Please use a PC Browser to access Register-Tadawul

Can NATO Contracts Accelerate Redwire’s (RDW) Global Defense Ambitions?

Redwire Corp RDW | 10.04 9.96 | 0.00% -0.80% Pre |

- Edge Autonomy, a subsidiary of Redwire Corporation, secured a contract with a European NATO country to deliver Stalker uncrewed aerial systems for intelligence and reconnaissance, signaling increased international uptake of Redwire's advanced aerospace technologies.

- This development highlights Redwire's expanding role in allied defense collaborations, which could strengthen its position in the global aerospace and defense industry.

- We'll examine how this significant defense contract could impact Redwire's investment narrative and its trajectory in the rapidly evolving defense sector.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Redwire Investment Narrative Recap

To invest in Redwire, you need confidence in the company's ability to capture rising global demand for advanced space and defense technologies, fueled by international contracts and ongoing innovation. While the new Edge Autonomy NATO win underscores Redwire's growing defense profile, recent developments do not directly address the most immediate challenge: persistent unpredictability in revenue recognition stemming from U.S. and international contract delays. This remains the company’s primary short-term risk, even as execution on new deals bolsters its long-term outlook.

Among recent announcements, Redwire being named the prime contractor for the Skimsat mission with Thales Alenia Space and ESA strongly ties in with the company’s push to solidify its presence in the fast-evolving space sector. This initiative reinforces Redwire’s European footprint and highlights its ability to win complex, multinational contracts, which could help support backlog growth and future revenue visibility if execution and schedule stability are maintained.

In contrast, investors should also keep a close eye on how continued volatility in government contracting could affect near-term top-line results…

Redwire's narrative projects $887.3 million revenue and $73.2 million earnings by 2028. This requires 50.3% yearly revenue growth and a $322.7 million increase in earnings from -$249.5 million.

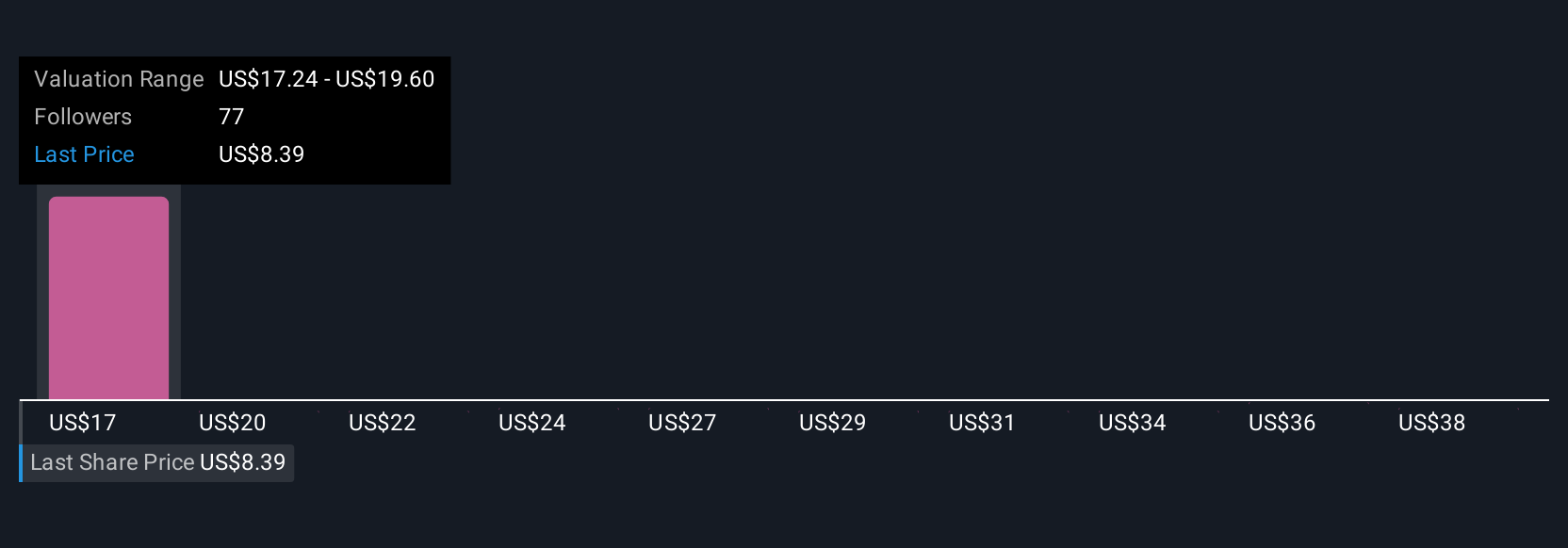

Uncover how Redwire's forecasts yield a $18.06 fair value, a 127% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered 11 unique fair value estimates for Redwire ranging from US$11.81 to US$40.80 per share. While many see potential given rapid revenue growth forecasts, ongoing contract volatility poses important questions for the company’s future performance; consider exploring several viewpoints.

Explore 11 other fair value estimates on Redwire - why the stock might be worth over 5x more than the current price!

Build Your Own Redwire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Redwire research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Redwire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Redwire's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.