Please use a PC Browser to access Register-Tadawul

Can RXO’s (RXO) AI-Driven Productivity Gains Sustain Profit Margins Amid Freight Market Challenges?

RXO, Inc. Common Stock RXO | 14.64 | -2.40% |

- Earlier this month, Barclays analyst Brandon Oglenski reaffirmed a Buy rating on RXO Inc. following the company’s strong Q2 performance, highlighting productivity gains from AI and machine learning that reached 45% over two years and adjusted EBITDA at the high end of guidance despite softness in freight and automotive sectors.

- RXO’s approach to optimizing price, volume, and service delivered a 7% sequential increase in truckload gross profit per load even as truckload volume declined, reflecting robust execution amid challenging conditions.

- We’ll examine how RXO’s accelerated AI-driven productivity progress influences the company's investment narrative and future margin assumptions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

RXO Investment Narrative Recap

To own RXO, an investor needs to believe in the company’s ability to leverage technology, particularly AI and machine learning, to drive sustainable margin improvement despite ongoing freight and automotive weakness. The recent news reinforces the short-term catalyst of AI-driven cost and productivity gains but does not materially change the biggest risk: continued exposure to softness in the high-margin automotive sector.

Among recent developments, RXO’s AI-powered check-in system, unveiled in January 2024, is highly relevant. This technology upgrade aligns with the narrative that operational innovation can offset macroeconomic headwinds, strengthening the company’s margin defense and supporting near-term confidence in its execution.

But while AI progress is helping RXO outperform on truckload gross profit, investors should also be aware that if auto sector softness persists or deepens...

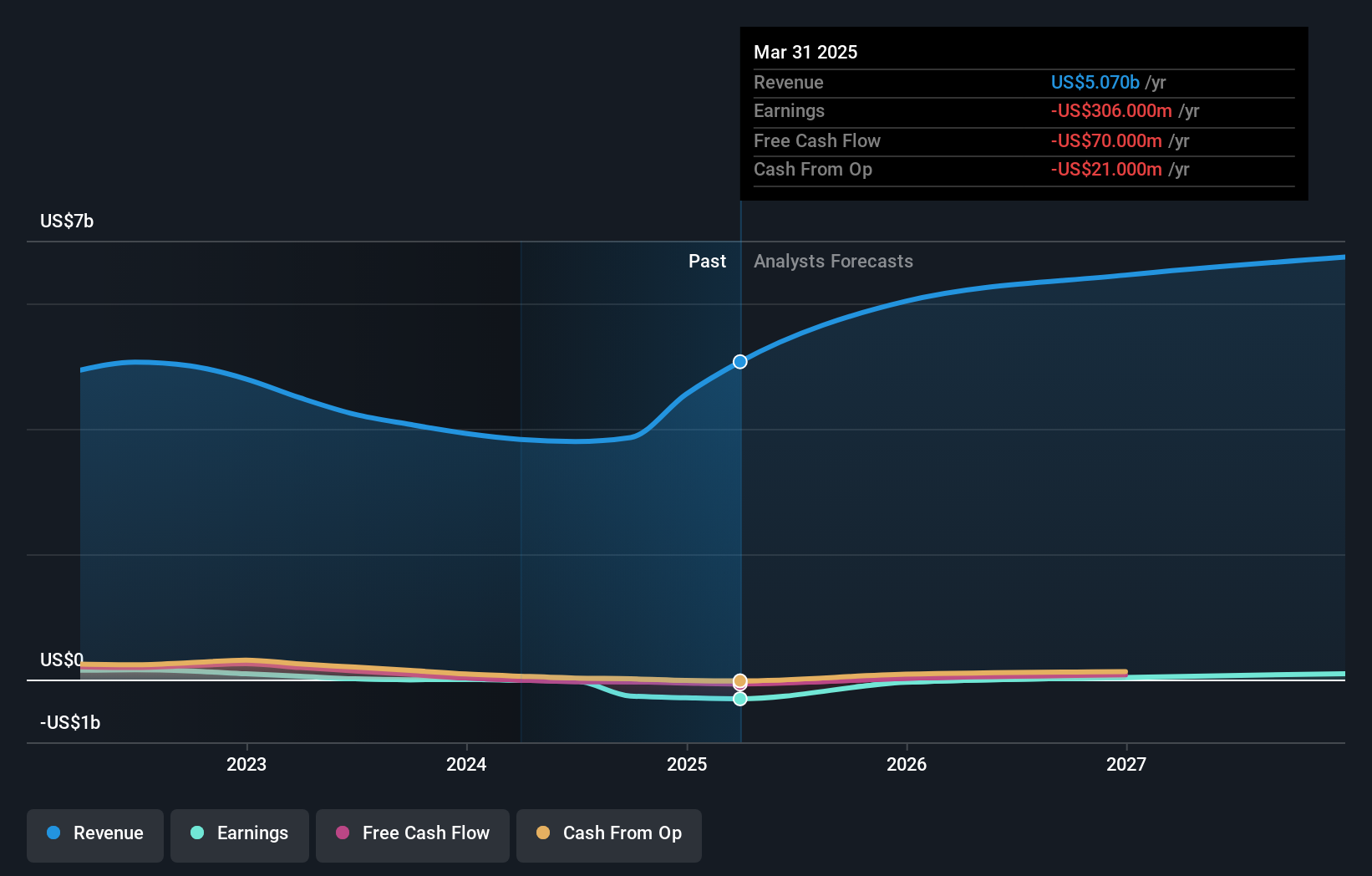

RXO's narrative projects $6.9 billion revenue and $132.5 million earnings by 2028. This requires 7.3% yearly revenue growth and a $440.5 million increase in earnings from -$308.0 million today.

Uncover how RXO's forecasts yield a $16.24 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members offer two distinct fair value estimates for RXO ranging from US$16.24 to US$33.46. While opinions differ, many are watching whether ongoing automotive sector headwinds could still threaten RXO’s margin recovery potential.

Explore 2 other fair value estimates on RXO - why the stock might be worth over 2x more than the current price!

Build Your Own RXO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RXO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free RXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RXO's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.