Cadence Design Systems (NasdaqGS:CDNS) Price Rises 14% Over Last Quarter

Cadence Design Systems, Inc. CDNS | 0.00 |

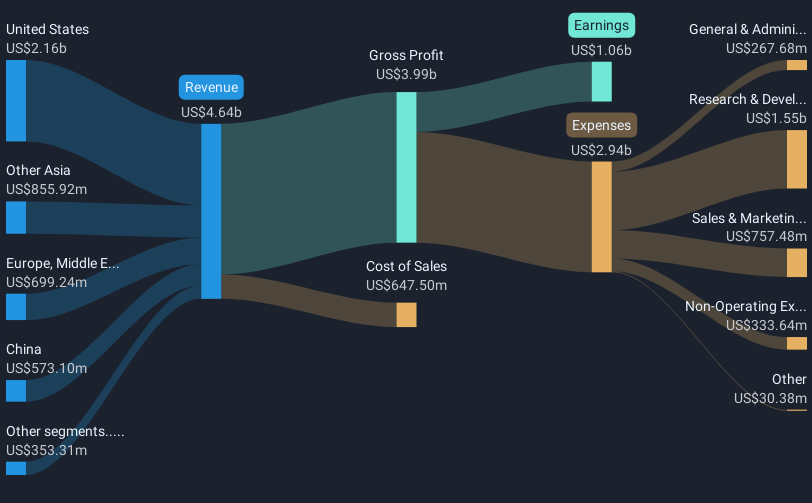

In May 2025, Cadence Design Systems (NasdaqGS:CDNS) launched the Millennium M2000 Supercomputer, delivering enhanced AI-accelerated simulations, alongside the Tensilica NeuroEdge 130 AI Co-Processor, optimizing neural processing. Despite these advancements, broader market trends like investor optimism over reduced tariffs between the U.S. and China may have provided a conducive environment for Cadence's stock price to rise 14% during the last quarter, aligning with the broader technology market movement. Meanwhile, Q1 2025 earnings demonstrated strong financial results, potentially reinforcing investor confidence amidst this upward trajectory.

Cadence Design Systems' recent advancements in AI-accelerated simulations and neural processing, through the Millennium M2000 Supercomputer and Tensilica NeuroEdge 130 AI Co-Processor, can potentially strengthen its AI-driven design and verification tools portfolio. These innovations may boost revenue, meeting increasing demand for their AI-enabled offerings and supporting future earnings growth. Analysts expect revenue to rise, driven by strong IP business performance and expanding partnerships with major industry players, though geopolitical risks pose challenges.

Over the past five years, Cadence experienced a total shareholder return of 211.71%, reflecting robust long-term growth. However, when comparing performance over the past year, Cadence underperformed the US Software industry, which returned 22.8%. This short-term underperformance contrasts with the company's five-year success and may influence investor perceptions.

Despite the recent positive news, Cadence's current share price of US$305.78 is relatively close to the consensus analyst price target of US$319.32, representing a modest 4.2% upside. This suggests that while recent developments are promising, the market may already be pricing in these advancements. Investors are encouraged to weigh these factors alongside the analysts' forecasts and company valuation when considering their stance on Cadence's long-term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Benzinga News 19/11 13:06

Truist Securities Maintains Buy on BILL Holdings, Lowers Price Target to $60

Benzinga News 19/11 17:55Walmart, Nvidia And 3 Stocks To Watch Heading Into Thursday

Benzinga News 20/11 07:27Cadence Design Systems (CDNS): Is the Current Valuation Overlooked After Recent Share Price Dip?

Simply Wall St 20/11 18:30MARA Holdings Stock Slides As Bitcoin Plunges Below $90,000

Benzinga News 20/11 18:33ZenaTech firma oferta para adquirir empresa de topografía en Utah, expandiendo Drone como Servicio en el mercado de infraestructura solar

Reuters 20/11 18:42Hive Digital Technologies Files For Mixed Shelf; Size Not Disclosed

Benzinga News 20/11 22:00Day's Trending USA Stocks | PACS: Overnight gain 55.3%, Strong Q3 performance, financial restatement, and positive outlook boost investor confidence

Sahm Platform Today 01:35