Please use a PC Browser to access Register-Tadawul

Can CubeSmart’s (CUBE) Texas Expansion and Dividend Reveal Its Strategy for Long-Term Sector Leadership?

CubeSmart CUBE | 35.79 | -2.08% |

- CubeSmart recently announced it will manage four Texas-based storage facilities through a partnership with Precision Global Corporation, and its Board of Trustees has declared a quarterly dividend of US$0.52 per common share payable in October 2025.

- This combination of new asset management agreements and the continuation of shareholder dividends underlines CubeSmart’s focus on expanding operational reach while sustaining returns for investors.

- Next, we'll look at how CubeSmart's new Texas management agreements could influence its broader investment outlook and sector positioning.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

CubeSmart Investment Narrative Recap

To own CubeSmart stock, investors typically look for stable dividend income and growth through operational expansion and third-party management agreements. The recent Texas partnership strengthens CubeSmart’s national presence, but it does not appear likely to materially shift the near-term catalyst, which remains improvement in same-store revenues and operating metrics. However, the biggest present risk, ongoing pressure on move-in rates and soft demand linked to the constrained housing market, remains an important factor for CubeSmart’s overall outlook.

The newly announced management partnership with Precision Global Corporation, which adds four Texas storage sites to CubeSmart’s third-party portfolio, closely ties into the company’s expansion of its third-party management business, an ongoing catalyst that could help offset pressures in organic revenue growth. This expansion effort highlights how operational gains outside of acquisitions may play a growing role for CubeSmart as challenging acquisition conditions persist.

By contrast, investors should also be mindful of how continued negative trends in same-store revenue could impact long-term growth potential...

CubeSmart's outlook suggests revenue of $1.3 billion and earnings of $388.6 million by 2028. This is based on a projected 5.2% annual revenue growth rate and a modest earnings increase of $2.8 million from current earnings of $385.8 million.

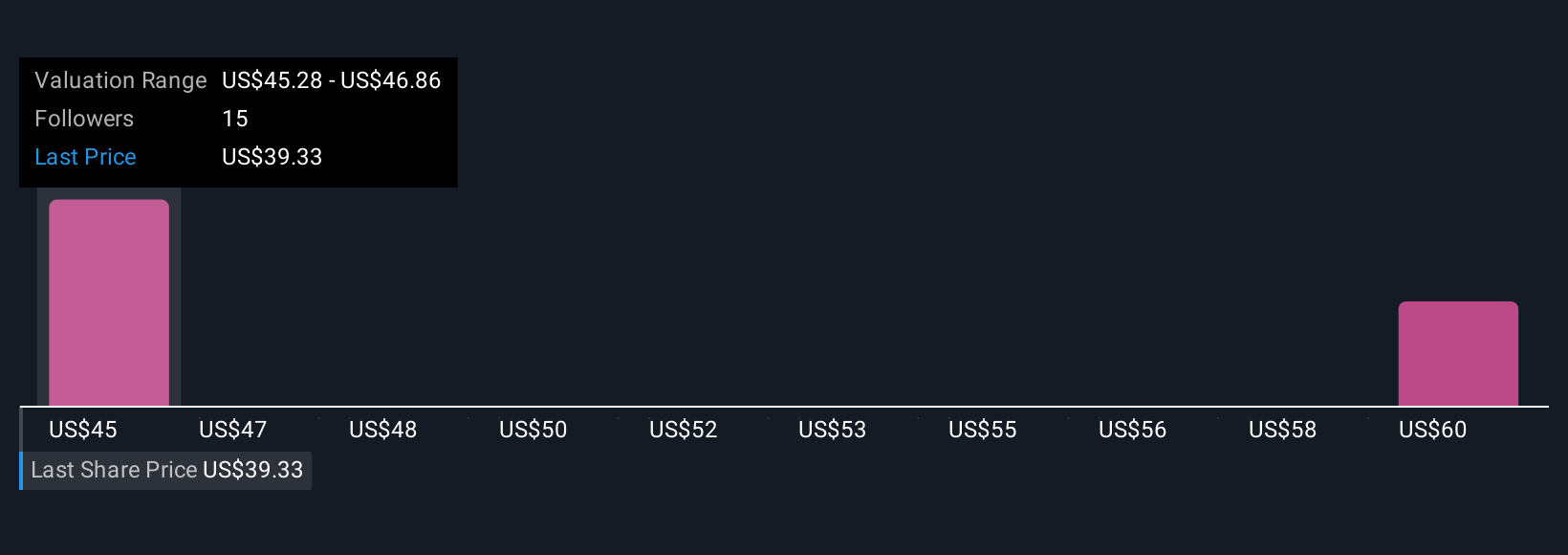

Uncover how CubeSmart's forecasts yield a $46.44 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Two estimates from the Simply Wall St Community place CubeSmart’s fair value between US$46.44 and US$74.37 per share. While these community perspectives span a wide valuation range, concerns persist over CubeSmart’s ability to reverse negative same-store revenue trends, which could influence sentiment on future earnings and returns.

Explore 2 other fair value estimates on CubeSmart - why the stock might be worth just $46.44!

Build Your Own CubeSmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CubeSmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CubeSmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CubeSmart's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.