Please use a PC Browser to access Register-Tadawul

Can Analyst Optimism on AI Help Datadog (DDOG) Sustain Its Competitive Edge in Cloud Services?

Datadog DDOG | 146.00 | -2.60% |

- Wells Fargo recently initiated coverage on Datadog with an overweight rating, highlighting the company's momentum in AI-powered cloud observability solutions and strong adoption among enterprise clients.

- This move reflects growing analyst confidence in Datadog's leadership at the intersection of cloud infrastructure and artificial intelligence, amid rapid industry adoption of new AI technologies.

- We'll examine how Wells Fargo's focus on Datadog's expanding AI-native customer base could influence the company's investment narrative going forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Datadog Investment Narrative Recap

Owning Datadog is ultimately a bet on continued enterprise cloud adoption, increasing complexity of digital infrastructure, and the need for unified AI-powered observability. While Wells Fargo’s new overweight rating and bullish price target have lifted investor sentiment, the biggest near-term catalyst, broadening AI-native customer adoption, remains unchanged, and the risk around revenue concentration among large, AI-centric clients is still material for shareholders.

Of the recent company updates, Datadog’s Q2 2025 results, with revenue up 28% year-over-year and raised full-year guidance, align closely with Wells Fargo’s optimism about the platform’s traction among enterprises adopting AI workloads. This earnings momentum illustrates how Datadog’s mission-critical role is underpinning both its top-line growth and its investment narrative.

However, beneath the enthusiasm for rapid AI-driven expansion, there are still risks investors should not ignore, especially as Datadog’s reliance on major AI-native customers could mean...

Datadog's narrative projects $5.2 billion in revenue and $406.8 million in earnings by 2028. This requires 19.9% yearly revenue growth and a $282 million increase in earnings from $124.6 million today.

Uncover how Datadog's forecasts yield a $162.08 fair value, a 7% upside to its current price.

Exploring Other Perspectives

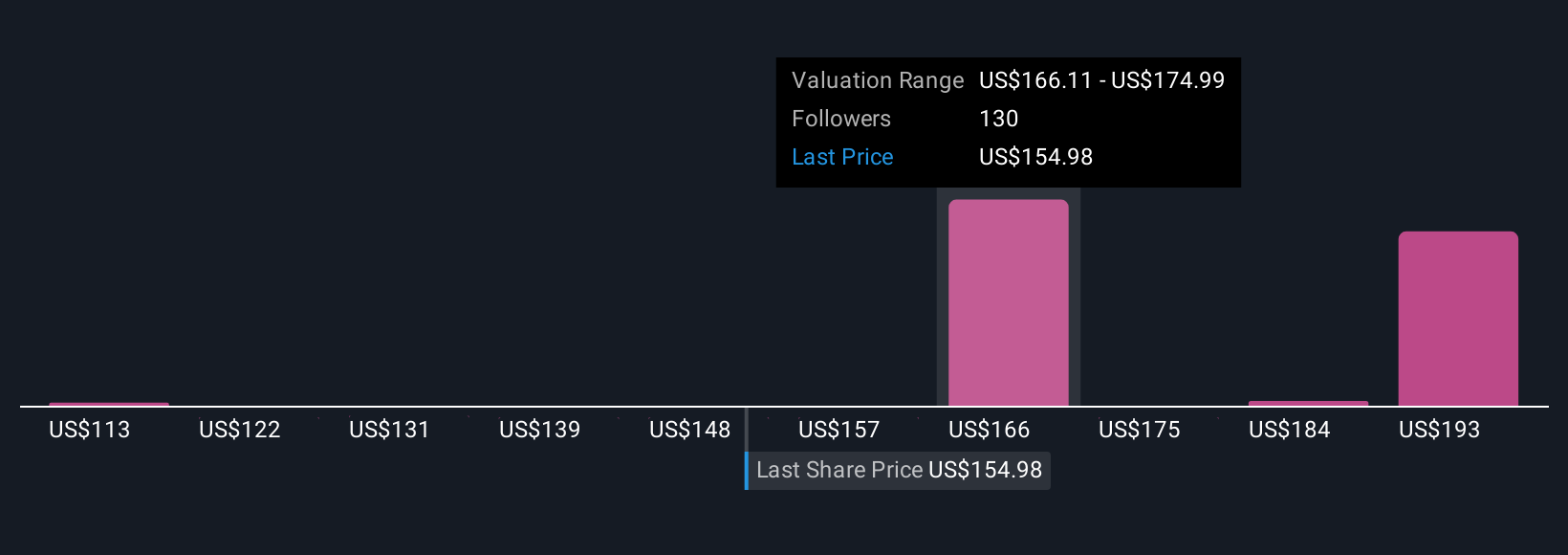

Simply Wall St Community members provided 11 fair value estimates for Datadog, ranging from US$112.84 to US$190.35 per share. While these figures span a broad spectrum, the persistent risk of heightened revenue concentration among top AI clients could amplify volatility for those watching the company’s performance, so consider a range of opinions before making decisions.

Explore 11 other fair value estimates on Datadog - why the stock might be worth 26% less than the current price!

Build Your Own Datadog Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Datadog research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Datadog research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Datadog's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.