Please use a PC Browser to access Register-Tadawul

Can Kenvue's (KVUE) Response to Tylenol Claims Reinforce Its Brand Trust With Consumers?

Kenvue, Inc. KVUE | 18.32 | +0.77% |

- In recent days, Kenvue faced intense scrutiny after former President Donald Trump asserted a link between Tylenol (acetaminophen) use during pregnancy and autism, prompting the FDA to announce plans for updated warning labels despite a lack of established scientific causation.

- Medical experts and Kenvue management responded by emphasizing the product's safety, as analysts and regulators weighed reputational, legal, and regulatory risks for the company amid heightened public debate.

- We'll consider how the increased regulatory pressure and misinformation risks may reshape Kenvue's longer-term growth and reputational outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Kenvue Investment Narrative Recap

To be a shareholder in Kenvue, you have to believe in the company's ability to maintain trust in its core brands while streamlining operations and modernizing sales channels. The recent scrutiny over Tylenol and autism has increased regulatory and litigation risks, but the immediate impact on the company's e-commerce or operational transformation catalyst appears limited for now, as product safety and leadership’s response have helped reassure much of the market.

A highly relevant recent development is the FDA’s announcement of plans to update warning labels on Tylenol, following public claims about autism risks. This policy move brings Kenvue’s regulatory risk to the forefront, potentially complicating near-term legal exposure for its flagship brand at a time when steady earnings and modernization are key to investor confidence.

Yet, in contrast to operational headwinds, investors should be aware of how fast-changing litigation or new regulations could impact Kenvue’s core...

Kenvue's outlook anticipates $16.3 billion in revenue and $2.1 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 2.6% and an earnings increase of $0.7 billion from the current level of $1.4 billion.

Uncover how Kenvue's forecasts yield a $22.13 fair value, a 35% upside to its current price.

Exploring Other Perspectives

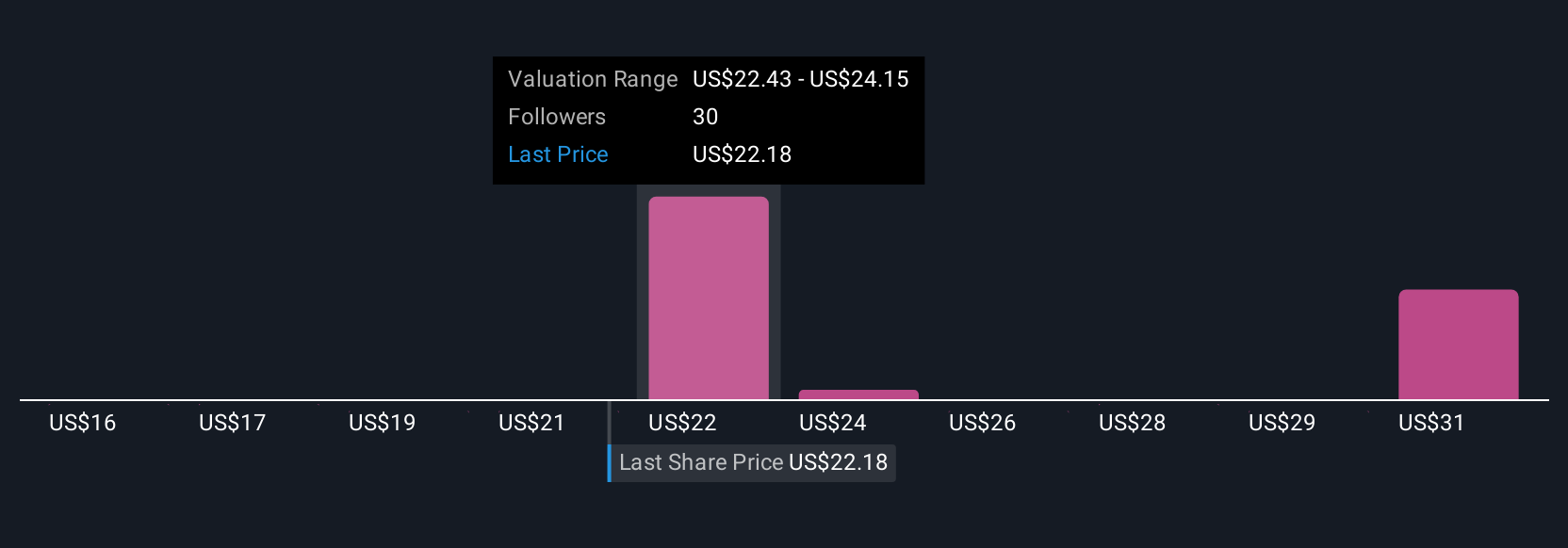

Six fair value estimates from the Simply Wall St Community span US$15.58 to US$26.39 per share. With litigation risks and regulatory uncertainty rising, opinions among market participants can vary widely, consider these when weighing contrasting views on Kenvue’s future.

Explore 6 other fair value estimates on Kenvue - why the stock might be worth as much as 61% more than the current price!

Build Your Own Kenvue Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kenvue research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kenvue research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kenvue's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.