Please use a PC Browser to access Register-Tadawul

Cal-Maine Foods (CALM): Assessing Value as Company Launches First-Ever Quarterly Earnings Call and Webcast

Cal-Maine Foods, Inc. CALM | 88.48 | +1.83% |

Cal-Maine Foods (CALM) just gave shareholders something new to talk about: the company announced its first-ever quarterly earnings conference call and webcast, kicking off a fresh chapter in how it communicates with investors. Scheduled for October 1, the event will mark the beginning of an expanded effort to share more detail about financial results and growth plans in real time. For investors, this represents a meaningful step toward greater transparency at a moment when both opportunity and scrutiny around the company seem to be rising.

This move comes as Cal-Maine Foods continues to grow and diversify in the egg and prepared food space, even as its share price story remains mixed. After a 45% gain over the past year, the stock has lost some steam in recent months, with a drop of 14% this month and a 5% decline year-to-date. Momentum may be cooling in the short run, but the company’s three-year and five-year returns still suggest long-term gains are intact. With these new investor communication initiatives, all eyes are turning to whether management’s openness can speed up or stabilize future performance.

The key question now is whether Cal-Maine Foods offers a bargain at today’s valuation or if the current price already reflects expectations for future growth and improved transparency.

Price-to-Earnings of 4x: Is it justified?

Cal-Maine Foods trades at a price-to-earnings ratio (P/E) of 4x, which is significantly lower than the US Food industry average of 18.2x. This suggests the stock is trading at a discount compared to its peers.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings. For Cal-Maine Foods, this low multiple reflects the market’s current expectations for its future earnings growth and risk profile in the food sector.

Such a low P/E could indicate the market is underestimating the company’s ability to maintain or grow earnings, or there may be concerns about projected declines in profitability. However, with Cal-Maine’s multiple well below industry norms, value-focused investors may see it as an attractive opportunity if the business can navigate upcoming headwinds.

Result: Fair Value of $103.45 (UNDERVALUED)

See our latest analysis for Cal-Maine Foods.However, declining annual revenue and a sharp drop in net income highlight challenges that could affect Cal-Maine Foods' outlook in the future.

Find out about the key risks to this Cal-Maine Foods narrative.Another View: What Does Our DCF Model Say?

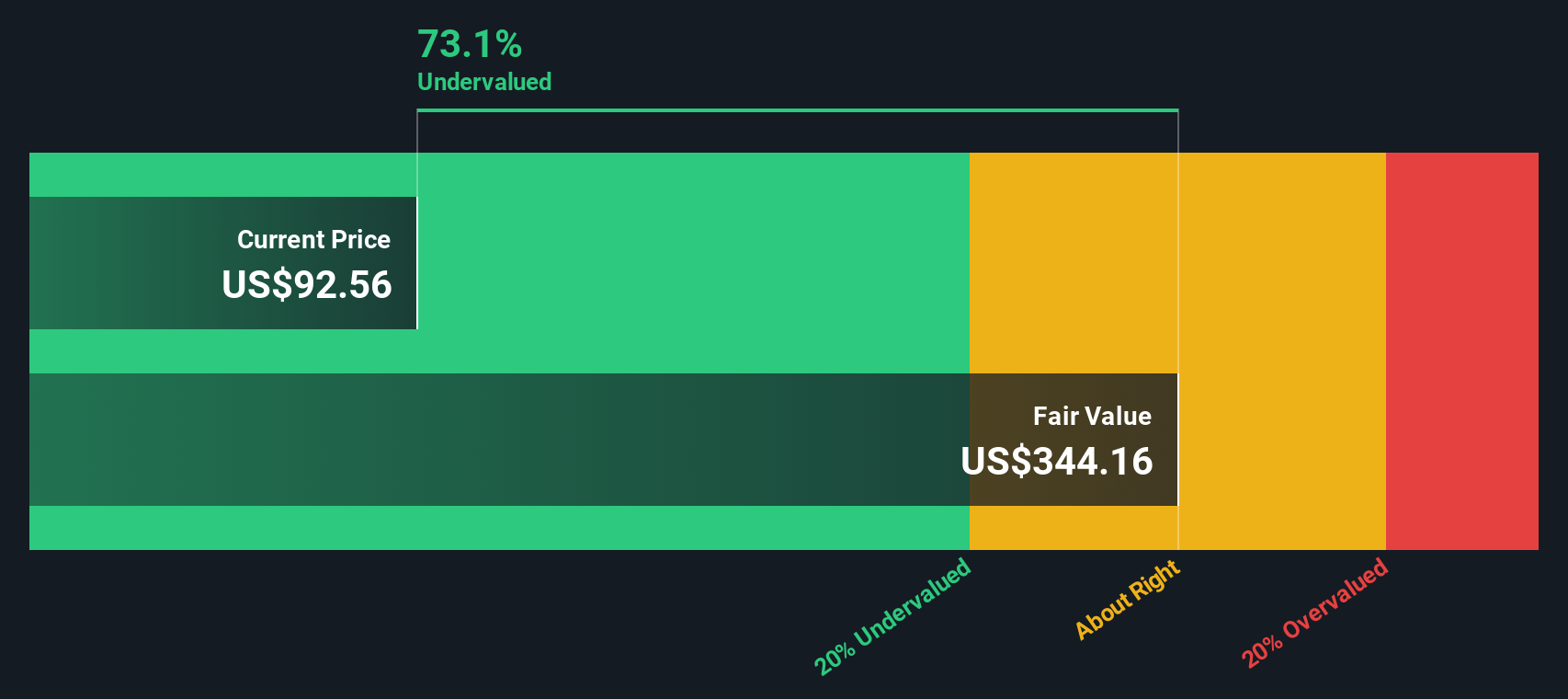

While the market’s valuation approach paints a picture of potential upside, our SWS DCF model offers a second perspective and suggests the company is still undervalued. Could both approaches be seeing the same opportunity, or does this signal hidden risks?

Build Your Own Cal-Maine Foods Narrative

If you see the story differently or want to dig into the numbers yourself, you can put together your own take in just a few minutes. Do it your way.

A great starting point for your Cal-Maine Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by seeking stocks beyond Cal-Maine Foods. Powerful opportunities are waiting, and you’ll only find them if you take the next step.

- Tap into rapid growth potential by exploring innovation with AI penny stocks as companies reshape entire industries through artificial intelligence and machine learning breakthroughs.

- Strengthen your portfolio’s income stream by finding high-yield options with dividend stocks with yields > 3%, featuring stocks that consistently deliver dividends over 3%.

- Identify undervalued opportunities ahead of the market by using undervalued stocks based on cash flows to find quality businesses trading at a discount to their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.