Please use a PC Browser to access Register-Tadawul

Can Ondas Holdings’ (ONDS) New Capital and AI Defense Push Transform Its Global Growth Ambitions?

Ondas Holdings ONDS | 8.75 | -2.99% |

- In recent days, Ondas Holdings completed a major follow-on equity offering and helped launch Ondas Capital, aimed at accelerating deployment of unmanned and autonomous defense technologies, while Safe Pro Group announced collaborations with Ondas to deploy advanced AI for real-time image processing on drones in regions affected by unexploded ordnance.

- The combination of equity financing and new partnerships positions Ondas Holdings to expand its solutions for defense and security, especially in emerging markets such as Eastern Europe and Ukraine.

- We’ll explore how Ondas Holdings’ significant capital raise and new AI-driven defense partnerships may reshape its growth prospects and investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Ondas Holdings Investment Narrative Recap

At its core, owning Ondas Holdings relies on the belief that autonomous and AI-driven defense solutions can deliver rapid growth and expand the company’s market footprint, particularly via partnerships and access to new capital. While the latest equity offering and defense technology collaborations could provide ample resources for growth, only sustained revenue acceleration, amid volatile margins and ongoing losses, will address the most pressing risk: whether Ondas can turn increasing sales into meaningful profitability in the near term.

Of particular note is the recently announced deployment of Safe Pro Group’s AI technology, powered by Ondas-enabled drones, to detect landmines and explosive threats in Ukraine. This real-world partnership brings immediate relevance to Ondas’ expansion in defense and security markets and presents a tangible catalyst that may drive program uptake and new contract opportunities.

But on the other side of the equation, investors should be aware of the risks if revenue growth falls short and mounting losses persist...

Ondas Holdings' outlook forecasts $151.6 million in revenue and $16.3 million in earnings by 2028. Achieving this would require annual revenue growth of 141.1% and an earnings increase of $63.2 million from the current -$46.9 million earnings.

Uncover how Ondas Holdings' forecasts yield a $8.17 fair value, a 11% downside to its current price.

Exploring Other Perspectives

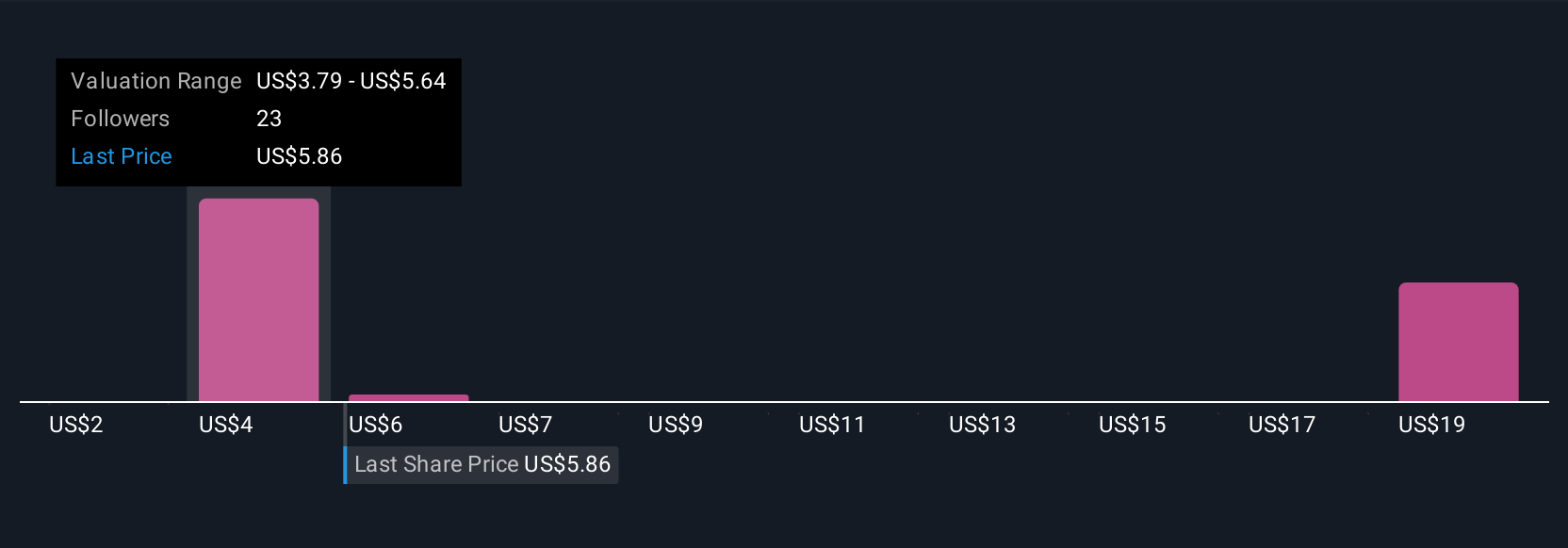

Simply Wall St Community fair value estimates for Ondas Holdings range from US$0.47 to US$14.21, reflecting input from 12 independent investors. Rapid top-line growth remains a consensus expectation, yet ongoing losses and high operating expenses may leave future performance highly dependent on effective execution; examine these varied perspectives.

Explore 12 other fair value estimates on Ondas Holdings - why the stock might be worth less than half the current price!

Build Your Own Ondas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ondas Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ondas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ondas Holdings' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.