Please use a PC Browser to access Register-Tadawul

Can MetLife’s (MET) New Global Citizen Partnership Reshape Its Corporate Responsibility Narrative?

MetLife, Inc. MET | 83.15 | +1.20% |

- MetLife announced a major three-year partnership with Global Citizen, including a US$9 million MetLife Foundation commitment as a founding donor to the FIFA Global Citizen Education Fund for worldwide access to education and sport.

- This move highlights MetLife’s focus on corporate responsibility and advances its efforts to create positive social impact at scale.

- We’ll examine how MetLife’s expanded global community engagement may influence its investment narrative and broader business outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

MetLife Investment Narrative Recap

To be comfortable as a MetLife shareholder, you need to believe in the company's ability to deliver consistent earnings and capital returns despite pressures on investment margins and unsettled conditions in some international operations. While the new partnership with Global Citizen raises MetLife’s corporate responsibility profile, its impact on near-term profitability or core business drivers like interest rate dynamics and underwriting margins is not material right now. The biggest short-term catalyst continues to be premium and sales growth in major global markets, while the most pressing risk remains ongoing volatility in investment returns, especially in Asia.

Among recent announcements, MetLife’s introduction of new cancer support benefits is particularly relevant, it illustrates continuous product innovation to strengthen customer engagement and potentially drive growth in group benefits, which aligns with the company’s focus on expanding its asset-light, fee-generating business lines. This directly ties into MetLife’s efforts to capture international premium growth but does not mitigate the underlying risk presented by variable investment income in overseas markets.

However, investors should also be aware that, despite increased global engagement, persistent volatility in investment returns, especially from Asia, continues to...

MetLife's outlook calls for $83.8 billion in revenue and $6.3 billion in earnings by 2028. This scenario assumes a 4.7% annual revenue growth rate and a $2.2 billion earnings increase from current earnings of $4.1 billion.

Uncover how MetLife's forecasts yield a $91.86 fair value, a 13% upside to its current price.

Exploring Other Perspectives

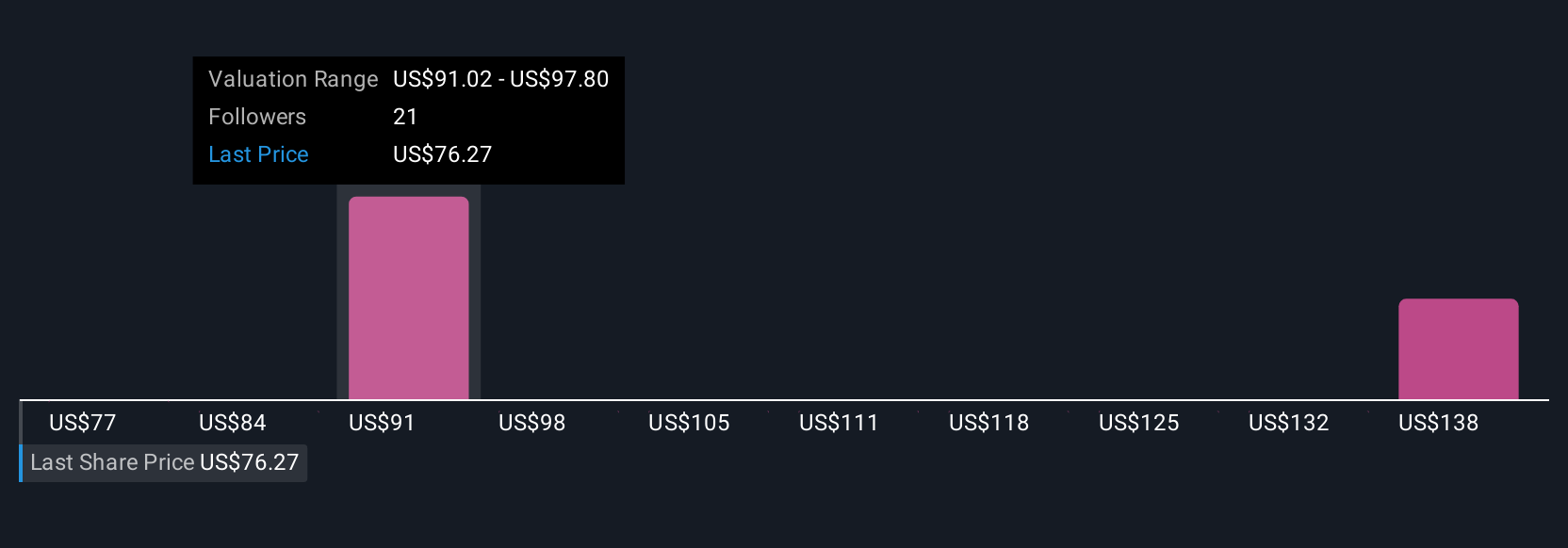

Four Simply Wall St Community views estimate MetLife’s fair value between US$77.46 and US$112.36 per share. With ongoing earnings sensitivity to interest rates and investment returns, you may want to compare these viewpoints with your own expectations for the company’s long-term stability.

Explore 4 other fair value estimates on MetLife - why the stock might be worth as much as 38% more than the current price!

Build Your Own MetLife Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MetLife research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MetLife research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MetLife's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.