Please use a PC Browser to access Register-Tadawul

Can Bloom Energy’s 52% Monthly Surge Be Justified After Microsoft Data Center Partnership?

BLOOM ENERGY CORP BE | 119.18 | +0.92% |

Are you trying to figure out whether now is the right time to make a move on Bloom Energy stock? You are definitely not alone. There has been a burst of excitement around the stock lately, and it is easy to see why. In just the past week, Bloom Energy climbed 18.2%. Looking at a longer timeframe, the growth story becomes even more impressive, with the share price up 52.4% in the last month and a remarkable 739.5% over the past year. Even for a company in the clean energy space, these types of gains tend to get investors, analysts, and skeptics alike taking a closer look.

What is behind all the fireworks? Recent developments in the broader market’s appetite for clean tech and alternative energy solutions seem to be pushing money into this sector. Bloom Energy is benefiting as attitudes shift toward companies well-positioned for a lower-carbon future, and speculation increases about which firms in the sector will emerge as leaders. Of course, rapid growth can sometimes mean added risk, or simply that a stock is moving ahead of itself. So how does Bloom actually stack up from a valuation standpoint?

If you look at the most common valuation metrics, Bloom Energy gets a value score of 1 out of 6, suggesting it only appears undervalued on one of the main checks. That is not exactly the mark of a bargain in the making. Still, valuation is rarely a simple story, and there is more to it than just ticking boxes. Next, we will break down how each of these valuation checks works, and later on, explore a smarter way to understand what the numbers really mean for investors.

Bloom Energy scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

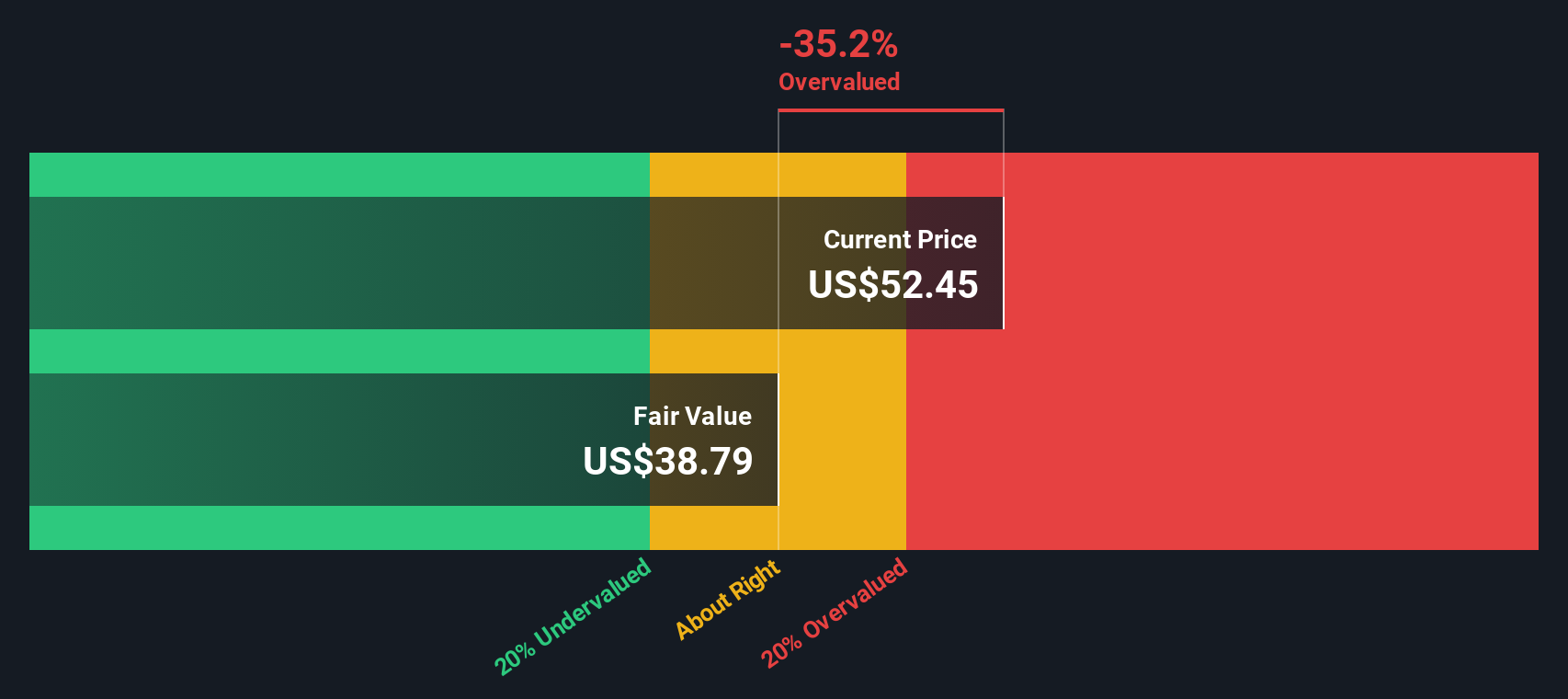

Approach 1: Bloom Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those amounts back to the present using today’s dollars. In Bloom Energy’s case, the DCF analysis uses a two-stage free cash flow to equity approach, meaning it considers both analyst forecasts and extended projections from Simply Wall St.

Currently, Bloom Energy has generated $1.21 million in free cash flow over the last twelve months. Looking ahead, analysts anticipate a sharp rise in annual cash flows, with the company's free cash flow projected to reach $784 million by 2029. Estimates then extrapolate out to over $2.1 billion in 2035, reflecting high growth expectations. All values are reported in US dollars.

The resulting DCF model places Bloom Energy’s estimated intrinsic value at $91.66 per share. With the current valuation implying a 5.1% discount to this fair value, the model suggests the stock is trading very close to its true worth.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Bloom Energy's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

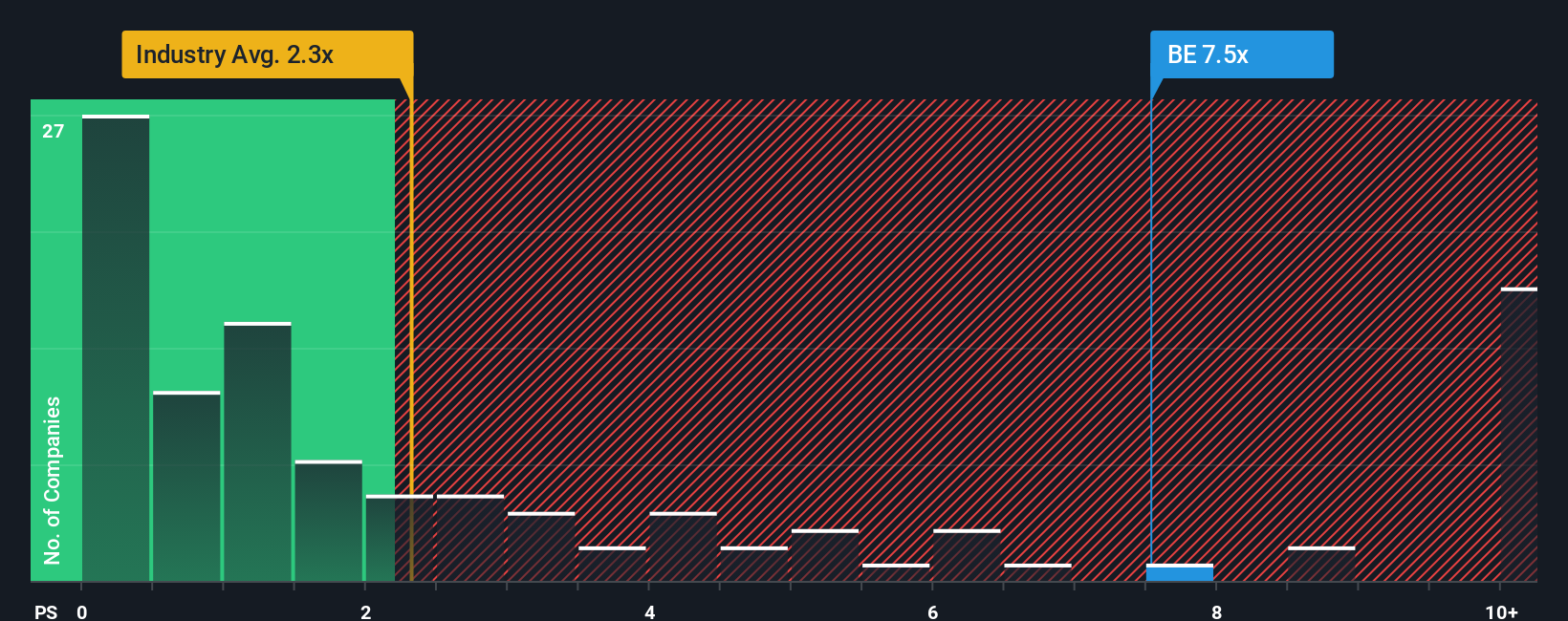

Approach 2: Bloom Energy Price vs Sales

When evaluating companies in high-growth industries, especially those yet to achieve sustained profitability, the Price-to-Sales (P/S) ratio is a particularly useful valuation tool. This multiple allows investors to assess how much they are paying for each dollar of the company’s revenue, which is essential when earnings are volatile or negative. Strong growth potential generally justifies a higher P/S ratio, whereas greater risks or weaker growth prospects often call for a discount.

Bloom Energy currently trades at a P/S ratio of 12.5x. For context, the average among its peers stands at 5.5x. The wider Electrical industry sees an average closer to 2.3x. At a glance, this positions Bloom at a significant premium to both direct competitors and the overall sector, likely reflecting excitement over its growth and future prospects.

However, Simply Wall St’s proprietary “Fair Ratio” aims to provide a more nuanced view by considering not only the company's revenue growth, but also profitability, risk profile, market cap, and its unique place within the industry. This approach delivers a tailored benchmark. For Bloom Energy the fair P/S ratio is estimated at 6.1x. Because the company’s actual P/S is materially higher than this figure, the stock currently appears to be trading above what would be justified even after adjusting for its rapid expansion and related factors.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bloom Energy Narrative

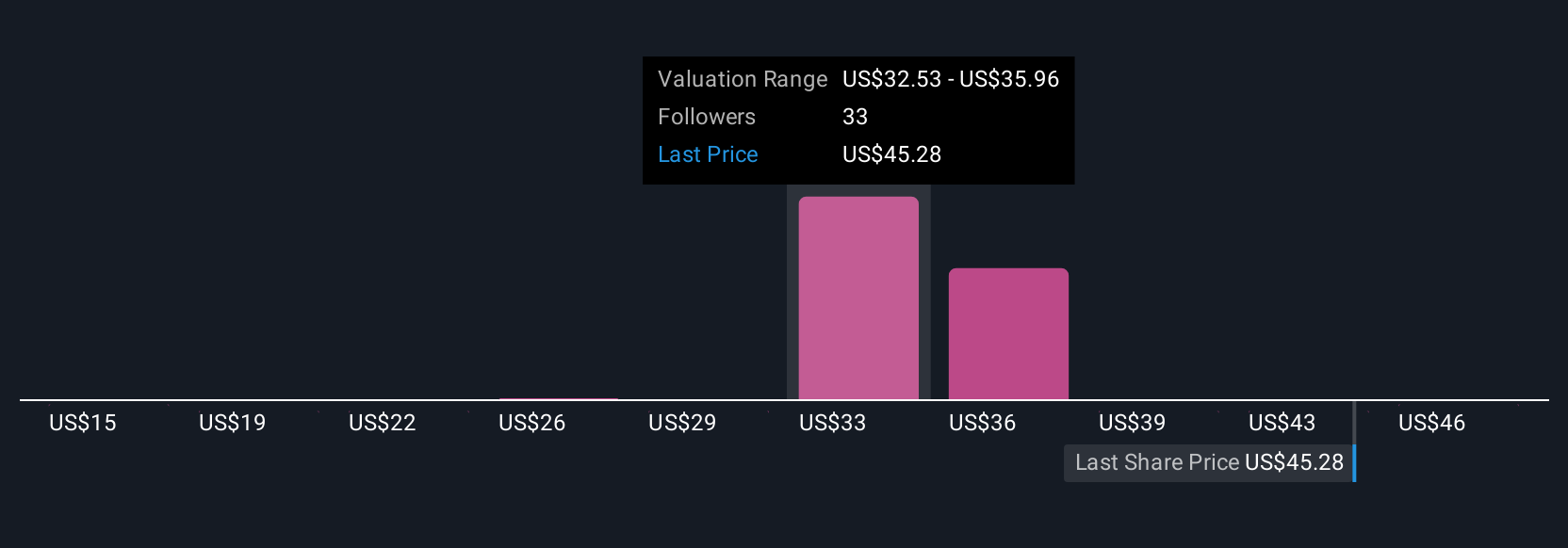

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Simply put, a Narrative is your personal investment story that connects what you believe about a company's future with the numbers behind it, such as forecasted revenue, earnings, and margins, to calculate your own fair value estimate.

Narratives turn financial analysis from a list of ratios into a cohesive picture, helping you link Bloom Energy’s business story to clear forecasts and then to a fair value. This makes your decision process both logical and intuitive. These Narratives are easy to create and update on the Simply Wall St Community page, where millions of investors share perspectives directly tied to the latest news and developments.

With Narratives, you can quickly see how your fair value compares to the current price, making it easier to decide whether Bloom Energy is a buy, hold, or sell for you. As new information, such as earnings reports or news, becomes available, Narratives are updated dynamically, ensuring your investment thesis always reflects current realities.

For example, one investor’s Narrative might be bullish, driven by rapid growth in data center demand and strong partnerships, setting a high fair value for Bloom Energy. Another may focus on risks around competition and margins, arriving at a much lower estimate. This demonstrates how Narratives empower you to act on your own informed view of the company.

Do you think there's more to the story for Bloom Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.