs, it is important to consider both optimistic and cautious scenarios for BWXT’s outlook, see how other market participants are sizing up the stock.

Explore 7 other fair value estimates on BWX Technologies - why the stock might be worth as much as 17% more than the current price!

Build Your Own BWX Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BWX Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free BWX Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BWX Technologies' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.