Please use a PC Browser to access Register-Tadawul

Can Plasma Technology Adoption Redefine Constellium’s (CSTM) Competitive Edge in Low-Carbon Aluminum?

Constellium SE Class A CSTM | 25.44 | -1.43% |

- On August 5, 2025, PyroGenesis Inc. announced it signed an additional contract with Constellium to implement plasma torch technology in an aluminum remelting furnace, marking the start of Phase 2 in their joint decarbonization project.

- This latest step highlights Constellium's focus on adopting advanced electrification technology to reduce emissions and improve energy efficiency in aluminum processing.

- Let's explore how this commitment to plasma-based electrification could impact Constellium’s future positioning within the aluminum industry.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Constellium Investment Narrative Recap

At its core, Constellium appeals to investors who believe rising demand for low-carbon aluminum, driven by decarbonization and energy transition trends, will reward companies investing in cleaner production technologies. The new plasma torch contract underscores Constellium’s ongoing push to electrify aluminum remelting, though near-term catalysts like profit margin recovery remain far more dependent on stabilization in automotive and aerospace shipments. The biggest risk continues to be weak demand in these core markets, which could outweigh benefits from sustainability efforts for now.

Of the company’s recent updates, the Q2 2025 earnings release stands out, with higher sales of US$2,103 million but sharply lower net income at US$36 million. This news provides an important context: while innovation initiatives like plasma torch adoption could improve efficiency over time, pressure on earnings and margins from key end markets remains the focus for short-term performance.

Yet against these promising technology upgrades, investors should not overlook the ongoing risk that automotive and aerospace demand recovery may take longer than expected...

Constellium's narrative projects $9.9 billion revenue and $448.3 million earnings by 2028. This requires 9.3% yearly revenue growth and a $416.3 million earnings increase from $32.0 million today.

Uncover how Constellium's forecasts yield a $18.31 fair value, a 27% upside to its current price.

Exploring Other Perspectives

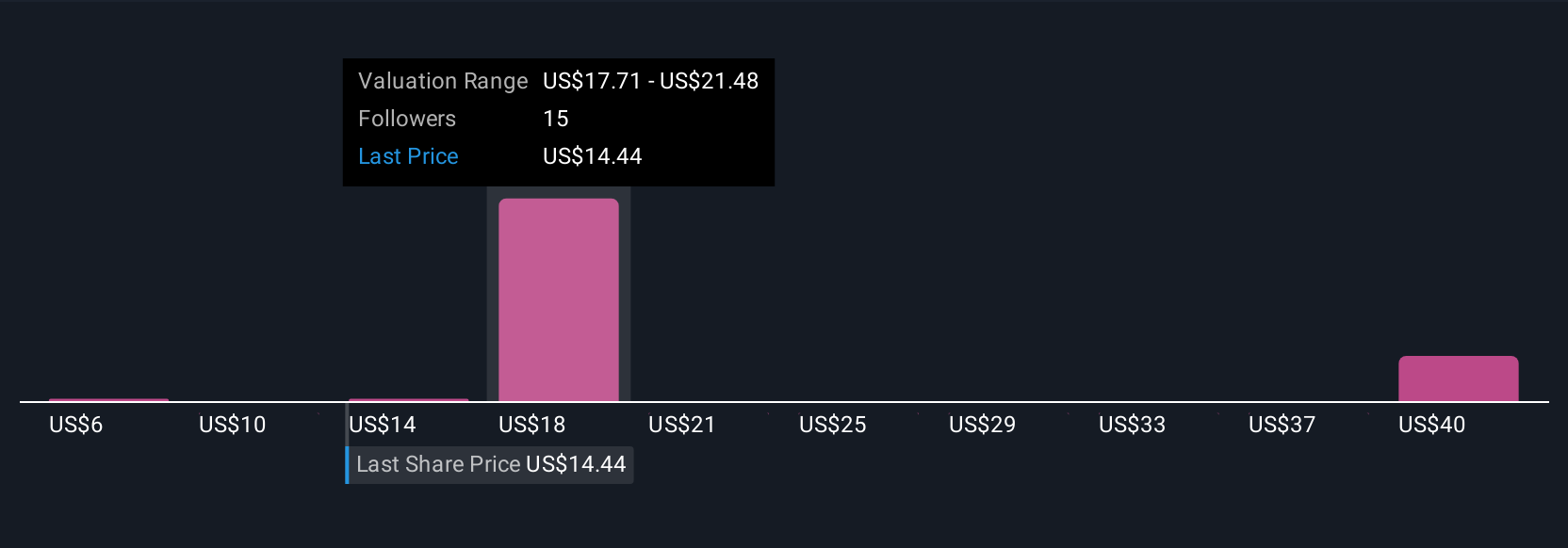

Simply Wall St Community members provided four fair value estimates for Constellium ranging from US$6.40 to US$44.10 per share. With this wide spectrum of views, consider how ongoing margin pressure from end market weakness continues to shape the outlook for many participants, explore these alternative perspectives before forming your own view.

Explore 4 other fair value estimates on Constellium - why the stock might be worth over 3x more than the current price!

Build Your Own Constellium Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellium research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Constellium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellium's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.