Please use a PC Browser to access Register-Tadawul

Can General American Investors' (GAM) Steady Preferred Dividend Reveal Its Long-Term Capital Allocation Priorities?

General American Investors Co Inc GAM | 58.31 | -0.34% |

- The Board of Directors of General American Investors Company, Inc. declared a dividend of $0.371875 per share on its 5.95% cumulative preferred stock, series B, scheduled for payment on September 24, 2025 to shareholders of record on September 8, 2025, covering the June 24 to September 23 accrual period.

- This quarterly dividend declaration highlights the company’s commitment to consistent preferred shareholder returns even as payout dates approach in the coming months.

- We’ll examine how the regular preferred dividend underscores General American Investors Company’s approach to balancing consistent income with overall shareholder confidence.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is General American Investors Company's Investment Narrative?

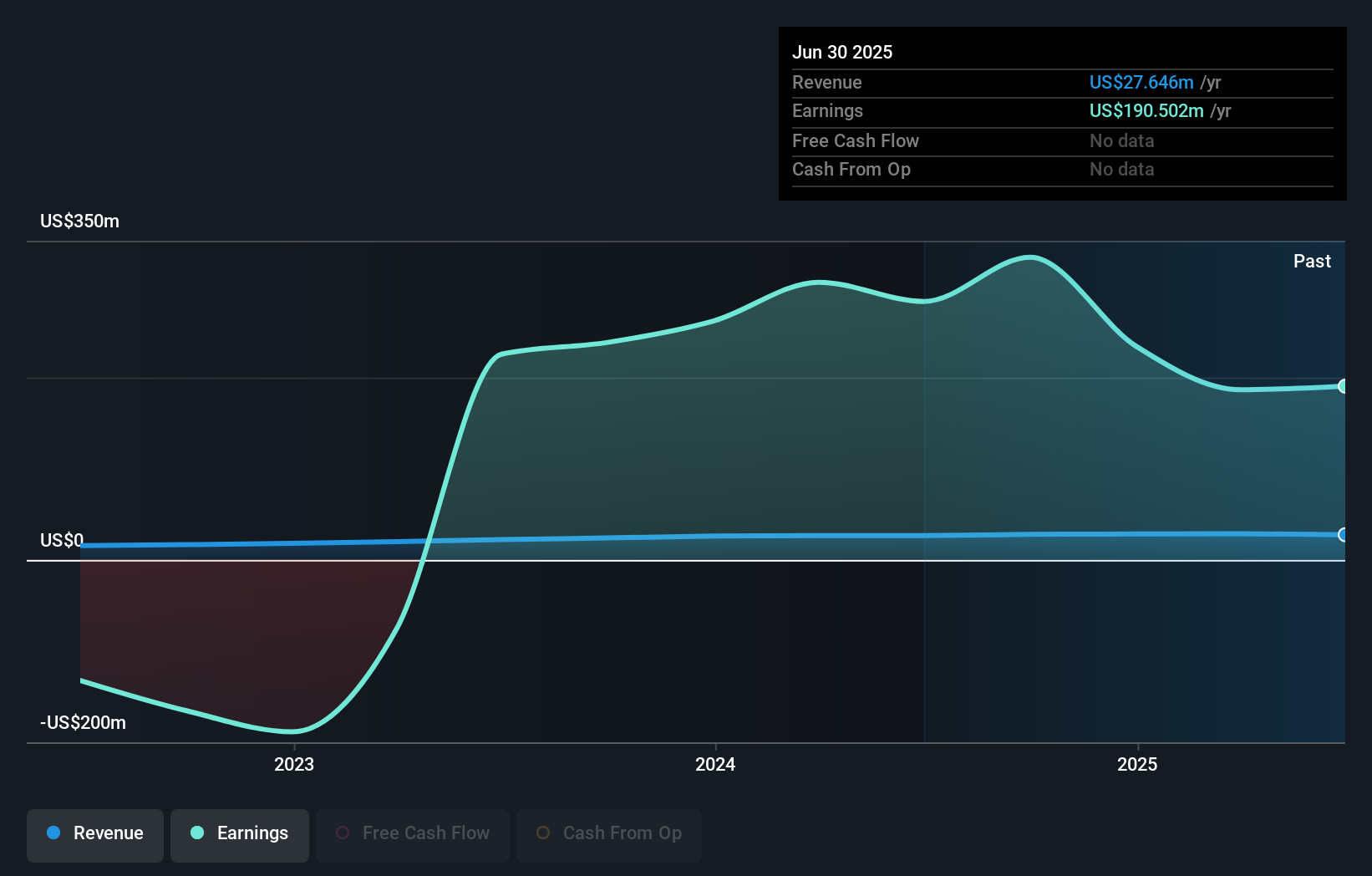

To believe in General American Investors Company as a shareholder is really about trusting its ability to offer consistent income in a sector where steady returns are highly valued but not always assured. The fresh declaration of a $0.371875 quarterly preferred dividend reinforces the signal that the company remains focused on rewarding its income-oriented investors, a positive factor especially after a long run of regular preferred dividends and ongoing buybacks. Given the relative price stability and a modest recent share price uptick, the dividend news seems unlikely to materially change short-term catalysts, which still center around portfolio performance, the integration of new board members like Sarah M. Ward, and any continued progress on buybacks. The biggest risks remain the lack of visible revenue and profit growth compared to industry peers and the company’s exposure to large one-off earnings items, which add unpredictability to future results. The regular preferred dividend declaration does not address these structural challenges but does keep income-focused holders engaged for the time being.

By contrast, the risk for future profit swings due to large one-off items is one investors should be aware of.

Exploring Other Perspectives

Explore another fair value estimate on General American Investors Company - why the stock might be worth over 2x more than the current price!

Build Your Own General American Investors Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General American Investors Company research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free General American Investors Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General American Investors Company's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.