Please use a PC Browser to access Register-Tadawul

Can a New Ratings Advisory Leader Shape Evercore’s (EVR) Competitive Edge in Investment Banking?

Evercore Partners Inc. Class A EVR | 344.67 344.67 | -0.02% 0.00% Post |

- Evercore recently announced that Ovadiah Jacob has joined the firm as a senior managing director in its private capital markets and debt advisory group, with a focus on ratings advisory, based in New York.

- Jacob brings over 15 years of experience advising on complex, high-profile transactions across multiple industries, most recently at Goldman Sachs, which may bolster Evercore’s market expertise and client service capabilities.

- We'll explore how Jacob's specialized background in ratings advisory could influence Evercore’s position within the evolving investment banking landscape.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Evercore Investment Narrative Recap

To own shares in Evercore, investors need to believe that independent advisory firms can thrive by attracting top-tier talent, broadening global reach, and driving fee growth, despite cyclical deal volumes and intensifying competition. The addition of Ovadiah Jacob brings specialized ratings advisory experience that could support private capital markets expansion, but it doesn’t materially change the primary near-term catalyst (integration of new European talent) or mitigate the chief risk (sustained cost inflation with uncertain deal flows).

Among Evercore’s recent announcements, the upcoming integration of Luigi de Vecchi as Chairman of continental European advisory stands out. This move is especially relevant as Evercore seeks to capitalize on the planned Robey Warshaw acquisition, poised to accelerate international client wins, while new sector leadership additions like Jacob reinforce the firm’s commitment to deeply resourced global platforms.

Yet, against these growth moves, investors should stay alert to the ongoing risk that rising fixed costs may strain margins if revenue growth slows...

Evercore's narrative projects $5.4 billion revenue and $953.1 million earnings by 2028. This requires 18.7% yearly revenue growth and a $490.9 million increase in earnings from $462.2 million today.

Uncover how Evercore's forecasts yield a $378.29 fair value, a 18% upside to its current price.

Exploring Other Perspectives

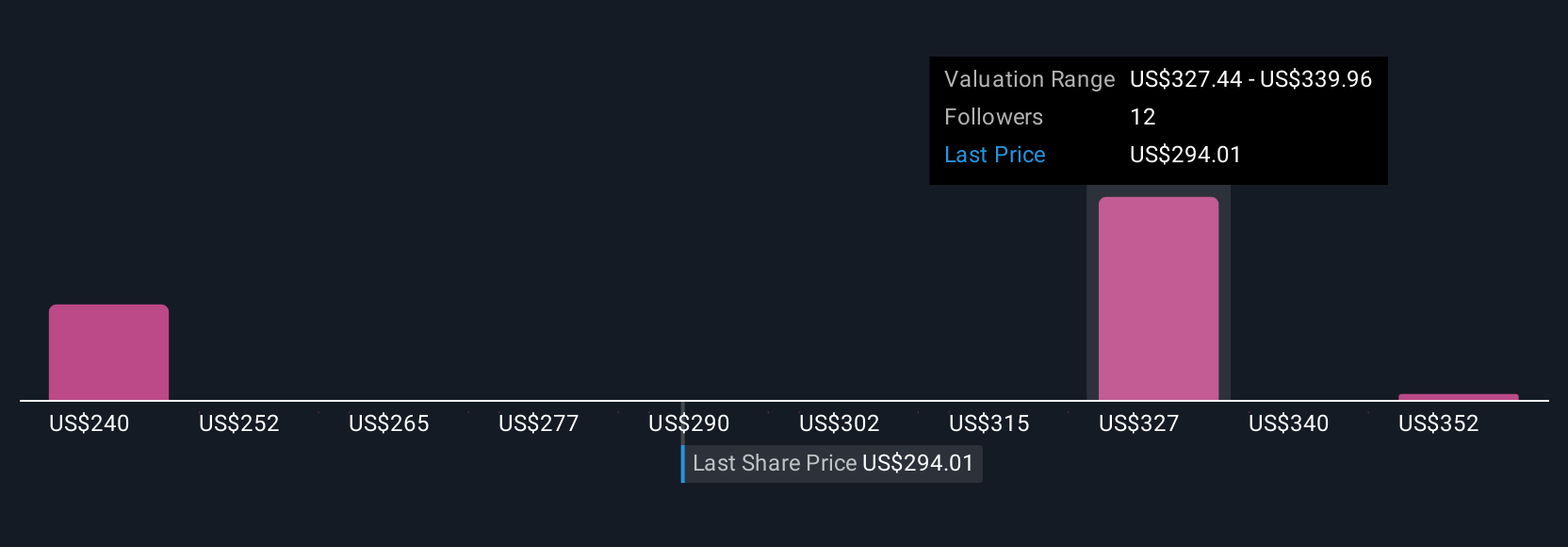

Three community members on Simply Wall St set Evercore’s fair value between US$226.90 and US$378.28, reflecting a wide spectrum of forecasts. Many are focused on the need for Evercore to convert international hiring into sustained advisory revenue, with future profitability hinging on the success of these expansion efforts.

Explore 3 other fair value estimates on Evercore - why the stock might be worth 29% less than the current price!

Build Your Own Evercore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evercore research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Evercore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evercore's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.