Please use a PC Browser to access Register-Tadawul

Can Corning’s 84% Surge in 2024 Be Justified After New Technology Partnerships?

Corning Inc GLW | 122.16 | +8.31% |

- Wondering if Corning could still be a smart buy, or if the market's already priced in all the upside? You are not alone, as plenty of investors are questioning the stock's value right now.

- Corning's share price has soared an impressive 84.1% over the past year and 82.4% year-to-date, outpacing many peers but also bringing fresh questions about risk and future growth.

- Recent headlines highlight Corning's increased investment in specialty glass and new technology partnerships, fueling optimism among shareholders. At the same time, some analysts are watching for signs that the company's momentum may shift if industry headwinds return.

- According to our valuation checks, Corning scores 0 out of 6 for undervaluation criteria. So is there more to this story, or is the market onto something? Let’s break down the main ways analysts approach valuation and hint at an even more complete perspective you will want to see at the end of this article.

Corning scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

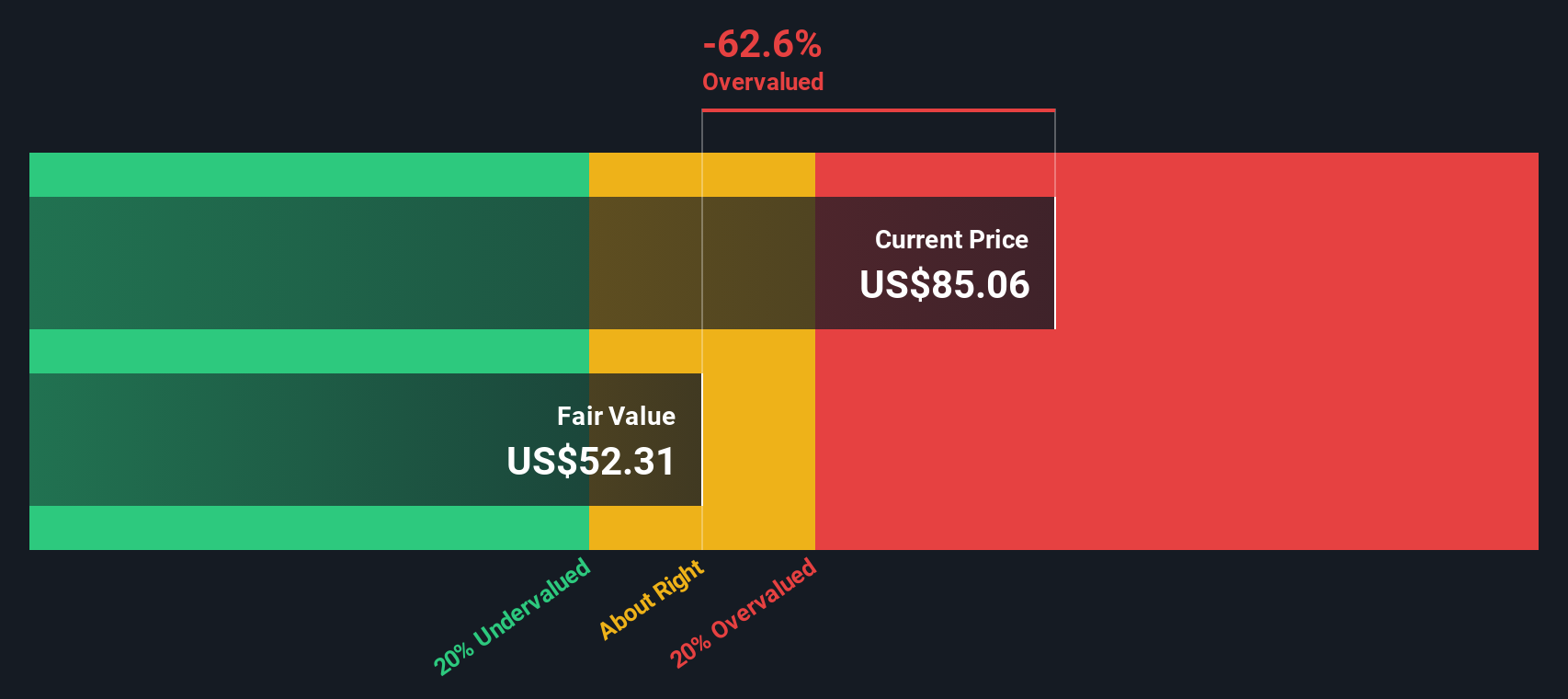

Approach 1: Corning Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's dollars. This approach seeks to capture the present value of all cash that Corning is expected to generate for shareholders over time.

For Corning, the DCF model begins with the company's current Free Cash Flow, which stands at $938 million over the last twelve months. Analysts have provided up to five years of specific cash flow forecasts, with Free Cash Flow projected to rise to around $3.39 billion by 2029. Beyond that, further annual projections, calculated by Simply Wall St based on expected growth rates, continue the trend through 2035.

Using all these estimates, the DCF model calculates an intrinsic value of $66.52 per share for Corning. However, the current share price is about 28.1% above this figure, suggesting that the stock is overvalued based on these cash flow projections alone.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Corning may be overvalued by 28.1%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

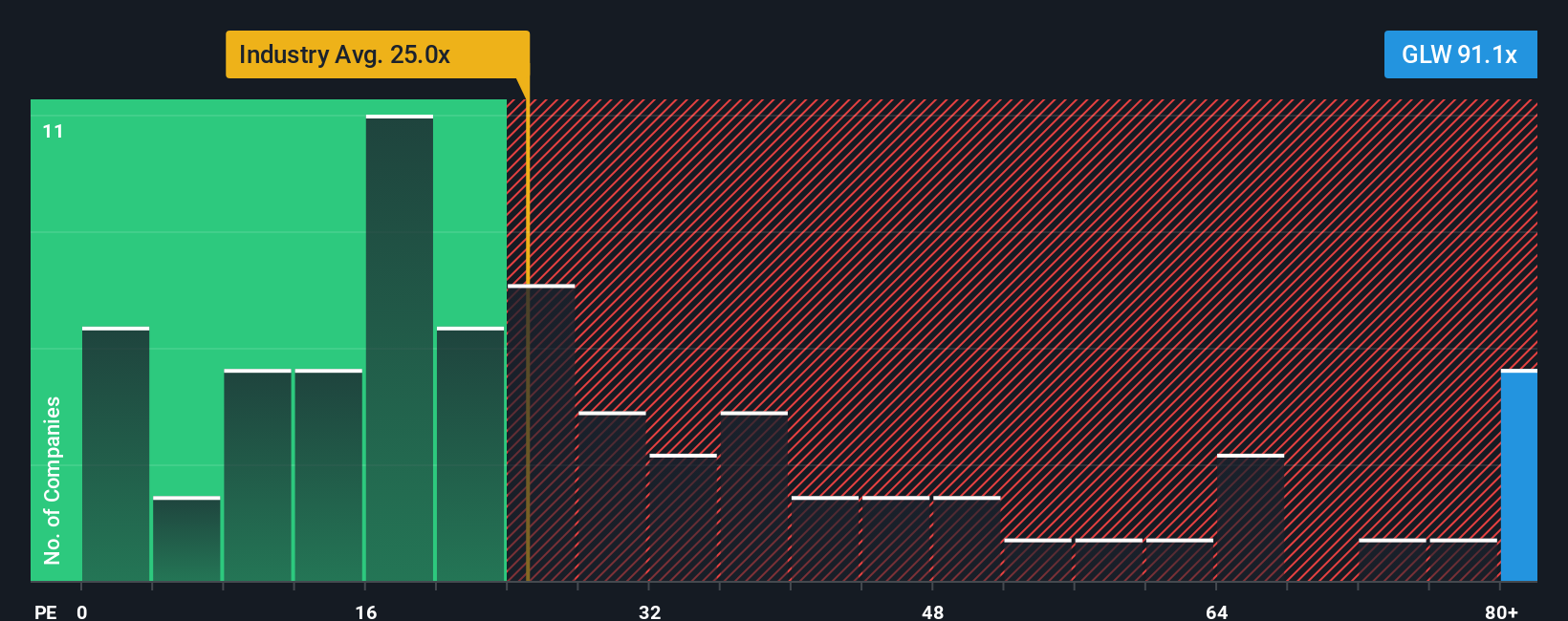

Approach 2: Corning Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is commonly used to value profitable companies like Corning because it directly relates a company's market value to its earnings. This provides investors with a clear sense of how much they are paying for each dollar of profit. When used thoughtfully, the PE ratio helps identify whether a stock is trading at an attractive valuation relative to its profit-generating ability.

Growth expectations and risk profiles play a big role in determining what counts as a "normal" or "fair" PE ratio. Companies with rapid earnings growth, high margins, or strong competitive advantages typically justify higher PE ratios. In contrast, those facing uncertainty or slower future growth may warrant a lower multiple.

Currently, Corning trades at a PE ratio of 53.5x, which is well above the electronic industry average of 25.2x and higher than the peer average of 38.4x. At first glance, these comparisons may make Corning appear overvalued, but there is more to the story.

Simply Wall St’s proprietary “Fair Ratio” framework calculates a fair PE multiple for Corning of 37.7x after assessing not just earnings but also growth prospects, profit margins, industry conditions, company size, and risk factors. This approach provides a more tailored benchmark than simple peer or industry averages.

Ultimately, with Corning’s actual PE ratio (53.5x) significantly higher than its Fair Ratio (37.7x), it suggests the stock may be priced above what its fundamentals justify at this time.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Corning Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personalized story about a company. It connects your view of Corning’s business strengths, challenges, and future direction to your own financial forecasts, such as what you expect for revenue, profit margins, and ultimately fair value. Narratives empower you to anchor your investment decisions not just to numbers, but to your reasoning behind those numbers. This makes your approach more transparent and actionable.

On Simply Wall St's Community page, millions of investors are already using Narratives as an accessible tool to visualize, update, and share their investment cases. Narratives help you set a Fair Value price based on your expectations, then directly compare it to today’s share price, so you can clearly see if it aligns with your buy or sell decision. As new information arrives, for example Corning’s earnings or big news about a new partnership, your Narrative is automatically updated and helps your outlook stay relevant.

For example, some investors currently forecast a bullish Fair Value for Corning as high as $92.75, while the most cautious see it closer to $47.00. This illustrates that each Narrative can reflect very different, but equally valid perspectives on the same company’s future.

Do you think there's more to the story for Corning? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.