Please use a PC Browser to access Register-Tadawul

Can Cushman & Wakefield's (CWK) Leadership Expansion Reshape Its Growth Strategy?

CUSHMAN & WAKEFIELD PLC CWK | 15.14 | -0.98% |

- In recent weeks, Cushman & Wakefield expanded its leadership team across major U.S. markets, appointing three new managing principals in Atlanta, Minneapolis-St. Paul, and Seattle-Portland, and hiring a highly experienced executive in Miami focused on institutional multifamily investment sales.

- This surge in recruitment, doubling the company’s previous annual numbers within nine months, reflects a focused strategy to strengthen client service and capture opportunities in an improving commercial real estate market.

- We'll explore how Cushman & Wakefield's extensive talent acquisition drive may impact its growth prospects and existing business outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cushman & Wakefield Investment Narrative Recap

To be a Cushman & Wakefield shareholder, an investor needs to believe in a steady rebound in commercial real estate activity and continued demand for expert portfolio advice, despite risks from cyclical business swings and shifting work patterns. The recent hiring surge across key U.S. markets may help the firm capture short-term market opportunities but does not fundamentally change the biggest risk: high reliance on transactional revenues if the sector slows again. Among the latest developments, Cushman & Wakefield's appointment of Roberto Pesant in Miami, bringing deep experience in multifamily investment sales, is particularly relevant. It highlights the company's intent to broaden its service offering and attract institutional clients in large, growing markets, which could support recurring fee growth if commercial real estate continues to recover. But while these steps support growth ambitions, investors should be aware that structural trends in office demand could shift faster than expected, meaning...

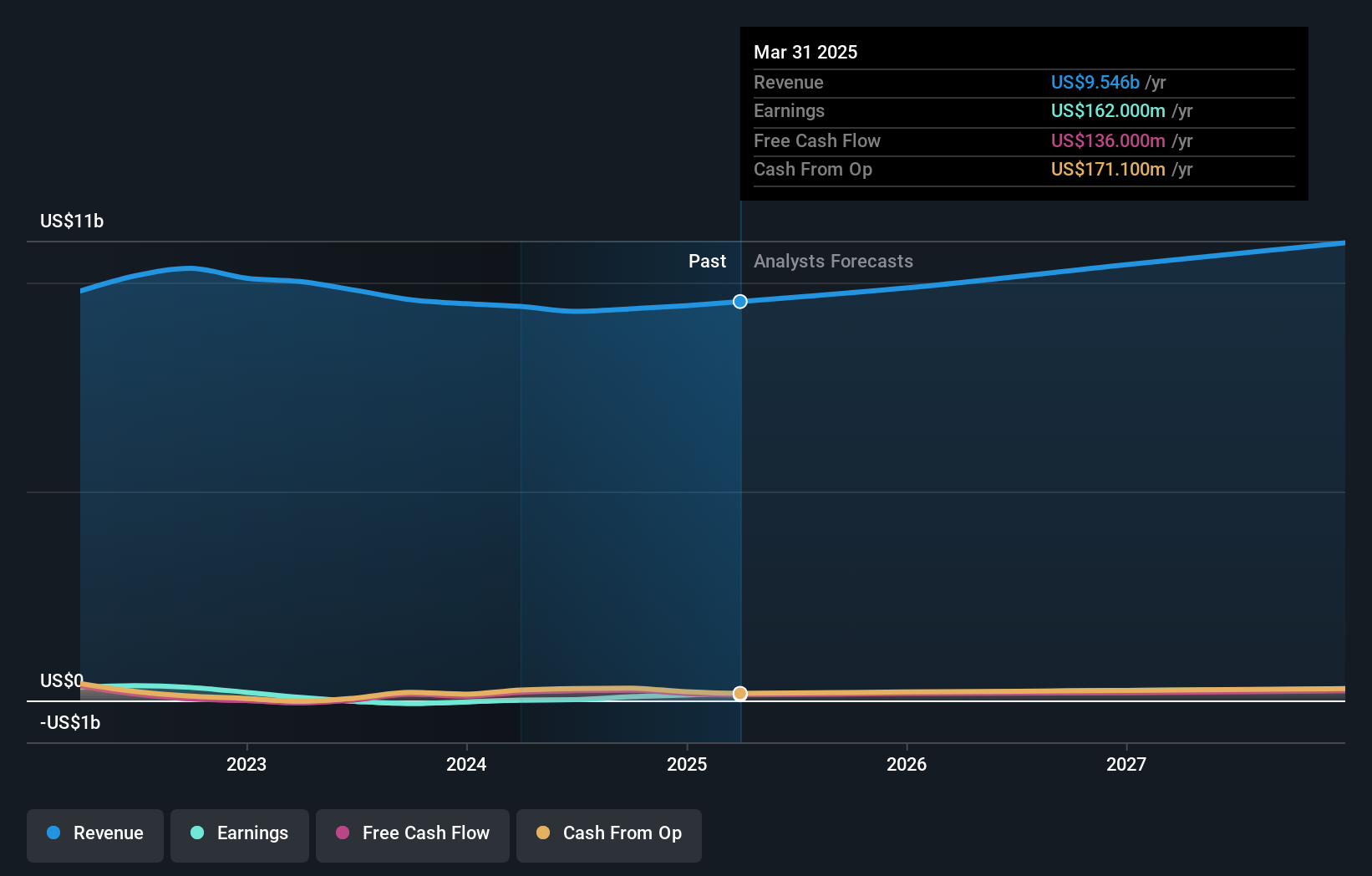

Cushman & Wakefield's outlook anticipates $11.4 billion in revenue and $342.8 million in earnings by 2028. This requires 5.4% annual revenue growth and a $137 million increase in earnings from the current $205.8 million.

Uncover how Cushman & Wakefield's forecasts yield a $16.06 fair value, in line with its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates range from US$4.64 to US$18.13 per share, underscoring very different views on future potential. With reliance on leasing and capital markets activity still the key risk, consider how changing real estate dynamics might shape actual results compared to these diverse opinions.

Explore 3 other fair value estimates on Cushman & Wakefield - why the stock might be worth less than half the current price!

Build Your Own Cushman & Wakefield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cushman & Wakefield research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cushman & Wakefield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cushman & Wakefield's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.