Please use a PC Browser to access Register-Tadawul

Can PTC Therapeutics' (PTCT) New PKU Partnership Reveal Its Long-Term Rare Disease Strategy?

PTC Therapeutics, Inc. PTCT | 75.42 | -1.09% |

- RareMed Solutions recently announced an expanded partnership with PTC Therapeutics, launching non-commercial pharmacy dispensing services for Sephience™, following its FDA approval for phenylketonuria (PKU) in adult and pediatric patients.

- This collaboration aims to provide comprehensive patient support and demonstrates how stakeholder partnerships can enhance access and coordination for innovative rare disease therapies.

- We'll next explore how Sephience's approval and enhanced patient support programs could influence PTC Therapeutics' investment outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

PTC Therapeutics Investment Narrative Recap

To be a PTC Therapeutics shareholder, you need to believe that the company can convert its leading position in rare disease treatments, especially following Sephience's approvals, into sustained commercial success while managing significant reliance on a small product portfolio. The recently expanded RareMed partnership reinforces near-term catalysts tied to Sephience’s launch and patient access, but does not materially change the company's largest immediate risk: overdependence on a few key drugs in a highly scrutinized regulatory space.

Of all recent developments, the FDA’s Complete Response Letter for vatiquinone stands out, as it directly affects PTC's efforts to diversify beyond Sephience and Translarna. The delay highlights the importance of execution for pipeline expansion and the impact setbacks can have on short-term confidence and future revenue visibility.

In contrast, investors should be aware that beyond commercialization milestones, uncertainties still surround revenue sustainability due to...

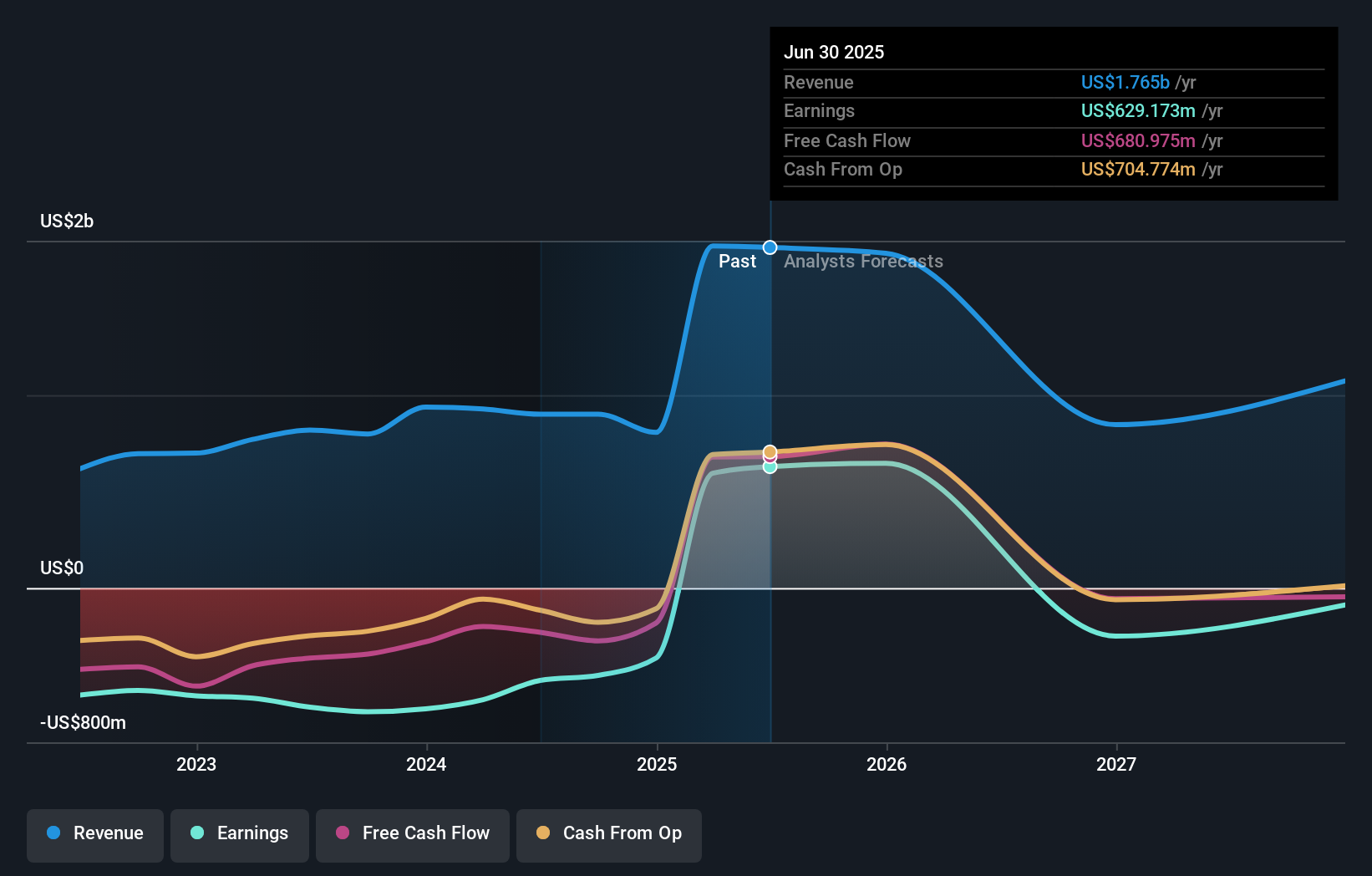

PTC Therapeutics' outlook anticipates $1.3 billion in revenue and $55.4 million in earnings by 2028. This implies an annual revenue decline of 10.3% and a decrease in earnings of $573.8 million from the current $629.2 million.

Uncover how PTC Therapeutics' forecasts yield a $66.69 fair value, a 9% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s single US$66.69 fair value estimate for PTC Therapeutics points to limited current diversity in retail opinion. While recent product launches have boosted optimism for revenue growth, continued heavy reliance on a small group of therapies shapes a more cautious outlook among many participants.

Explore another fair value estimate on PTC Therapeutics - why the stock might be worth as much as 9% more than the current price!

Build Your Own PTC Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PTC Therapeutics research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free PTC Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PTC Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.