Please use a PC Browser to access Register-Tadawul

Can Quantum (QMCO) Leverage Veeam Ready Expansion to Strengthen Its Edge in Data Protection?

QUANTUM CORP QMCO | 9.03 | -7.38% |

- On September 22, 2025, Quantum Corporation announced that its Scalar i7 RAPTOR tape library, the industry's highest-density tape library, achieved Veeam Ready qualification, extending this certification across Quantum's entire Scalar portfolio for enhanced data protection and cyber-resilience.

- This milestone highlights Quantum's focus on high-efficiency, secure, and sustainable storage solutions at a time when organizations face increasing demands for long-term data retention and robust cybersecurity.

- We'll explore how the expanded Veeam Ready status for the Scalar i7 RAPTOR influences Quantum's investment outlook and data protection strategy.

Find companies with promising cash flow potential yet trading below their fair value.

Quantum Investment Narrative Recap

Quantum’s investment thesis hinges on belief in its transition to recurring revenue models and innovation in secure, high-density storage. The Scalar i7 RAPTOR’s Veeam Ready status is an incremental positive for data protection credibility, though in the near term, ongoing concerns around net losses and extended supply chain lead times remain the most meaningful catalysts and risks, respectively. The potential for accretive revenue gains from new product wins is counterbalanced by Quantum’s financial instability and lack of profitability.

Among recent company developments, the August launch of ASI Cloud InfiniStor, powered by Quantum’s ActiveScale, is directly relevant to the expanding integration between Quantum’s storage platforms and major enterprise cloud and backup solutions. This underscores the company’s ambition to deepen its market presence through partnerships and product certifications, a key catalyst for expanding recurring revenue opportunities.

However, investors should also be aware that despite technological progress in data security, elevated supply chain lead times and uncertainty around...

Quantum's narrative projects $307.6 million revenue and $40.0 million earnings by 2028. This requires 3.9% yearly revenue growth and a $155.1 million increase in earnings from -$115.1 million currently.

Uncover how Quantum's forecasts yield a $11.50 fair value, in line with its current price.

Exploring Other Perspectives

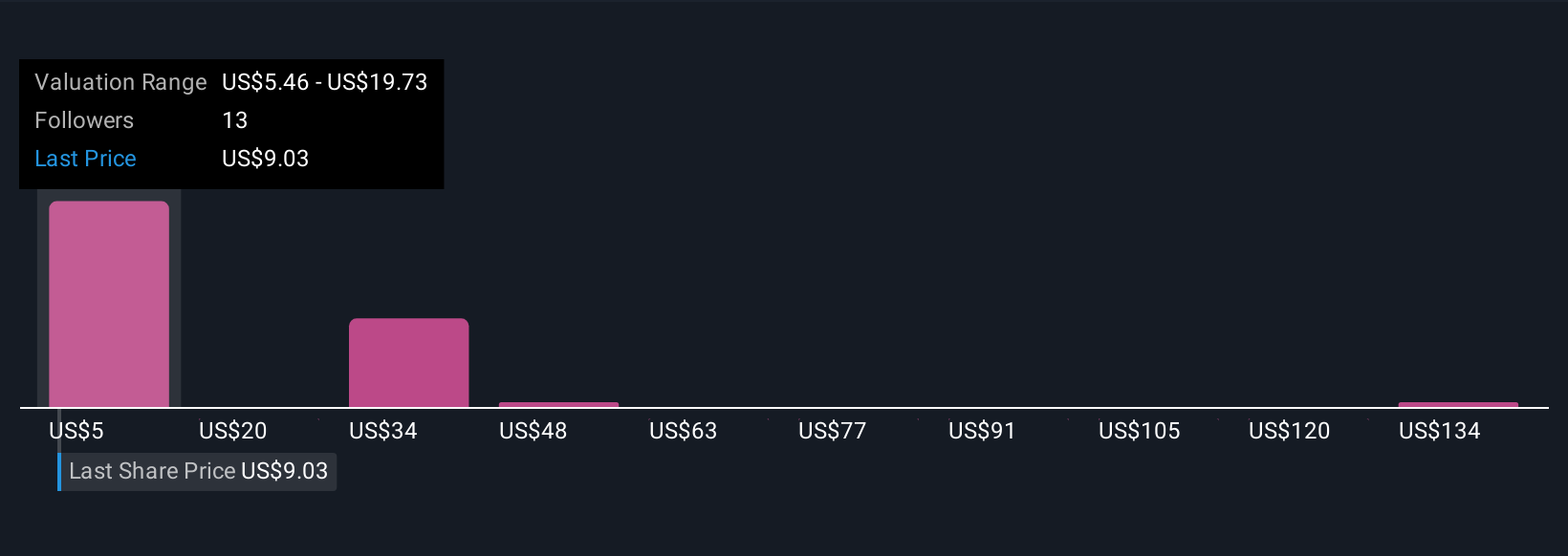

Six retail investor fair value opinions from the Simply Wall St Community range from US$5.46 to US$148.20, signaling starkly different outlooks. While some focus on potential from recurring revenue growth, persistent supply chain disruptions could weigh on the path toward profitability, explore the full scope of community perspectives.

Explore 6 other fair value estimates on Quantum - why the stock might be worth less than half the current price!

Build Your Own Quantum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quantum research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Quantum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quantum's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.