Please use a PC Browser to access Register-Tadawul

Can MARA Holdings’ (MARA) Outreach and Production Pace Signal a Shift in Long-Term Strategy?

MARA Holdings MARA | 11.52 11.57 | -2.70% +0.43% Pre |

- MARA Holdings announced unaudited production results for August 2025, reporting 705 Bitcoin produced, and took part in the Gastech Exhibition & Conference where its MD for International addressed the audience.

- This recent activity underlines the company's efforts to communicate operational progress while maintaining engagement with both the digital asset and energy sectors, fostering broader industry connections.

- We'll examine how MARA Holdings' operating update and industry outreach may shape the company's long-term growth and diversification narrative.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

MARA Holdings Investment Narrative Recap

For anyone considering MARA Holdings, the big-picture thesis rests on its ability to leverage digital asset mining while expanding into AI infrastructure and energy partnerships, creating growth avenues beyond bitcoin mining. The latest production and industry engagement news affirms operational consistency, but with bitcoin output little changed from prior months, the most important near-term catalyst, sustained mining profitability, remains largely unaffected. The key short-term risk continues to center on bitcoin price and network difficulty volatility, both of which could pressure earnings and cash flow if unfavorable moves occur.

Among recent announcements, the reported August 2025 production of 705 bitcoin is most relevant here, highlighting both the resilience and the challenge of sustaining output as mining becomes more competitive. This steady production echoes back to July’s results and reinforces the company’s ongoing exposure to bitcoin pricing dynamics, a central catalyst with significant influence on revenue and sentiment.

Yet, in contrast to consistent operational headlines, investors should be mindful that growing capital commitments for mining infrastructure mean even a modest downturn in bitcoin prices could quickly escalate into...

MARA Holdings' outlook forecasts $1.1 billion in revenue and $31.5 million in earnings by 2028. This is based on an expected 12.4% annual revenue growth rate, but a significant decrease in earnings of $647.3 million from current earnings of $678.8 million.

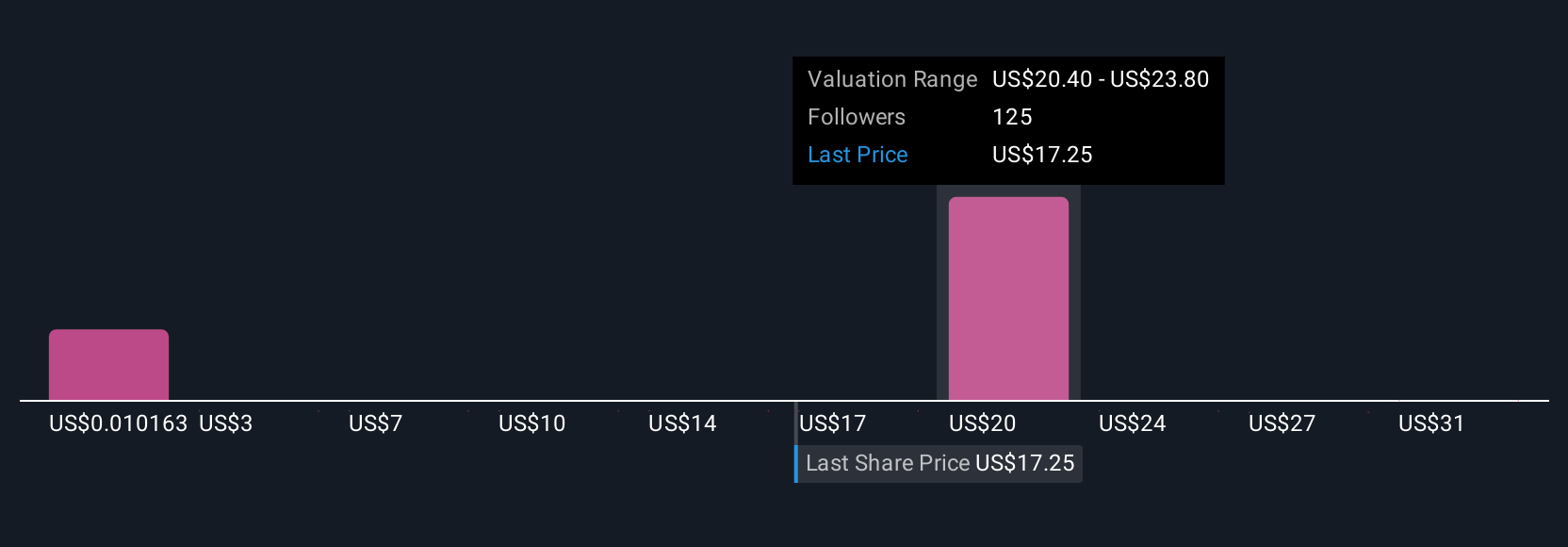

Uncover how MARA Holdings' forecasts yield a $23.32 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Ten community-generated fair value targets for MARA Holdings range from US$17.45 to US$73.78, showcasing widespread differences in growth outlooks. With most focused on production consistency and sector competition, your interpretation of risk and opportunity could land anywhere across this spectrum, explore how these viewpoints could reshape your own expectations.

Explore 10 other fair value estimates on MARA Holdings - why the stock might be worth just $17.45!

Build Your Own MARA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MARA Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free MARA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MARA Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.