Please use a PC Browser to access Register-Tadawul

Cadence Bank (CADE): Is There More Value Ahead as Long-Term Gains Continue?

Cadence Bank CADE | 42.11 | 0.00% |

Cadence Bank’s share price recovery over the past year has been steady, with a 5.24% total shareholder return and momentum building in recent months. The stock is up nearly 14% year-to-date and more than 52% over three years. While short-term moves have been modest, the long-term performance reflects solid investor confidence in the bank’s ongoing strategy and growth outlook.

If you’re seeking fresh ideas beyond the banking sector, now’s a perfect time to explore fast growing stocks with high insider ownership.

But with Cadence Bank’s shares trading just below analyst targets while still boasting strong long-term returns, investors may wonder whether the recent momentum signals an undervalued opportunity or if the market is already factoring in further growth.

Most Popular Narrative: 10% Undervalued

Compared to the last close at $38.41, the widely followed narrative assigns Cadence Bank a fair value that is notably higher, setting up a story of potential upside if expectations hold. This analysis uses a discount rate of 6.78% to calculate the present value of future earnings, factoring in both recent momentum and the bank’s merger outlook.

The ongoing expansion in high-growth Sunbelt markets, particularly Texas and Georgia, continues to drive robust organic loan and deposit growth, supported by population inflows and business activity. This should underpin sustained revenue and net interest income expansion.

Want to know what’s fueling this premium valuation? The narrative hinges on aggressive growth in key Southern markets and bold profit assumptions for the years ahead. The real surprise: What analysts are projecting for the bank’s future bottom line and margin expansion. What’s behind these ambitious targets? Dive deeper to see the forward-looking story that sets this fair value.

Result: Fair Value of $42.70 (UNDERVALUED)

However, risks such as regional economic slowdowns or challenges related to recent acquisitions could impact Cadence Bank’s optimistic growth projections and future profitability.

Another View: Is the Market Overpaying?

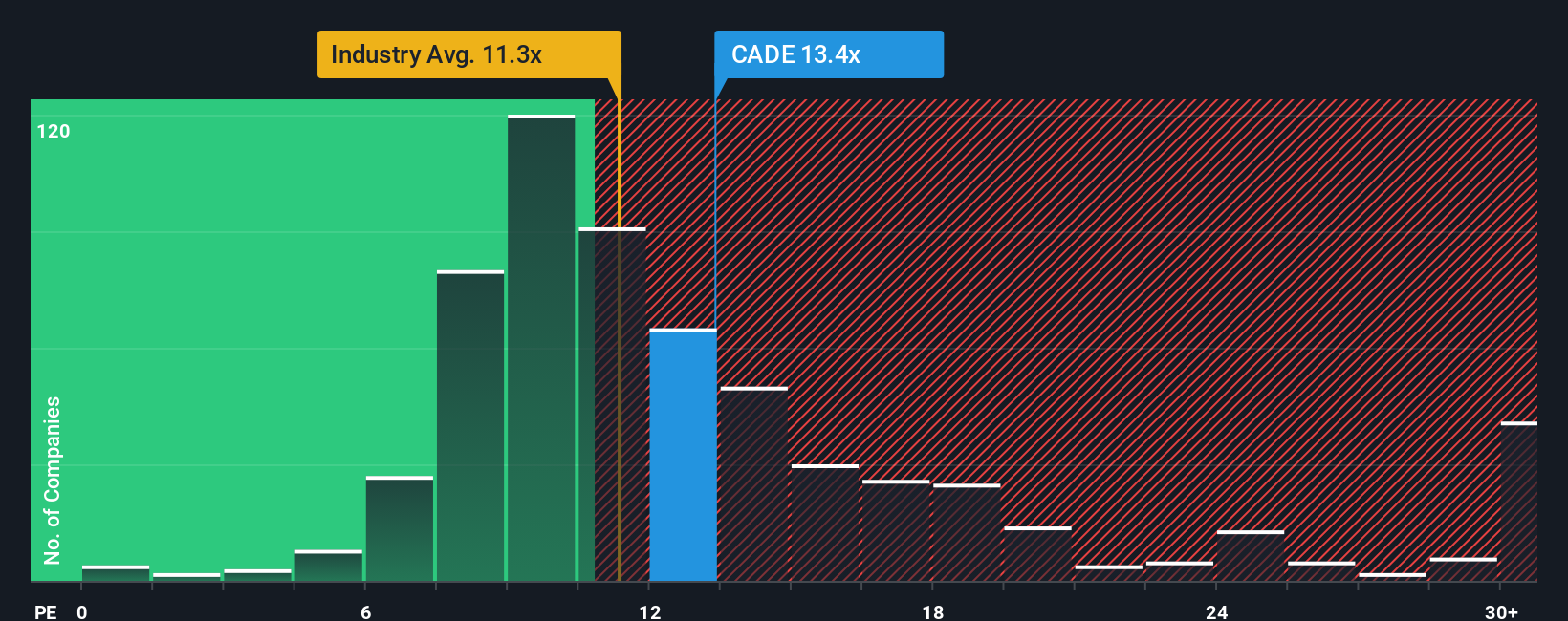

While fair value estimates show Cadence Bank could be undervalued, a look at its price-to-earnings ratio suggests otherwise. At 13.8x, the bank trades above both the industry average (11.1x) and its own fair ratio of 13.3x. This suggests that investors may be paying a premium compared to peers. Could sentiment be running ahead of fundamentals?

Build Your Own Cadence Bank Narrative

If you think there’s more to the story or want to build your own argument, it’s quick and easy to craft your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cadence Bank.

Looking for More Smart Investment Opportunities?

Don’t let your portfolio stall while the next big winners are breaking out elsewhere. Tap into new investment themes today with these powerful ideas you can act on right now:

- Boost your potential returns by targeting exciting companies that may be trading for less than their true worth through these 879 undervalued stocks based on cash flows.

- Capitalize on the future of medicine by checking out these 31 healthcare AI stocks, where artificial intelligence is transforming diagnostics and care.

- Put your money to work with dependable cash flow by exploring these 16 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.