Please use a PC Browser to access Register-Tadawul

Can Hovnanian Enterprises, Inc.'s (NYSE:HOV) ROE Continue To Surpass The Industry Average?

Hovnanian Enterprises, Inc. Class A HOV | 129.66 | -0.83% |

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. By way of learning-by-doing, we'll look at ROE to gain a better understanding of Hovnanian Enterprises, Inc. (NYSE:HOV).

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hovnanian Enterprises is:

19% = US$159m ÷ US$835m (Based on the trailing twelve months to July 2025).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.19.

Does Hovnanian Enterprises Have A Good ROE?

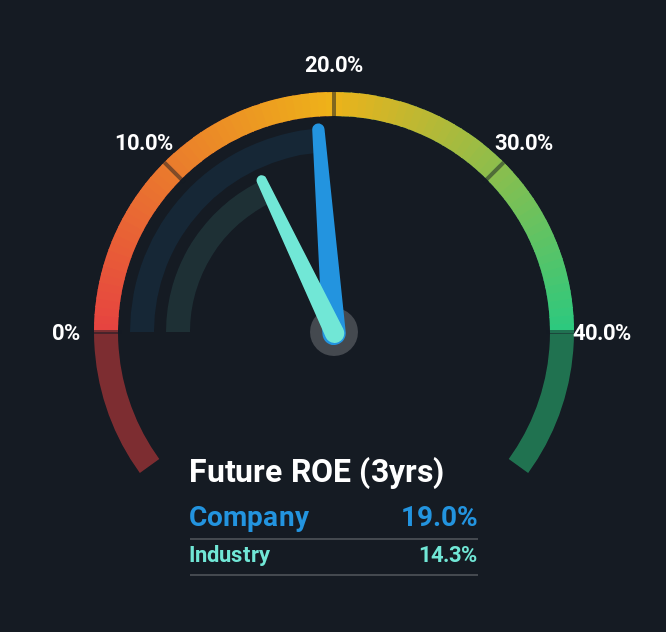

One simple way to determine if a company has a good return on equity is to compare it to the average for its industry. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. As is clear from the image below, Hovnanian Enterprises has a better ROE than the average (14%) in the Consumer Durables industry.

That's what we like to see. With that said, a high ROE doesn't always indicate high profitability. Especially when a firm uses high levels of debt to finance its debt which may boost its ROE but the high leverage puts the company at risk. To know the 3 risks we have identified for Hovnanian Enterprises visit our risks dashboard for free.

How Does Debt Impact ROE?

Companies usually need to invest money to grow their profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the use of debt will improve the returns, but will not change the equity. In this manner the use of debt will boost ROE, even though the core economics of the business stay the same.

Combining Hovnanian Enterprises' Debt And Its 19% Return On Equity

Hovnanian Enterprises clearly uses a high amount of debt to boost returns, as it has a debt to equity ratio of 1.23. While its ROE is respectable, it is worth keeping in mind that there is usually a limit as to how much debt a company can use. Debt does bring extra risk, so it's only really worthwhile when a company generates some decent returns from it.

Conclusion

Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. A company that can achieve a high return on equity without debt could be considered a high quality business. If two companies have around the same level of debt to equity, and one has a higher ROE, I'd generally prefer the one with higher ROE.

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. So I think it may be worth checking this free report on analyst forecasts for the company.

Of course Hovnanian Enterprises may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.